THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Mutual funds are a great way for beginning investors to start investing in the stock market.

The offer many advantages that other investment vehicles simply cannot match.

But mutual fund investing has been overlooked by many who prefer to invest in individual stocks or exchange traded funds (ETFs).

In this post, I am going to go through the basics of mutual funds so you have a complete picture about this investment vehicle and how they can benefit you.

By the end, you will know if mutual funds are a smart addition to your asset allocation, or if you would be better server with other types of investments.

Table of Contents

Ultimate Guide To Mutual Fund Basics

What Is A Mutual Fund?

The definition of mutual funds is an investment program funded by shareholders that trades in diversified holdings and is professionally managed.

I’ll be honest, I’ve been in this industry for over 20 years and even I have a hard time understanding that!

Simply put, a mutual fund is a portfolio of stocks with professional management.

By owning 1 share of a mutual fund, you can own hundreds of stocks.

For example, instead of buying 1 share of General Electric and 1 share of Apple, you can instead buy 1 share of a mutual fund and own both stocks.

Another way to look at how they work is to think about buying a variety pack of Capri Sun at the grocery store.

You could buy a box of strawberry, another box of fruit punch, and a box of grape. But doing so would cost you a lot money.

Instead you could buy the variety pack and get all three flavors for a lower overall price.

Of course, this is a simplified example.

A typical mutual fund owns shares of thousands of companies.

When you buy one share of it, you aren’t buying one share in each company.

You are buying fractions of shares in these companies.

So if you own 10 shares, you might own:

0.81 shares of General Electric

0.75 shares of Apple

0.55 shares of AT&T

0.30 shares of Best Buy

Because a mutual fund invests in so many companies, there is no relationship between the number of mutual fund shares you buy and the number of company shares you own.

In other words, the 10 mutual fund shares you bought above will not necessarily equal out to owning 10 shares of various companies.

Also understand there are mutual fund managers that oversee these investments.

If it is actively managed, the management team is regularly buying and selling trying to get the best investment return.

If it is passively managed, the management team is making sure it stays true to the index it is tracking.

I’ll go into more detail about this shortly.

Different Types Of Mutual Funds

When it comes to understanding mutual funds, it’s important to know the various types.

There are 3 main types you need to know about.

Open End Mutual Funds

Open end funds are the most common type of mutual fund.

In fact, when you hear people talking about them in general, odds are they are talking about open ended funds.

An open ended mutual fund is one that has no set number of shares.

Mutual fund investors can buy or sell at any time, without needing another person on the other end.

The mutual fund is the entity that will issue you new shares and buy your shares back.

You can think of it like a bank.

When you want to withdraw or deposit money, you just head to the bank and complete the transaction.

This is different than with individual stocks, where you need a person on the other end to either buy shares from or sell shares to.

Closed Ended Mutual Funds

Closed end funds are more like stocks.

They issue a set number of shares to the public.

Because of this, you need to find a buyer when you sell and a seller when you want to buy.

Doing this is fairly easy, as with stocks.

The main difference is with this is that they trade at a premium or a discount.

This means the price you pay or sell for can be different than what the net asset value (NAV) of the fund is.

I’ll go more into net asset value shortly.

Unit Investment Trusts

Unit investment trusts are their own breed.

They issue a set number of shares like a close ended funds do.

But they have a date when the trust will end.

If you want to sell your shares, you can do so by either selling them back to the trust, wait to redeem your shares when the trust ends, or you can sell your shares in the open market.

Note that selling your shares in the open market is not common.

Because open ended mutual funds are what most individual investors invest in, the remainder of the article will focus on this investment type.

Classifications Of Mutual Fund Investments

Now it is time to talk about the many classifications of mutual funds.

No matter your risk tolerance or investing goals, there is a mutual fund for you.

If you want to invest in stocks, bonds, international stocks, or any combination of these and more, you can do so.

