THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

By being smart about your investing strategy and keeping tax efficiency in mind, you can keep more of your money from Uncle Sam. I know I can’t be the only one who isn’t a fan of forking over my hard earned dollars to the government.

So below is an outline of how to get started with tax efficient investing. Don’t worry, it’s a lot easier than it sounds.

Table of Contents

What Is Tax Efficient Investing?

First off, we need to make sure everyone understands what tax efficient investing is all about. In a nutshell, it means strategically investing in a way that ensures you pay the least amount of tax possible.

By investing in this manner, you are able to keep more money invested throughout the years. This allows your money to compound and grow faster, leading to larger amounts of wealth.

To invest in a tax efficient way, you should do the following:

- Fund certain types of accounts before others

- Place certain investments in each of these accounts strategically so you can take advantage of the tax code.

Taking advantage of the tax code allows you to keep more money and invest more money over time.

How To Get Started With Tax Efficient Investing

Now that we have a basic idea of tax efficient investing, we can talk about how to get started. However, before you start thinking about your investments strategically, you need to have a plan.

Without a plan, you are sunk, so take the time to set up a long-term investing plan. Having this document will ensure greater success when turmoil hits, and trust me, it will.

Luckily, I’ve already written about developing and setting up such a plan. You can read this post to get started. And don’t worry, I’ll still be here when you get back.

So let’s get started with tax efficient investing. We’ll first look at the account level and then specific investments.

Tax Efficient Investing At The Account Level

Retirement Accounts: 401k Plan

On an account level, you should be funding retirement (also called non-taxable) accounts before you fund non-retirement accounts (also called taxable accounts). If you are covered by a 401k plan at work, it is important to put as much money into it as possible. The reason for this is because every dollar you contribute lowers your taxable income.

It works like this: when you get paid, your employer first takes out any 401k contribution you are making. Then whatever is left over, you get taxed on. I realize you have other deductions, but I am ignoring them here to keep things simple.

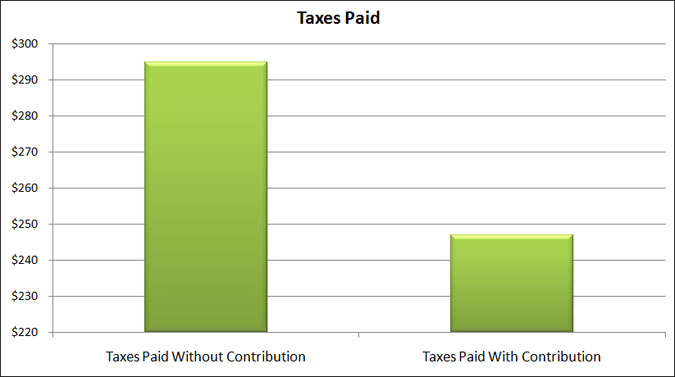

For example, if your bi-weekly gross paycheck is $1,925 and you do not invest in a 401k plan, you will be paying $295 in federal taxes every paycheck. If, on the other hand, you put $193 into your 401k plan each paycheck (10%), you would pay $247 in taxes and have $193 saved for retirement.

Notice what happened there? By contributing to a 401k, you reduced the taxes you paid by $48, from $295 to $247. I know that number isn’t as sexy as the tax refund you probably get, but it should be.

The mistake many people make when looking at this scenario is focusing on their net pay. With zero 401k contributions, your take home pay is $1,630 per week. With the 401k contribution, your take home pay is $1,485. They see a smaller paycheck and think that investing in their 401k plan is a dumb move.

They don’t see that:

- They saved $48 on taxes and will continue to save more on taxes as they continue to invest more money. Over the course of a year, you save over $1,200 in taxes.

- They saved $193 into their 401k plan, yet their take home pay is only $145 less than what it would be without a 401k contribution.

I encourage you to visit this site and play around with the calculator. It’s easy to use and you will see just how much you can save on taxes by contributing to your 401k plan. You will also see the effect it will have on your take home pay.

Retirement Accounts: IRAs

While your 401k plan is the granddaddy of retirement plans when it comes to taxes, you also have individual retirement accounts (IRAs), both Traditional and Roth.

The main difference between the two are that with a Traditional IRA, your money grows tax deferred, meaning you only pay taxes on the money when you take it out.

With a Roth IRA, your money grows tax-free, meaning you never pay taxes on the money while in the account or when you withdraw it. However, the money you put in has already been taxed.

You can check out all of the differences between these account types by reading this post.

