THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Before getting into this discussion, I need to make a clarification between a tax credit and a tax deduction. Too often, people confuse the two and think they are equally as good. But, this isn’t the truth.

Table of Contents

What Is A Tax Credit?

A tax credit reduces the amount of income tax you have to pay and it is a dollar for dollar match. For example, the lifetime learning credit, which is currently $2,000 reduces your income tax by that $2,000.

What Is A Tax Deduction?

A tax deduction is an amount of money that lowers your tax liability by reducing your taxable income by the same percent tax bracket you are in. For example, student loan interest can be written off of your taxable income based on your tax bracket, thus reducing your tax liability.

Why Credits Are Better

If you are like many reading this, you are still confused about what the difference is between the two. Don’t worry, taxes are a complex topic and credits and deductions are as well. The key as to why credits are better is for the dollar for dollar match they provide.

A tax deduction on the other hand, only reduces your taxable income and thus your tax liability proportionally, depending on the tax bracket you are in. Let’s look at both of these in action to help you better understand.

Real Life Example

John makes $50,000 per year. This puts him squarely in the 25% tax bracket. As he is determining his taxes, he realizes he paid $2,000 in student loan interest last year, thus he gets a tax deduction. How much is his tax deduction?

It is not $2,000. His tax deduction is the $2,000 in student loan interest he paid multiplied by the 25% tax bracket he is in. John can deduct $500 from his taxes (2,000 x 0.25). So, at the end of the day, John now has a taxable income of $49,500 (his original $50,000 less the $500 student loan deduction).

Mary on the other hand, also makes $50,000 per year and is in the 25% tax bracket. She does not have any student loans to reduce her taxes. However, there was a program this year where if you bought an energy efficient appliance, you could take a credit for the amount of the appliance on your taxes, up to $1,000.

Mary bought an energy efficient dishwasher that qualifies. It cost her $1,000. Because this is a credit, Mary can credit her taxable income by $1,000 (the amount she paid for the appliance). At the end of the day, Mary now has $49,000 in taxable income (her original $50,000 less the $1,000 credit).

Hopefully this shows you that any deduction you claim on your tax return only reduces your tax liability by the tax bracket you are in. If you are in the 25% tax bracket, every dollar you spend that is eligible for a deduction allows you to write off $0.25 of that dollar on your taxes. If you are in the 10% tax bracket, $0.10 of every dollar you spend that is eligible for a deduction will go towards reducing your tax liability.

With that said, the IRS realizes that the more money people make, the less they need the help of many of the tax credits and deductions. Therefore, many of them are phased out as your income increases. This means at an eventual income amount, you will not be able to take the write off.

Why Tax Deductions Are Misleading

Even though you are getting a tax deduction, are you really saving any money? So many people argue that you should take your time paying off your student loans because the interest you pay is tax deductible. That is true, but not every dollar. At most it’s $0.35 of every dollar because any higher of an income will phase out most credits and deductions.

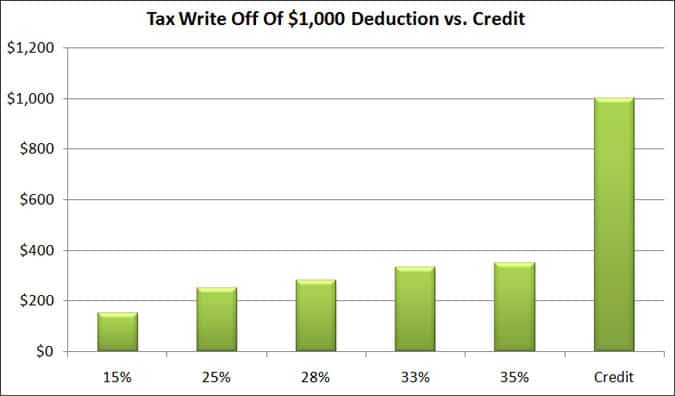

Take a look at the chart below. It shows you the tax benefit from $1,000 if it were a tax deduction or a tax credit. As you can see, with a credit, you take advantage of the entire $1,000. But with a credit, at most you can only write off $350 and that assumes you are earning a high salary. Most people will fall somewhere between being able to write off $150 – $280.