Here is a breakdown of the common classifications:

- Equity Funds: Invests in stocks, tends to have a more aggressive investing strategy

- Bond Funds: Invests in fixed income, tends to have a conservative investing strategy

- Money Market Funds: Invests in short term debt instruments, has a very safe investment strategy

- Balanced Funds: Invests a percentage in both stocks and bonds, has a less aggressive investment strategy

These are then broken down further into more specific categories.

For example, with bond funds, you could invest in short term bonds, intermediate bonds, or long term bonds.

With equities, you can invest in small cap growth stocks, small cap value stocks, a combination of both, large cap growth stocks, large cap value stocks, or a combination of both.

- Read now: Discover why you need to learn about asset allocation

- Read now: Find out diversification is critical to success

The same is true with international stocks as well.

You can even invest in funds that only invest in dividend paying companies, or invest in an underlying index, like the S&P 500 Index.

Finally, you can invest in target date funds, also called lifecycle funds.

- Read now: Learn all about target date funds

These fund of funds allow you to pick your anticipated retirement year and the fund will adjust the asset allocation over time to grow and preserve your wealth.

Each of these groups of mutual funds will follow a different investment strategy based on its goals.

As of 2019, there are close to 8,000 mutual funds out there.

I know that may sounds overwhelming, but you don’t need to invest in a lot to achieve diversification and meet your risk tolerance.

I’ll get into this more shortly.

Advantages And Disadvantages

Now it is time to talk about the benefits and drawbacks of mutual funds.

Note there are more than I list, I am just listing the most important ones you need to consider.

Advantages Of Mutual Funds

Ability To Invest With Little Money. With a mutual fund, you can invest with a small amount of money. Your initial investment can be as little as $100 to $500. From there, any additional investment is as little as $25 up to $100. And in some cases, you can make subsequent investments for as little as $1. This low barrier for entry makes this type of investment popular with smaller investors.

Instant Diversification. When you buy mutual funds, you are buying shares of thousands of companies at once. As a result, you have a diversified portfolio instantly. This lowers some of the risk you face investing by spreading your money among many different companies.

Professional Money Management. You don’t have to put a lot of work into watching the stock market when you invest in mutual funds. Your money is being managed by a professional team that is trying to earn a good return.

Dividend Reinvestment. While not required, you have the option to reinvest any dividends or capital gains you earn. Doing this allows you to buy more shares, which compounds your money and helps it to grow faster.

Systematic Investment Plan. When you invest in a mutual fund, it is simple to set up an automatic investment plan. You pick the amount of money you want to invest, which can be as little as $1 for some mutual funds. You then pick the frequency you want to invest. This can be weekly, monthly, quarterly, or any frequency you want. By using a dollar cost averaging plan, you avoid market timing and grow your wealth for the long term.

Disadvantages Of Mutual Funds

Too Diversified. Some investors make the mistake of buying a couple mutual funds with the same investing objective thinking it will improve their diversification. They don’t make the connection that each fund owns a basket of investments. The problem is that many funds own the same underlying securities, just in different allocations. So while you think you are doing yourself a favor by investing in many different ones, you could be simply shooting yourself in the foot because you are owning many more shares of the same companies.

High Costs. Mutual fund cost is something few investors think about, but should. Mutual funds cost money to invest in, called the expense ratio or management fee. You never get a bill in the mail however. They all take their fee from the performance of the fund. Because of this, many investors pay a higher fee than they are aware. But these fees add up over time. As a result, it is important to pay attention to how much you are paying in fees.

No Real Time Trading. The way mutual funds work is you place an order to buy or sell and your order gets executed at the market close. So if the market is dropping and you want out, you won’t be able to sell until the market closes, even if you place your sell order at 10am.

Tax Inefficiency. One of the bigger downsides to mutual funds is the tax structure. If other shareholders are buying or selling a lot, the fund will experience capital gains. And even though you didn’t buy or sell, these capital gains are realized by you the shareholder and you pay taxes on them. For most people, this is more of an inconvenience than a deal breaker as capital gains are taxed at a lower tax rate. But it is still something that you need to consider.