Some people are in favor of one over the other, but having both makes sense since they both offer different tax benefits. It is in your best interest to talk to your tax advisor about which one makes the most sense for your specific needs and goals.

In the case of a 401k and IRA, the added benefit is that the money in these accounts grows tax deferred (tax-free in the case of the Roth IRA). This means that anytime you sell a holding for a gain, you pay zero taxes on it.

Additionally, whenever a holding pays interest, dividends, or capital gains, these too are tax-free. This means you never pay tax on them when you receive them in your account.

So again, with retirement (or non-taxable) accounts, we have:

- 401k Plan

- Traditional IRA

- Roth IRA

These accounts should be funded first, since in certain cases the money you save escapes taxes, and the money in these accounts grows tax-free forever, or until you withdraw the money.

Retirement Accounts: Health Savings Account

This account isn’t really a retirement account, but many people, including myself, use health savings accounts as defacto Roth IRAs. Therefore, I am going to briefly touch on them.

Basically, an HSA account is similar to a flexible spending account (FSA). You contribute money tax-free and use the money for medical expenses. But with an HSA, you don’t have to use the money in a calendar year.

Instead, you can let it grow over time. In addition to this, you can also invest the money in your HSA in the stock market.

To make your HSA a tax efficient account, you fund your HSA through payroll deductions and then use out-of-pocket money to pay for your medical expenses. You let the money in your HSA account stay invested and grow tax-free.

When you are older, you can then use that money to pay for medical bills.

You can read more information about this strategy in this post I wrote.

Taxable Accounts

Many investors also invest in a taxable account. This is an account not tied to retirement in the way the IRS looks at it. So you are free to withdraw money from it, without penalty, whenever you feel like it. But it doesn’t have the favorable tax treatment like retirement accounts do.

Basically, a taxable account gets taxed whenever there is an event in the account. An event includes a sale, dividend payment, interest payment, or capital gain. It is important to know that even if you reinvest dividends and/or capital gains, you still pay tax on that income.

Therefore, the best tax-efficient investing strategies begin with first investing your money into retirement accounts before you put that money into a taxable account. This is due to the fact that the money can grow in retirement accounts without dealing with taxes.

A typical tax efficient investing strategy should be:

- Fund 401k to the max

- Fund a Traditional/Roth IRA to the max

- Fund an HSA account

- Fund a taxable account

Where To Invest Assets

Now that you know the best order to fund your accounts, you should know which tax efficient investments to place into these accounts, since that makes a difference as well. This is because different assets and their income are taxed differently.

Therefore, it is important to understand how these things are looked at income-wise. I am not going to get too technical with taxes here, I’ll just lay out the basics. Basically, the type of income a holding pays determines how much you pay in taxes. Here is the breakdown:

- Dividends: ordinary or qualified

- Bond Interest: ordinary income

- Capital Gains: taxed as short or long-term

I’ll go into a little more detail with each one of these so you can better understand the tax treatment of each.

Dividends: Dividends are either ordinary or qualified. If they are ordinary, then the tax you pay is ordinary income, which is the same tax you pay on your work income. This means a higher tax as you make more money and earn more dividend income. But if the dividend is qualified, then the most tax the majority of investors will pay on it is 15%.

What makes a dividend qualified?

There are a few things, including where the company is located, if it is traded on a U.S. market, and how long you held the stock for. What you should know is that if you chase dividends, meaning you are buying stocks right before they declare a dividend, then you are most likely paying ordinary income rates.

But if you hold for the long-term, odds are you are going to have qualified dividends and pay a lower tax rate.

Bond Interest: Bonds pay out interest that is classified as ordinary income. Again, this is the same tax rate you pay on your income, so the more bond interest and salary you make, the more income tax you will be paying.

However, some bond income is tax-exempt. This could get tricky because some income is tax-exempt from federal taxes and not state taxes, while other income is the other way around, taxable at the federal level but not the state. And in some cases the income is tax-exempt from both federal and state income tax.

Capital Gains: If the gain is short-term (held less than one year) then you will pay a higher tax on that gain. As of this writing, any short-term capital gains are taxed at ordinary income tax rates.

If the gain is long-term (held longer than one year) then you will pay a lower tax on that gain. Here is the breakdown on how these gains are taxed.

Now, what exactly is a capital gain? If you buy Apple stock for $100 and sell for $105, then you have a capital gain of $5. The length of time from when you bought and when you sold determines if it is short-term or long-term.

So if you bought and sold within a year, it is a short-term gain. Longer than one year is a long-term gain.