Added to that, most credits and deductions have a limit on the maximum amount you can benefit from. If you don’t earn too much and can claim the deduction, you can only deduct up to $2,500 in a year in student loan interest.

Revisiting the example of John above, he is “saving” $0.25 of every dollar in student loan interest he pays on his taxes. I will grant you that it is better than nothing, but wouldn’t you rather pay off the loan and be able to save or invest 100% of the money instead? In other words, he is spending $1.00 to save $0.25. That doesn’t make much financial sense to me.

To put another way, in the end he paid $1,500 in student loan interest after taking the $500 deduction on his taxes. Since when is it OK to pay $1,500 in interest?

How To Save Money On Taxes

While I am all for taking every tax credit and deduction you can claim, there are other, smarter things you can do to save on taxes in the first place. Here is a list of such things that will save you money on taxes and help increase your wealth.

Contribute To Your 401k: When you contribute to your 401k plan, the money you invest is taken out of your paycheck pre-tax. This means you don’t pay any tax on that income. And it gets better. As your 401k earns interest, dividends and capital gains, all of this income is deferred. This means you don’t pay any taxes until you withdraw the money.

Contribute To A Traditional IRA: If you qualify, you can make a deductible contribution to a traditional IRA. For 2016 and 2017, you can save $5,500 a year in an IRA and potentially shield that income from taxes.

Put Money Towards Your Health: If you are covered by a health savings plan at work, any contributions you put into the account are pre-tax, lowering your overall tax. And if you use the money for a qualified medical expense, you won’t have to pay tax when you spend the money either.

If you aren’t covered by a health savings account, you have another option. The flexible spending account. As with a health savings account, you put money away pre-tax, saving you money. The only catch here is that you have to use the money you put aside that year. So make sure you estimate how much money you need for medical bills for the year before you decide on how much to contribute.

Pay Off Student Loans: I realize that when you pay off your student loans you lose out on the deduction you get for the interest you paid. But when you get rid of these loans, you have more free cash flow. This will allow you to invest more money in your 401k plan or an IRA, which will lower your taxable income, thus saving you money on taxes.

To pay off your loans the quickest, look into refinancing. Rates are low and you can easily save money by refinancing.

Invest Smarter: Dividends, capital gains and interest that you earn on your investments are all taxed at different rates. By making sure you build a tax efficient portfolio, you can save money on taxes.

For example, interest you earn on bonds are taxed as ordinary income. So if you are in the 25% tax bracket, any interest you earn is also taxed at 25%. By putting these bonds into your retirement accounts, you allow for them to grow tax deferred and not pay any taxes.

On the other hand, dividends and capital gains are taxed at a lower rate, so putting them into your taxable account makes sense.

Final Thoughts

I am all for saving as much as you can on your taxes, which is why you need to think long and hard when choosing to do your taxes yourself or hiring a pro. While the software that lets you do your own taxes is great, there can be some sticky situations.

Of course, just picking a tax pro off the street doesn’t ensure you will get every deduction either. This is why you need to make sure you are committed to the tax software and your abilities or the person you hire.

At the end of the day, remember, tax deductions are nice, but credits are better. And just because you can deduct something from your taxes doesn’t mean it is the best use of your money. In many cases, you are much better off doing things like maxing out your 401k plan so that you can shield larger amounts of income from taxes.

[Photo Credit: stevepb]

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

The funny thing is that deductions and credits are probably some of the simpler parts of the tax code.

Although as a general rule I would be wary of any situation where you have to spend money in order to get a tax break. You might be better off not spending the money in the first place.

Very true!

Spending money to get a tax break is like falling for the buy more to save more trick.

