THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There is a lot of debate surrounding the buy and hold investment strategy.

Some people swear by it, while others think there is a better way to invest your money.

In this post, I walk you through the pros and cons of a buy and hold strategy so you can decide if this investing approach is right for you and your financial goals.

Table of Contents

11 Important Pros And Cons Of Buy And Hold Strategy

6 Pros Of A Buy And Hold Strategy

There are many great benefits to a passive investment strategy like buy and hold.

Here are the biggest buy and hold strategy pros to know.

#1. Don’t Miss Out On Big Returns

When you invest with a long term strategy like buy and hold investing, you never miss out on big returns.

Ask any long term investor or financial advisor and they will tell you that you never know which days the stock market will have large gains.

What they can tell is you is many times, these days typically happen when the market is very volatile, often after large swings to the downside.

And when you miss out on these large gains, it has a huge impact on your long term wealth.

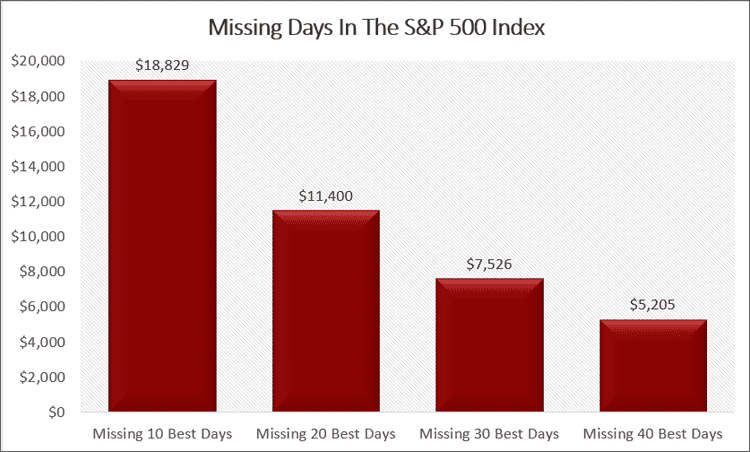

Below is a stock chart that shows you want you miss out on when you miss the days with the biggest returns.

As you can see, missing just 10 days can cost you close to $13,000!

And the more days you miss, the worse your performance is.

This is why many investors have since a low annual return, because they miss out on these days, thinking they can outsmart the stock market.

Do yourself a favor and accept there are market cycles and just ride them out, keeping your money invested.

You will come out much better in the long run.

#2. Earn A Healthy Return

Another advantage of buy and hold is since you are always invested in the stock market, you will earn close to what the market earns.

And over the long term, this comes out to around 8% annually.

Sadly, as I mentioned above, most investors don’t do this.

They invest in the hot stock of the moment and continuously buy and sell instead of buy and hold.

All of this jumping around costs investors money.

First, they tend to miss some of the good days.

On top of this, they pay more trading commissions and other investment costs.

Finally, why spend your time monitoring the stock prices when you could be doing other things instead?

#3. Less Time Consuming

Jack Bogle, founder of the Vanguard Group and one of the people responsible for creating the index fund had a great saying that his favorite holding period was forever.

What he meant by this is that you do the work upfront and pick some high quality mutual funds or exchange traded fund (ETFs), and then keep them forever.

- Read now: Learn why VTSAX is a great investment

- Read now: Here are Jack Bogles investing rules to follow

You don’t need to spend a lot of time researching investment securities or preforming fundamental analysis in order to find the bests places to put your money.

You do your research one time, build a stable portfolio and then add money on an ongoing basis.

And you can even automate the additional investments you make.

In all, you save yourself a ton of time.

#4. It Has A Proven Track Record

The fact of the matter is that buy and hold investing works.

It is the basis of any long term chart you see that shows you the growth of your investment.

These charts aren’t showing you how much your investment would be worth if you were buying stocks and selling them on a frequent basis.

It is showing you what happens to your money if you keep it invested for a long period of time.

So buy and hold does work, you just need to let it work its magic and not try to interfere.

#5. Tax Savings

Most investors end up paying taxes on short term capital gains, long term capital gains, and dividends.

While long term gains and dividends are taxed at a lower rate, this might not always be the case.

And with passive investing, you lower your tax bite.

This is because with less selling of investments, you realize fewer gains.

Of course, this isn’t to say you will never have short or long term gains, but you will have much less if you are a buy and hold investor as opposed to an investor who is always buying and selling different investments.

#6. Removes Emotion

The biggest enemy to an investor isn’t short term fluctuations or market crashes in the stock market.

It is actually the investor themself.