The issue with capital gains can happen when you invest in mutual funds or exchange traded funds (ETFs). Here you have no control over when the manager sells shares. Even though you personally didn’t sell, you still get paid any capital gains the fund experiences, so you could be in for a surprise come tax time.

Tax Efficient Investing Strategies

So how do you invest to limit the amount of tax you pay? It’s a lot easier than it might sound.

#1. Invest For Retirement First

Your first tax efficient investing strategy step is to invest money into retirement accounts. This allows you to lower your taxable income and pay fewer taxes.

#2. Put The Right Investments In The Right Accounts

Next, the majority of any taxable bonds you hold should be held in retirement accounts. Since the money in those accounts grows without tax consequences, whenever the bonds pay interest you never pay any taxes on them.

This same idea holds true for any real estate investment trusts (REITs) that you own. They too pay interest as ordinary income, so holding these in a retirement account is a smart move.

For dividends, the key is to be a buy and hold investor, otherwise, if you trade too frequently you are going to pay ordinary income tax rates. If you really want to invest in dividend stocks though, you could do so in a retirement account since those dividends won’t be taxed.

Just make sure you know what you are doing so you don’t risk your retirement money. Also, be sure to take into account the commissions you are paying. It may not even be worth it if the commissions are high. (For the best low-cost online broker for you, check out my comparison chart.)

When it comes to capital gains, there are a few things you can do:

- For stocks, try to hold until at least a year to get the more favorable tax treatment.

- For mutual funds, look into “tax advantaged” mutual funds as well as index funds. These will rarely pay capital gains.

- For exchange traded funds, again, look into index ETFs. Many ETFs rarely pay capital gains to shareholders and when they do, they are typically less than mutual funds.

#3. Take Advantage Of Losses

Finally, the last thing you can do to save money on taxes when investing is to tax loss harvest. The IRS allows you to write off any realized gains against any realized losses in a calendar year.

So if you have an investment that lost $2,000 and one that gained $2,000 you can sell both and not pay any taxes. If you only sold the investment that had the gain, you would owe taxes on this amount.

But it gets even better. You are allowed to write off losses against ordinary income, up to $3,000 per year. So let’s say you have an investment that lost $2,000 but you don’t have any capital gains and you don’t want to sell any investments that have a gain.

You can use the $2,000 against your ordinary income. This means if you earned $75,000 this year and you apply the investment loss to it, you would only owe taxes on $73,000 of your income.

Note that if you have losses in excess of $3,000 you can carry them forward to future years until you use them up.

Frequently Asked Questions

Tax efficient investing can make your head spin. I know when I first started working for high net worth clients, I was lost. But I educated myself and now it all makes sense. Seeing as this might be the first time you are researching tax-efficient investing strategies, I put together a frequently asked questions section.

What is a tax advantaged investment?

This is just another way of saying tax efficient. The goal is to limit the amount of taxes you owe on any income your investments produce.

Are index funds more tax efficient?

Yes. Index funds are more tax efficient because they rarely experience any capital gains. This is because the fund manager is only buying and selling the underlying holdings that make up an index.

What is a tax efficient mutual fund?

Any index-based mutual fund is tax efficient. You might also come across mutual funds labeled as “tax managed”. These too are mutual funds created to limit taxes.

Are REITs tax efficient?

Overall, real estate investment trusts (REITs) are not tax efficient. The income they pay to shareholders is considered ordinary income by the IRS. This means it is taxed at the same rate as the income you earn from your job.

As a result, the best place to hold REITs is in a retirement account so that the income is tax deferred.

What are the best tax efficient investments for taxable accounts?

The best options are index mutual funds and exchange traded funds. As noted earlier, they will limit the amount of capital gains you may realize.

Where can I easily invest in a tax efficient way?

The best option is to use a robo-advisor. These brokers are set up to help you invest as tax efficiently as possible. And the best part is they do it all for you. All you have to do is open an account.

My two favorites are Wealthsimple and Betterment. I encourage you to start with them.

If you want to do everything yourself, you can’t go wrong investing with Charles Schwab or Vanguard.

What are the best tax efficient investments for higher rate taxpayers?

This could be a post all on its own. But for starters, you should shelter as much money as you can into tax deferred accounts. This includes 401k plans, 403b plans, deferred compensation plans, variable annuities, etc.

On the investment side, any investment that pays ordinary income, such as bond funds or REITs, should be in retirement accounts. In addition, any high dividend paying funds should also be in your retirement accounts. Because, if your income is high enough, you are paying close to 24% in taxes on your dividends.