Mutual Fund Fees

Any talk about mutual funds has to cover fees.

There are all sorts of fees they charge.

To start off, they all charge a management fee.

This fee pays the annual operating expenses of the fund, which includes paying the portfolio manager and the costs associated with running it.

As I talked about above, this fee is taken directly from the fund itself.

For example, let’s say your mutual fund charges you a fee of 1% per year.

At the end of the year, you see it returned 7%. What the fund really returned is around 8%.

After the fee is taken out, you earn what is left over.

Most investors ignore this fee and that is a big mistake.

The reason is because this fee eats away at your money over time.

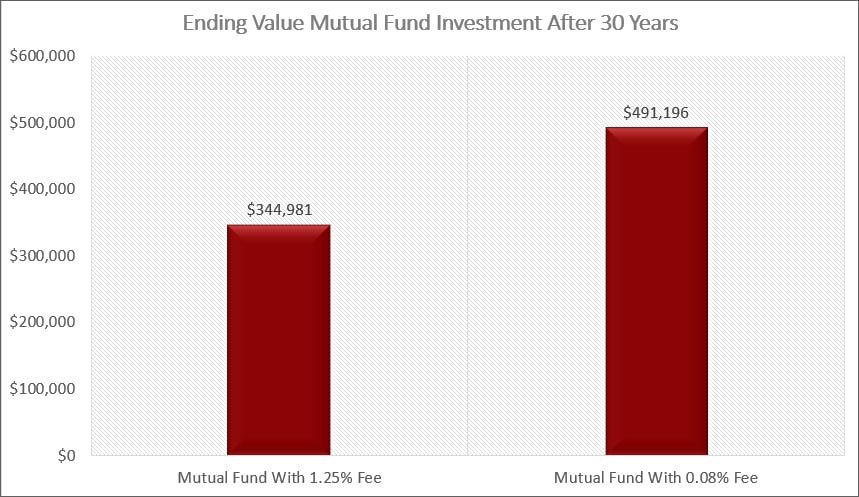

For example, let’s say you are investing and are charged an expense ratio of 1.25%.

You have invested $50,000 and it earns 8% annually for the next 30 years.

At the end of 30 years, your initial $50,000 is now worth $344,981 and you paid $59,883 in fees.

It gets worse.

The opportunity cost of paying a high fee is $98,267.

This means the $59,883 you paid in fees could have grown into an additional $98,267.

In essence, your total fees are $158,151. That is a lot of money.

Now let’s look at the same situation but with an index mutual fund that charges 0.08% in management fees.

- Read now: Learn the pros and cons of index funds

After 30 years you initial $50,000 is worth $491,196 and you paid a total of $11,936 in fees.

This includes the opportunity cost.

The result by investing in a mutual fund that charges a lower management fee is you having $150,000 more in savings!

If you decide to start investing in mutual funds, you have to pay attention to the expense ratio.

Don’t make the mistake average investors make thinking by paying a higher fee, they get a better management team and therefore higher potential returns.

Investing doesn’t work this way.

In fact, the lower the fees, the better off you are.

Why is this?

Because no fund manager can consistently beat the market.

Professional managers get lucky and beat the market from time to time, but no one does it every single year.

From 1991 through 2005, Bill Miller of Legg Mason did beat the market every single year.

The ironic thing is that even he chalked it up to luck. (For those of you curious, the odds of actually doing this are 1 in 2.3 million).

Unfortunately the fees don’t end with the management fee.

Here are a handful of other expenses you can expect to encounter and need to look out for.

Understand that not all funds charge the following sales charges.

You have to read the fees section in the fund prospectus to know what fees you will be charged.

Front End Load

This is a fee you pay to invest in a mutual fund in the first place.

Typically load funds charge 5.25%, which is a sales commission that goes to the advisor selling you the investment.

So if you invest $100, the first $5.25 goes to the broker or financial advisor and the remaining $94.75 gets invested.

