THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Sadly, most people have absolutely no idea how much they will need in order to retire.

They see the magazine headlines talking about $2 million dollars and think saving this amount of money is impossible.

So they give up before they even start.

Don’t do this.

You don’t need $2 million for retirement. In many cases you need a lot less. And in all cases, having something is a lot better than having nothing, even if that something is $25,000.

Trust me, I’ll show you why.

This post is going to walk you through the steps to figure out how much you need to save for retirement and how to see where you currently stand.

This process is easy to do and involves some basic math. And you’ll have your answer in a short amount of time. Let’s get started.

Table of Contents

Figuring Out How Much You Need For Retirement

Step #1. Figuring Out Your Spending

In order to know exactly how much money you will need for retirement, you need to have an idea of how much you will spend in retirement.

I know you are thinking, “How in the world will I figure this out?”

Luckily there are a couple of options for you to figure it out.

Option #1: Create A Budget

In order to get an idea of how much you will spend, you need to assess how much you are currently spending.

This requires a budget.

By seeing where your money goes, you will get a good idea of how much money you are saving and spending each year.

And while it might not seem that important now, knowing these 2 numbers will help you tremendously down the road.

But first, here are some resources to help you set up a budget.

- Check out my post on learning to budget. It will walk you through setting up a budget for the very first time.

- Afterwards, you can check out my post of excel budget templates. This post has a handful of free budget templates to make the process of budgeting easy.

- Finally, if excel isn’t your friend, you can use software to help you out. Check out You Need A Budget as an option.

Once you start plugging in numbers for a couple of months, you will get an idea of how much you are spending.

You can then multiply this number out for the year to get your annual spending amount.

If you want an answer to the amount of savings needed for retirement quicker, you can check out the next option.

Option #2: Review Last Year’s Spending

While should still set up a budget, there is an alternative way to figure out your spending.

Look at last year’s bank statements and credit card statements. You can total up all of the expenses for each month to see how much you spend per year.

In many cases, you might even be able to simply download the annual summary as opposed to each month, saving you time and additional math skills.

The only issue with going this route is if last year was an outlier for you.

For example, if you spent more money than usual doing a remodeling project or making a major purchase.

If that was the case, do your best to not include this amount in your estimate.

Step #2: Use Your Spending To Figure Out How Much You Need To Save For Retirement

Once you have your annual spending number you are going to take it and do some additional basic math.

Take your spending number and subtract any income you expect to receive while retired.

This includes part-time work, Social Security income, and rental income. Don’t include investment income or dividends from your investment portfolio.

You may also want to exclude Social Security if you aren’t sure it will be around when you retire.

Take the result and multiply it by 25 and you have your answer. This is also known as the 4% rule.

For example, let’s say your annual spending is $40,000.

You don’t expect any other income in retirement, so you just take your number and multiply by 25.

This gets you to $1,000,000 which is the amount of savings needed for retirement.

By multiplying your spending by 25, you get a good estimate of the savings needed for 30 years of retirement.

If you wanted to do the math a little differently using the 4% rule, you would look at your current savings amount and see how much income it would provide annually.

For example, if you have $100,000 saved for retirement, then you can withdraw 4% or $4,000 a year depending on inflation and not run out of money.

Now, I’m not sure how many of us can live on $4,000 a year as most of us can’t even live on $1,000 a month, so you know you need to build a larger portfolio by saving more money.

If you are planning to retire early, you should skip the 25 multiplier and instead use 33.

In this case, $40,000 times 33 gets you to $1,320,000.

You may be thinking that your expenses will certainly be less when you retire than they are now.

After all, you won’t be driving to work every day, you won’t need new clothes for work, or have to get your clothes dry cleaned anymore.

While this is true, I don’t think you should cut these out of your estimate.

Why?

First off, you aren’t going to just sit in the house every single day.

You are going to go out to lunch to catch up with old friends, start new hobbies, possibly do some work around the house, and potentially travel.

You also still need to drive to get to places.

All of these things cost money.

Money that you currently are not spending, meaning your spending could stay the same or even increase in retirement.

By using your current spending, you are coming up with a conservative estimate of your retirement income needs.

It’s better to estimate higher expenses and have more money saved for retirement than not enough.

2 Alternative Estimates Of Amount Needed For Retirement

I know that figuring out your spending and doing the math will take a little bit of time, regardless of how easy the math is.

But some people just want a faster answer.