In your taxable (non-retirement) account, you should invest in municipal bonds and low turnover mutual funds and ETFs like index funds.

Finally, you want to make sure you are taking advantage of tax loss harvesting to offset any gains you might realize.

How can I see the impact that taxes have on my investments?

The best tool I use for this is Personal Capital. It’s free to sign up and you can see how much your investments are costing you and get detailed analysis on how to be a smarter investor to keep more of your money.

To get started with Personal Capital or learn more, click here.

Financial Impact of Tax Efficient Investing

So what kind of impact can you expect to achieve by implementing a tax efficient investing strategy? This can be a complicated example with all of the moving parts, so I am going to keep it as simple as possible.

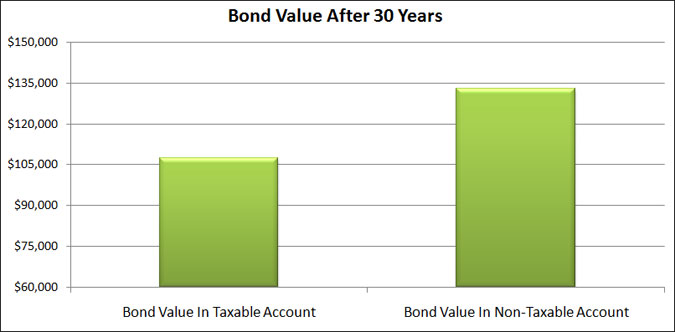

Let’s say you invest money into a bond fund that pays you $2,000 in interest. Since it is a bond fund, the interest you earn is considered ordinary income and is taxed at your marginal tax rate of 25%.

If we look 30 years into the future, what does the annual payment of $2,000 look like if you keep that investment in a taxable account versus a non-taxable account?

Over the course of 30 years, you end up with close to $108,000 in the taxable account and close to $133,000 in the non-taxable account. That is a difference of $25,000!

By simply putting your investments in the right account type, you save yourself a ton of money. Think about all of the various investments you have and what your savings would look like if you made it a point to invest in a tax efficient manner.

In the next example, I want to revisit contributing to a 401k plan. Let’s say you earn $75,000 a year and are in the 25% tax bracket. You contribute 10% of your salary to your 401k plan.

Over the course of 35 years, what impact does this have on the taxes you pay?

By not contributing to a 401k plan, you pay over $450,000 in taxes. But when you contribute to your 401k plan, you pay $331,000 in taxes. That is a tax savings of almost $120,000!

Of course, when you go to withdraw the money from your retirement accounts, like a 401k plan or traditional IRA, you will have to pay taxes. But the idea is that while you are working, the tax bracket you are in is higher than when you are retired and no longer earning an income.

The bottom line is that taking the time to invest in a tax efficient manner allows you to keep more of your money.

Final Thoughts

At the end of the day, the goal for tax efficient investing is to keep more of your money by paying the least amount of taxes. You can easily do this with a solid investing strategy. While it might sound confusing now, it really isn’t.

Just taking the time to walk through this guide will enable you to start taking action and shielding yourself from taxes.

As a quick recap:

- Invest first in retirement accounts, then non-retirement accounts

- Put investments that pay ordinary income (bonds and REITs) into retirement accounts

- Hold dividend paying securities for the long term to take advantage of lower tax rates

- Invest in “tax managed” or index funds/ETFs to lower and possibly avoid capital gains

- Take advantage of tax loss harvesting

While you won’t get a statement showing you how much you saved on taxes by following this strategy, you will end up keeping more money.

It’s the same idea with management fees you pay. You don’t see them, but they are there and you need to take action so you can keep more of your money.

And keeping more of your money invested allows it to compound at a faster rate, which potentially opens the door to an earlier retirement than you might have thought possible.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

A lot of good information! Right now we are saving up for a down payment for a house so our investing is a little different: I put into an employer 401K up to the Company match, temporarily stopped my Roth contribution, but we do max out my wife’s Roth using 100% equity ETF’s. Everything else goes to the down payment.

After the house we will max out both Roth’s and then move back to a 401K. I personally like Roth’s using ETF’s over 401k simply because the 401k has a limited selection and I would rather pay taxes now. It’s all a matter of preference I think. Thanks!

Thanks Jon. You just gave me an idea on Tax Efficient Investing. It’s like I have been investing for years and I haven’t even focused on this part. I have overlooked this so I kinda wasted some money on taxes. Thanks for the headsup.

Great advice! It’s important to invest, but you never want to lose money to taxes if you don’t have to. Thanks for sharing this advice!