Understand that you are still paying the management fee in addition to the load, so the example I showed you above ends up looking a lot worse for your money.

Why would you pay to invest in a mutual fund?

Beats me, but many people do it.

When you pay to invest in a mutual fund, it is referred to as a front load.

Some charge a back end load instead.

In this case, they take a fee when you sell.

Typically, this fee is only on certain classes of mutual funds.

The good news is there are many no load mutual funds, which means there is no sales charge to buy or sell.

12b-1 Fee

This is a fee charged by the distributor for providing services to shareholders.

Typically this fee is 0.25% but can be much higher.

This is taken from the return of the fund, like the expense ratio and it is also in addition to the management fee.

Short Term Redemption Fee

Some funds charge this fee to individuals who sell out of a fund within 90 days or less of buying it.

The idea here is that the management team wants to limit short term trading.

While on the surface short term trading doesn’t seem like trouble, it actually is.

The more trading the management does, the more costs there are and they get passed through to you.

This fee is usually 1% of the sale amount. So if you are selling $1,000 and are charged this fee, you would pay $10.

The good news is there are many funds that don’t charge any of these fees, except for the management fee, so be sure to find those options.

Net Asset Value

I briefly mentioned the net asset value earlier and it is important you understand it as it is how a mutual fund price is determined.

The net asset value, or NAV is calculated after the market closes.

The NAV is simply the value of the underlying assets the fund holds minus the its liabilities.

It is then divided by the number of shares outstanding.

To find how much your holdings are worth, you simply multiply the number of shares you own by the NAV.

An open end mutual fund always trades at the NAV because you are buying shares directly or selling your shares directly back.

In other words, if you buy or sell shares, you know you are paying or receiving the same value of what the fund is worth.

With a close end mutual fund, this is not the case.

Since you buy and sell shares with other investors, you can pay more or less than the NAV.

If you pay more, this is called the premium. If you pay less, it is called a discount.

What you pay all depends on the demand investors have for the fund.

What To Look For In Mutual Funds

So now that you have an understanding of the basics, what should you look for when it comes to picking and investing in mutual funds?

Here is a quick checklist for you to keep in mind.

#1. Look For Low Fees

As I said before, low fees are the key.

One percent might not sound like much, but it adds up over time.

There are plenty of choices out there that allow you to pay the bare minimum to invest.

I highlight these in the frequently asked questions section below.

But for a rough guideline, try to keep the expense ratio under 0.50%, ideally lower than this.

If you invest in passive index funds that track the market, you can easily invest for less than 0.15%.

In addition to this, watch out for the other fees I mentioned.

This is especially true for load mutual funds.

#2. Turnover

I didn’t talk about turnover above, but it is something to look for.

Simply put, portfolio turnover is how often the portfolio manager buys and sells the underlying investments.

If the number is over 100%, this tells you that the underlying investments you owned when you first bought the fund are not the same as one year later.

Remember what I told you about the more trading the management team does, the higher the costs are to you?

Here is a prime example of this in action. Look for low turnover.

How To Buy Mutual Funds

Buying mutual funds is a lot easier now with the internet than it was when I was growing up.

For me, I had to call the mutual fund company to request an application and mail it back along with a check.

Now you can do it all online and electronically transfer money to start investing.

All the mutual fund families allow you to create an account and start investing online.

I would encourage you to set up an automatic investment plan when starting out.

This has you invest a set amount of money every month into the fund.

For most funds, this can be as little as $25.

The reason I recommend this is because your money will grow over time.

You will invest every month without having to remember to do so.

I also encourage you to reinvest any dividends and capital gains as well.

This dollar cost averaging strategy allows even more compounding and growth over time.

Frequently Asked Questions

This can be a confusing topic and as much as I try to explain them, I still get questions from readers.

Here are some of the most common questions I get asked.

Why invest in mutual funds?

It is an easy way to get started in the stock market with little money and be instantly diversified and have a professional money manager on your side.

While some brokers allow you to fractionally invest in stocks, it is not the same.