So here are two additional ways to know how much money you need for retirement.

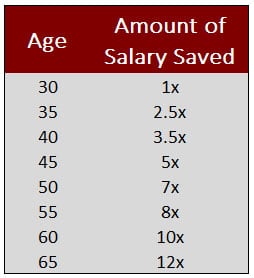

Estimate #1: The MoneySmartGuides Retirement Balance By Age

I recommend that by age 30 you should have at least your annual salary saved for retirement.

To put another way, if you make $45,000 per year, by age 30, you should have $45,000 saved for retirement. What about other ages?

These numbers are based on a study done by Fidelity. The numbers they came up with are a little less than these, meaning they suggest you should have saved less money.

But I want to make sure I never run out of money in retirement, so I want to save more than what they came up with.

Estimate #2: The 80% Rule

The 80% rule is easy to follow.

It assumes you need 80% of your income to live on in retirement. To figure out your number, take your salary and multiply it by 80%.

From there, you take the answer and multiply that by the number of years you plan to be retired.

For example, let’s say you earn $50,000 per year and you plan to be retired for 25 years.

We take 80% of $50,000 ($50,000 x 0.8) and get $40,000. This is how much money we need each year to live on.

Next, we take the $40,000 and multiply it by 25 ($40,000 x 25) to get $1,000,000.

Therefore we need to save $1 million dollars for our retirement.

While this rule won’t tell you that you should have a certain amount saved by a certain age, it will help to keep you on track.

For example, going back to the example of needing $1 million for retirement, if you are 40 years old and have $300,000 saved, you are doing great.

But if you only have $25,000 then you need to start saving more.

Getting More Precise With A Retirement Number

Those are some of the fastest ways for you to know how much money you need for retirement. Easy, right?

But what if you want more detailed information? What if you want to see if you are on track for meeting your goal?

After all, if you have $50,000 saved and plan to retire in 15 years, will you make it to your goal of $1,000,000?

Unfortunately, this is where things start to get a little tricky. There are a lot of variables to take into account. For example:

- How much money have you saved?

- How are you invested?

- How much money are you saving each year?

- When will you retire?

- Do you have any major expenses coming up?

All of these will affect your ability to save enough to retire when you want to.

And up until a few years ago, you would need to sit down with an investment professional and pay a few hundred dollars just to get an idea if you are on track for retirement.

But not anymore.

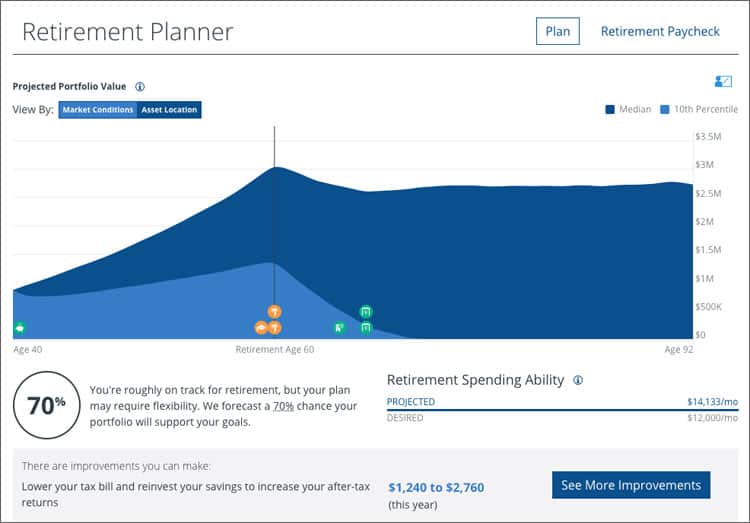

You can now figure all this out for free. And you don’t even need to do any math! All you have to do is open a free account at Personal Capital.

Connect your accounts, plug in some numbers, and it does the work for you.

The resulting number will tell you the probability you have for a secure retirement.

This is the tool my wife and I use to make sure we are on track. And as a side note, seeing this information is exactly what my wife needed.

She has a tough time seeing how investments grow over time and the impact compounding will have on our money.

When I showed her the retirement planner from Personal Capital, the light bulb went off and she got excited about retirement and saving for it.

I highly encourage you to get started with Personal Capital.

It is easy to use and will give you the most accurate answer for knowing if you are on track for retirement.

How To Catch Up If You Are Behind On Saving For Retirement

After running the calculations you might have come to the realization that you are behind on your retirement savings.