This is because too many investors fall victim to their emotions and react when they shouldn’t.

They could try market timing, trying to figure out when the perfect time to invest is, only to sit on the sidelines for too long.

Or they think that short term volatility is coming, so they sell to protect their money, only to see stock prices continue to rise.

Or just as bad, they wait too long to react and end up selling low, ensuring investment losses.

When you allow your emotions to make investment decisions for you, you cost yourself dearly.

A better approach is to tune out the noise of the market and do something else.

Having an investment plan is also beneficial as you can look back to see why you are investing in the first place.

When you pick solid investments using a passive strategy, it is a lot easier to ride out market volatility and stay invested for the long haul.

- Read now: See the pros and cons of index funds

This isn’t to say there won’t be any tough times, but they will be fewer and far between.

5 Cons Of A Buy And Hold Strategy

As good as buy and hold is, there are some downsides you need to consider.

Here are the biggest cons of a buy and hold strategy you need to consider.

#1. It Can Be Hard To Stay Invested

I mentioned above that using a buy and hold strategy can help you not have to fight your emotions as much.

But you still will have to fight them from time to time.

The easiest thing to do is to sell your holdings and wait for the market to come back.

While this is the easiest for you, it is also the costliest as we’ve seen.

Instead of selling, there are other strategies buy and hold investors can use to help.

The first is having an investment plan.

This will allow you to review the reason you are investing, so you can hopefully ride out the storm.

Another option is to ignore the news.

Stop letting them get you emotionally invested.

Go for a walk, read a book, or spend time with friends instead.

In some cases, it could help to pay for an investment advisor.

While hiring an investment advisor will cost you money, you have to look at the benefit.

- Read now: Should you hire an investment advisor

Refer to the chart earlier about missing days and you will see that having someone hold your hand and keep you invested over the long term is worth the cost.

The bottom line is, if you can find ways to stay invested and not just around to other securities all the time, you will see success with this strategy.

#2. Lots Of Short Term Noise

Sadly, there are a lot of people working against you when investing in a long term investment.

Wall Street and the media try to get you to hold for a short period and buy stocks regularly.

This is because they make money this way.

Wall Street makes money from trading fees and the bid/spread ask of the market price.

And the media makes money from advertisers.

The more investors watching their shows, the more the media can charge advertisers.

This is why investors need to work hard to ignore the noise when it comes to buy and hold investing.

The more you can tune out and ignore the noise, the better off you will be.

But just understand that other people will still be tuned in.

And as a result, many investors find that the people they run into on a daily basis, also are experts when it comes to investing.

Just know you have to work to politely ignore these comments and suggestions as well.

#3. Opportunity Cost

One negative of a buy and hold strategy is there are opportunity costs you have to take into account.

By locking up your money in a few set investments, you could miss out on using your money for other things.

This could be something as simple as a new investment.

- Read now: Learn more about opportunity cost

For example, withe how rapidly technology is changing our lives, there is sure to be new industries that come along and revolutionize our world.

We could miss out on them by only having our investment portfolio make up of a select few investments.

Of course, there is the counter-argument that over time the funds you are investing in will add holdings of these companies, so you will invest in the eventually.

#4. No Guarantees Of Return

While buy and hold investors will earn what the stock market does, this doesn’t mean you are guaranteed a return.

If an extended period of low to no returns happens in the market, you could end up behind on your investing goals.

Had you instead chosen an active investing strategy, you might have earned a return during these times.

The risk here through is that an overwhelming number of times, active investing does not beat a buy and hold approach.

And, there have only been a couple of time with a long period of no growth of the market.

So while there is a risk of low to no returns with a buy and hold strategy, there is greater risk to your long term wealth if you choose to go with active stock investing.

#5. Must Be Patient

The final drawback of this strategy for buy and hold investors is that you have to be patient.

This is harder and harder as we become a more instant gratification society.

We expect results immediately and when we don’t get them, we get upset and think what we are doing isn’t working.

This relates perfectly to keeping your emotions in check.

If you can do this, you will be better off.

It also speaks to the importance of having high quality long term investments.

Even though you might not see results immediately, having a portfolio of good investments will allow you to achieve the returns you need for success.

Final Thoughts

There are the biggest pros and cons of buy and hold investing.

While it can be hard to be patient over a long period of time, buy and hold remains a smart strategy for most investors.

It keeps investing simple, lowers the risk of being foolish with your money, and increases the likelihood of reaching your financial goals.

- Read now: Learn how to become a stock market millionaire

- Read now: Discover the importance of a diversified portfolio

- Read now: Does lump sum or dollar cost averaging work better

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.