It’s definitely wise to ensure the fine print with deductions, my sister got done over here when she had deductions on an investment property. My advice is to keep all reciepts!

Especially with rental properties…the in’s and out’s of the tax code regarding those can be very confusing.

Great explanation of the two! I now it confuses a lot of people. Deductions can be a good thing, but like you said I’d much rather pay off that student loan to free up my money.

Many times when you do the math and realize you are “saving” only $0.25 while still paying $0.75 it makes it hard to argue that the deduction is worth it.

I always keep all my receipts, practically to the point of obsession! Tax can be confusing so great timing with the article…yet again.

I keep all of my receipts too. The key is to stay organized throughout the year so that come tax time you aren’t spending all of your time trying find and file receipts.

This was so going to be my post for Friday, and you beat me to it. Very good information. I know that credits are better,but still get confused on what is a credit and what is a deduction. Very good and simple explanations. I like the personal examples.

Thanks! It’s hard to try to make the tax code a simple matter.

Sorry about beating you to the post!

Taxes are never a reason to make any financial decision, with the exception of donating to charity. You shouldn’t need a reason to donate, but if donating $1,000 means you get $400 of that back when you file, then you might as well donate $1,667 and get back $667 when you file. More money donated makes you look really good!

This is one of the arguments for not eliminating or phasing out the charitable deduction. Many charities claim that many people will not donate without the tax incentive to do so. I’d like to think people would still donate, regardless if they save money on taxes or not.

moneysma,

Thanks for breaking taxable income down, I am going to the accountant on Tuesday to see what I can use to bring my taxable income down. This is very enlightening, thanks!

Glad you found it helpful Jim!

That was a great break down. So when you claim dependents how does that work? I don’t have any kids and claim zero dependents and a LOT gets taken out of my check towards taxes and my friend claims 10 dependents and only gets $12 taken out of his pay check?? But at the end of the year will he owe more to the IRS anyways? I’d rather owe nothing to the IRS at the end of the year (by paying them out of each paycheck; I’d hate to find out I owed them and wasn’t expecting it) but I also don’t want to be paying them money I don’t have to. Do you know what I mean?

Great question! Claiming dependents will reduce the amount of taxes that are taken out of your paycheck. But, it you don’t claim a correct number, then you could end up owning much more or less come April 15th. Personally, when I was single and owned my own home, without kids, I claimed 2 dependents. Why? Since I could deduct my mortgage interest from my taxes, I was going to get a huge refund. By claiming more dependents, I reduced the amount of taxes I paid each week. In effect, I went from getting a huge refund to getting a small refund. I chose to get my money back in each paycheck instead of 1 big refund check from the IRS.

You can check out the IRS withholding calculator: http://www.irs.gov/Individuals/IRS-Withholding-Calculator to see how much you should withhold so that you are getting the biggest paycheck you can.

Oh. Okay that makes sense. Thanks. And that’s a great tip. I’m going to check out that calculator!

The point that a tax deduction only saves you a portion of the amount on your taxes is something that is lost to many. But every little bit helps, right? 🙂 I think a lot of people could use some education as to what is tax deductible, and what is not.

Every little bit does help, but you also have to look at the bigger picture. Why spend $0.75 in interest to save $0.25 when you could just pay off student loans quicker and save an entire $1.00?

I just wish there’s no tax deductions. Honestly, after reading your post, I don’t have questions on tax deductions but I have some on how our government uses it for us.

That’s the think I have trouble with when it comes to taxes. I am all for paying taxes for the better of everyone, but the mismanaging of our tax dollars makes me question why I pay in the first place. The people in Washington seem to be inept at handling money. I’d love to look at their personal finances!

Definitely agree on the deceptiveness on tax deductions. They should be called income deductions since they primarily decrease your income and only slightly decrease your taxes.

You might want to clarify your tax credit example. You say the $1000 decreases her income from $50k to $49k but I think you many to state her tax owed and decrease that by $1000.