Do you give up and call it quits? Not a chance.

There are a handful of things you can do that will make a difference.

Here are some options to look into.

Increase Your Salary

You can do this by working smarter to earn higher raises or even switch companies to boost your salary. This post offers a detailed guide for how to increase your salary.

If you happen to work in a field or industry that doesn’t give raises or works on a specific pay scale, you have another option.

You can work on the side to increase your income. I’m not talking about getting a second job at night earning a measly $8 an hour.

I’m talking about side hustles that can bring in anywhere from a few hundred to a few thousand extra each month. This post walks you through 51 ideas.

Save More Money

This is where budgeting comes into play.

Maybe after creating a budget you find that you typically have money at the end of the month, but because it is just sitting in your checking account you spend it.

In this case, set up an automatic transfer from your checking account to your savings account.

This ensures you are saving money and not spending it.

I use CIT Bank for my savings and love it. They consistently offer the highest yields in the country.

In addition to the point above, you can make saving money a mindless task.

By this I mean open a free account with Qapital. They will round up your spending to the nearest dollar and transfer that amount to a savings account from your checking account.

Before you know it, you will have a nice stash of extra money to put towards an IRA account.

Alternatively, you can open an investment account with Betterment.

When you set up an automatic transfer here, they will invest the money for you. You will grow your money faster by investing it versus putting it into a savings account.

Click here to get started with Betterment.

Reduce Your Spending

Another option to look at is cutting your spending.

As with saving money, there are many options here too.

For starters, look at your mortgage. Does it make sense to refinance? Use the calculator below to see how much you can save.

If you can save $300 a month and put that into your investment account, that is an additional $3,600 a year.

Over 15 years at an 8% growth rate you would have an extra $117,000!

Next, if you have student loans, look into refinancing these too.

Even if you can drop your payments by $100 a month, over 15 years at 8% this money grows to $40,000 when invested.

With just these 2 options you increased your savings for retirement by close to $160,000!

Another simple option is to start using Trim. They will analyze your spending and see if there are any subscriptions or membership fees you can cancel.

How many magazines do you get that you never read? What about groups you joined and pay for each year but never use?

Trim will help you find these charges and cancel them for you.

Want to save money on your cable bill? Trim will negotiate this bill for you too!

Finally, you can read my detailed post about cutting expenses.

It will walk you through 18 ways you can save over $1,000 a month. Just make sure you invest the money you save for retirement!

Saving Something Is Better Than Nothing

Despite all of your best efforts, you may come to find that no matter what you do, you will not be able to reach your retirement savings goal.

This may make you think there is no point in saving anything at all for retirement.

But that would be a huge mistake.

Even if you can’t reach your savings goal, you should still save as much as you can for retirement.

The reason is simple.

Anything you can save allows you to have more options.

For example, you might not be able to retire at 65. But by saving something you will be able to retire one day versus never.

Or, saving something for retirement could allow you to take a few trips to other countries, whereas if you saved nothing you wouldn’t get to travel at all.

The point is, something is always better than nothing.

Comparing Yourself To Others

Finally, I know that many times we want to see how well we are doing compared to our peers.

And when it comes to saving for retirement, this is no different.

But there are problems when you try to compare your retirement savings to others.

I go into detail about this in my average 401k balance post. But I’ll briefly talk about it here.

The main reason why you can’t accurately compare yourself to others when it comes to retirement savings is because of all the variables.

For example, you have to take the following into account:

- Age when you first began working

- How much debt you graduated college with

- Where you live

- How much you earn

Because of these factors and others, two people at the same age can have drastically different amounts saved for retirement.

And this doesn’t necessarily mean one is doing well and the other is doing poorly.

The only way to know for certain if someone is meeting their retirement savings goal is to figure out how much they will need and compare that to how much they have saved and their age.

Final Thoughts

How much money do you need for retirement?

I encourage you to run the numbers to find out.

You may be surprised at the number you come up with.

But don’t let it depress you. You have 2 options when it comes to having the money needed for retirement:

- Make it a point to save as much as you can each year and then try to save more each year thereafter.

- Learn to live on less so your annual expenses are lower.

Don’t fall victim to thinking you need to save a massive amount.

Look over your expenses and see if there are things you can cut out entirely or just reduce.

If you can find a way to knock off $250 a month from your spending, that comes to $3,000 per year less that you need to save.

Over the course of a 30 year retirement, that is $90,000!