With this option, you are picking the investments and you need to manage it going forward.

You also are not as diversified as you are with a mutual fund.

Who regulates mutual funds?

The Investment Company Act of 1940 was created to regulate mutual funds and oversight is performed by the U.S. Securities and Exchange Commission.

The good thing to know is that mutual funds are one of the most regulated investment options out there, so the odds of being scammed are low.

Note that this doesn’t include financial advisors.

You could have a shady advisor selling you a bogus investment.

But if you do your research, you should realize it’s a scam.

What are the largest mutual fund companies?

The biggest are Vanguard, Fidelity, T. Rowe Price, and Charles Schwab.

Each offers something a little different but my favorite is Charles Schwab.

The reason is because they offer their own mutual funds as well as other fund families.

And if you invest in Schwab funds you only need $1 to start investing and $1 for additional investments.

But you cannot go wrong with any mutual fund company listed.

Can I lose money in a mutual fund?

As with any investment in the stock market, you can lose money.

The only exception to this is if you invest in money market funds.

These act like a savings account and the share price is stable at $1.00 all the time.

While there were some of these investments that lost money during the financial crisis in 2008, the chances of it happening again are slim.

To lower your risk of losing money, you need to assess your investment risk tolerance and build a portfolio with a mix of aggressive investment and conservative investments.

- Read now: Learn more about risk tolerance

How do I choose a good mutual fund?

The first thing you need to do is understand your investment objectives.

What do you want to achieve by investing?

Once you know this, you can move on to picking the correct investment for you.

The easiest way to choose a mutual fund is to stick to a passive investing approach.

With this approach, you invest in funds that track the market.

The fees you pay will be minimal and the returns you get will be similar to what the stock market earns.

From there, it is all about choosing the fund company you feel most comfortable with.

If you are wanting to invest in actively managed mutual funds, then I suggest you compare them by looking at their investment objective and their 10 year annualized returns.

- Read now: Learn the difference between active and passive investing

- Read now: Discover why buy and hold investing is the path to wealth

You are not choosing the one with the highest investment returns, you are simply comparing two like funds to see how similar they are.

Also make note if the management team has recently changed as this can impact future returns as well.

What you should not base your decision on are the fund rankings.

The reason for this is because the rankings are based on historical performance and there is no guarantee that past performance will be repeated.

Final Thoughts

I realize that this was a lot of information about the basics of mutual funds, but there is a lot to know.

I suggest you take the time to re-read the post a few times so you can digest all of the information.

When you are finished, you should have enough confidence to start looking over mutual funds to invest in.

If you have any questions along the way, feel free to reach out to me.

While I can’t tell you exactly what to invest in, I can help you understand things you might be overlooking.

Lastly, just remember, it’s your money. No one cares about it as much as you do.

Because of this, it is important to understand as much as you can about investing.

Again, I am here to help you in any way that I can.

- Read now: Discover the best John Bogle quotes of all time

- Read now: Learn how to invest in a volatile stock market

- Read now: Find out how to invest a small amount of money

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Wow. Very thorough walk-through of mutual funds. Thanks for the read

Thanks! Hope you enjoyed it!

You hit the nail, investing in low cost mutual fund is the best way to invest.

Great overview Jon! Where I see people getting into trouble with mutual funds is buying different funds that essential cover the same stocks in each fund. A person doesn’t need excessive overlap. That’s why it’s always good to check the prospectus of a fund to see what stocks it holds.

I agree Brian. It’s easy to see the fund holdings online too. In other words, there is no reason to not know what a fund holds.

Good read it was very detailed. This can help someone who might be hesitant on where to invest. I also agree that many stock mutual funds all own the same companies. That’s why you have to look at different sectors once you are an established investor.

I agree that mutual fund is a good way to invest especially if you’re new with investing. The key is to find the one that has a low fee so you can maximize your return and make sure the stocks in it don’t overlap if you really want to diversify your investment.

All true. Doing a little research will go a long way in being successful.