THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I recently came across the Chaikin Stock Research and their Portfolio Health Check service, and I must say that I am impressed.

As many of you know, I am a strong advocate of buy-and-hold investing, also known as passive investing. While 95% of my investments do follow this belief, I do have a brokerage account that is filled with stocks. I use this account as my “fun account,” meaning it is money that I would like to earn a return on, but it also won’t be a big deal if I lose everything. It’s sort of my play money.

So, I decided to test out the Chaikin Portfolio Health Check service on this account and share my insights with you. Let’s dive in!

Table of Contents

What Is Chaikin Portfolio Health Check Service?

The idea behind the service is a back-tested 20-factor model whose goal is to predict the performance of a stock over the next three to six months. While 3-6 months may not seem like a very long time, it’s a great concept for both short-term and long-term investors.

It helps identify stocks that are a good buy and ones that are trading at a point that would be ideal to buy into.

You can go to Chaikin Stock Research and subscribe for free. The first page lets you enter stock symbols for the holdings in your portfolio. The list is pre-populated with some of the big names like Apple, Google, and Microsoft, but removing them is a breeze—simply click on the “X” next to them. Tap continue, and a PDF report will be created for you.

The Report

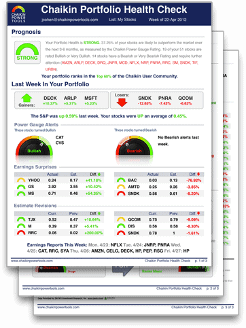

The look of the report is great. It is broken down in a smart way (read: easy to follow and understand). Mainly three colors are used to talk about your holdings: green for bullish, red for bearish, and yellow for any stock that the service is neutral on.

The service provides an overall prognosis of your portfolio, the previous week’s happenings, and stocks that turned bullish or bearish over the past week.

Below are earnings surprises, estimate revisions, and any other earnings reports due out in the upcoming week. This is valuable because we often forget or don’t have time to search for this information ourselves. So, aside from being helpful, having it in the weekly report frees up time.

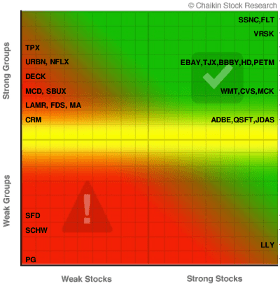

The next section of the report is the Industry Group Breakdown. There is a cool matrix (see below) that shows all of your holdings and whether they are strong or weak. The service goes on to recommend swaps for moving from bearish holdings to bullish ones.

The report concludes with news sentiments (whether the news has been good or bad for your specific holdings) and the performance of each stock over the past week.

Pricing

The first report you receive is free. From there, the subscription price is $9.95 per month or a flat $95 per year, which saves you 20%.

The price is arguably the only disadvantage to the Portfolio Health Check, but I feel that the $95 annual subscription price is a good deal for someone who primarily deals with stocks. For other investors like myself, I suggest you try it out first to see if it would be valuable to you.

Other Great Features

Chaikin Stock Research has smartphone apps for both Android and iPhone that allow access to all of the information on the go.

You can even download the desktop widget, which is available for both Mac and PC. Plus, if you have a trading account with optionsXpress, you can place your trades from this widget. It doesn’t get much easier than that!

Final Thoughts

To review, Chaikin Stock Research Portfolio Health Check is the only analysis tool that shows you where your portfolio is headed over the next 3-6 months.

It also does the following.

- Tells you weekly if you are positioned for success over the next 3-6 months

- Gives you specific ideas for swapping weak stocks and industry groups for strong ones

- Uses powerful analytics to guide you

- Offers clear graphics that let you review and understand the report in minutes

- Shows how you’re doing compared to the S&P 500 and Chaikin Community

- Recognizes trouble spots and opportunities on the Chaikin Power Grid—where stocks and industry groups are mapped out in quadrants

Check out the Chaikin Stock Research review about the Portfolio Health Check by Barrons and the video featuring the service by Fox News.

MoneySmartGuides’ articles are created as a result of unrivaled experience, in-depth research, and reliable editorial practices. I’m always happy to help or chat, so don’t hesitate to contact me at contact@moneysmartguides.com if you have any questions or comments.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Under $10 a month is not bad at all for a service like this. As you said, simply having access to upcoming events like earnings announcements would save me a lot of time. Do you know if they provide historical suggestions so you can see just how accurate their predictions have been?

That’s a good question. I don’t have the answer for that. I’ll look into it and get back to you.