At the end of the day, knowing how much you need to save for retirement is easier than you might think.

Run the numbers to see where you stand and then make adjustments as needed.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Wow that is an intimidating number. I think the average person would struggle to save anywhere near that. Even saving $1M for most people is a big accomplishment. When doing these calculations do you take into consideration that as the older you get, the less active you will be and the less money you will likely spend?

That is where it gets tough….who's to say you will be less active? Maybe you will play sports that aren't very intense. And, if you aren't very active, is that because your health isn't the greatest? If that is the case, then you better plan to save extra for health care costs. The key really is to save as much as you can each month. I think that the big number would be intimidating to everyone. Break it out into smaller chunks and concentrate on hitting those smaller goals.

I have become quite interested in retirement planning recently. It seems to be a good Idea to plan for it early. The sooner the better. Thanks for sharing.

As a financial adviser it really frustrates me to see some of these ridiculous “numbers” magazines and financial sites come up with.

Everybody looks at the lump sum number they’re going to have in retirement but they DON’T take into consideration inflation. Who cares if you have $1M 40 years from now? Sure, that’s a lot of money but it won’t be then. The fact is that everybody will be a “millionaire” in this country…it’s just a matter of time.

Many of us would like to travel when we retire. If you are healthy you would not be happy sitting around the house. At one retirement seminar I attended, we were advised that if one put away $1000 each year starting at the age of 18, you would have 1 million dollars at age 60. With these figures you would need to save $3000 a year. There was no mention how one would invest that money over the years to produce that amount. So, if anyone is 18 or 20 out there…….

Yeah, it is pretty intimidating looking into the future at an inflation-adjusted number. But along the lines of Work Save Live, inflation will also pump up our salaries, too, making it easier to imagine saving a bunch of money. Thinking about piling up $5,000,000 in 30 years when you only make $75,000 per year is tough. But your earnings (and savings) can just as easily increase with inflation, so it's not as tough as it seems. (Well, maybe $5,000,000 is pretty tough, but you get the point – the spending is not the only thing to be increased via inflation).

That's pretty darn close to the 4 million dollar amount I figured when I wrote about how much will you need for retirement. If I had to guess I would say to double that if you are currently in your 20's.

That is actually fairly close to the number that I've calculated for myself and my wife. However I have it broken out by tax deferred, pension, tax-free, social security (ha!) and the like. I'll have to use you as inspiration and put up something similar. Maybe I'll even clean up my spreadsheet to share with everyone. Great post you got here, and a lot of very important points!

Glad to hear you've taken the steps to plan for your retirement.

That’s a huge amount of retirement funds to work for. Earning it through a job would be tough considering that there are always expenses or bills to pay. That’s why investing your money and not just saving it, is wise. Of course there are risks involved in investing.

My number was around $2M, but did not calculate the inflation piece properly. Back to the drawing board.

Good article. For anyone interested, I’m writing a detailed 4 part series on this exact topic at http://www.theretirementmanifesto.com. 4 parts are: 1) Spending 2) Income 3) Contingency Plan 4)Retirement Cash Flow (putting it all together). Thanks for your great work on this critical topic.

Retirement is a tricky concept. We all have different visions of what retirement will look like and I think you need to have an idea of what you want before figuring out how much you’ll need.

Those of us of the hermit variety can’t wait to sit on our veranda with a good book while other’s will want to travel the world. Obviously, the spending needs in those two scenarios are vastly different. That’s why I like the 4% rule, once you can estimate what you’ll spend per year it’s a simple determining how much you’ll need.

I am now at 25 years of age and feel that I have to prepare for my retirement. Thanks for making me realize how much money I need for retirement. And, that formula is really helpful.

I am always bothered every time I think about retirement. There are a lot of financial factors I need to consider. I don’t know where and when to start. Thanks for sharing these great tips. It really helped a lot.

Where do you recognize that the money I retire with continues to have Return on the investment? The 4% rule needs more fleshing out. Example: retire at 70 with $500,000, half of perhaps $3000/mo expenses are covered by social security, retirement account continues to be invested for 25 or so years with 6-8% average ROI since I don’t use it all at once.

Yes it might cost me $1 million during my retirement years but I don’t need all of that to start with!

I do, however, also need to continue to be vigilant on how I spend but and how I invest.

I will be prepare for my retirements plan. This post really help me out, I will bookmark it. Thanks for sharing.