THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

You read that right, while all other credit card companies have a handful of card options for you to choose from, Discover is offering only one.

(One quick note to current cardholders, there is currently no plan to convert your “non-it” card to the “it” card. But, you can call Discover and request the new card. Everything will stay the same, including your account number, you’ll just receive a new card. I did this and the process was simple. I even kept using my “old” card until I received and activated my new card. Additionally, since I originally wrote this post, Discover has added a few variants of this card to their lineup.)

So is the new Discover it™ Card worth considering putting in your wallet? I think so, and here are some reasons why.

The Discover it™ Card Benefits

Cash Back: As with previous Discover credit cards, the new Discover it™ card offers 5% cash back on rotating categories throughout the year. All other purchases earn a flat 1%. But, if you use the online portal ShopDiscover, you can earn up to 10% cash back.

Also, Discover has been promoting it’s cards with additional cash back over random weekends. I’ve already received an email for 2% cash back on all my purchases a few weeks ago. All you have to do is sign up online.

Finally, they even added Amazon as a 5% cash back in their rotating categories. This is great if you frequent Amazon like I do. [**UPDATE** Since posting this, Discover has closed the ShopDiscover portal, but has Discover Deals. It’s essentially the same thing.]

Redeem Any Cash Back Amount: Many other cards that offer cash back make you wait until you have $25 to redeem the cash back and on top of that, you can only redeem in increments of $25. Discover allows you to redeem any cash back amount.

Annual Fee: The new Discover it™ Card carries no annual fee for card members.

Late Fee: Discover waives the late fee the first time you are late on a payment and will not increase your APR either. This is great because as we all know, life happens. There are times you forget when to make your payment. Also, it’s nice that they won’t automatically raise your interest rate like most other credit card issuers do.

Additionally, when making your payment, you can chose your payment date and pay by 12 midnight Eastern Time. This is a great feature because most other credit card issuers require payment by a certain time in the afternoon.

100% U.S. Based Customer Support: When I was going overseas this past summer, I called the credit card issuers that I was going to use while overseas to let them know. I didn’t want to take a chance of getting declined. When I called Discover, I was blown away. Before I spoke with a representative, I was told what calling center in the United States I was going to be talking to.

On top of that, the person I spoke with was very friendly and very helpful. In fact, it was a better experience than when I called American Express! Granted it was only one time, but American Express is known for their great customer service.

No Foreign Transaction Fees: If you travel overseas, this is a great card. Most other cards charge roughly 3% when you use your card overseas, but not Discover. When I called the customer service team that I mentioned above, they asked where I was traveling to and then verified whether or not Discover was widely accepted there or not. It was nice at how honest they were with me.

They told me that Discover was just beginning to make itself known in this country and that I should have a back up card just in case.

FICO Credit Score: Every month when you get your statement, printed on the front is your credit score. It’s awesome to see this every month just to make sure there aren’t any big swings which could mean something is up with your credit. While you can get your free credit score from other sources, it’s nice to not have to do that and just get it when my statement arrives.

Oh, and this feature is offered for free.

Credit Scorecard: In addition to getting your free credit score, the Credit Scorecard shows you 12 months of recent scores along with information that makes up your overall score. This includes:

- Length of credit history

- Total accounts

- Credit utilization

- Number of missed payments

- Recent inquiries

Note that this feature is available when you log into your Discover account.

Social Security Alerts: It seems every day there is another news story of a security breach stealing personal information. There are many steps you can take to prevent identity theft and Discover is here to help you. They recently began to offer Social Security Alerts.

When you activate this feature with your account, Discover scans the internet and dark web for your Social Security Number and alerts you if it finds anything. You will know right away if someone is trying to open a new loan, mortgage or credit card in your name.

Freeze it™: A new feature on the card is the Freeze it™ feature. If you lose your card, or it is stolen, you can just log on to the Discover app on your phone and freeze your account. This means no one can make any purchases on the card. If you misplaced your card and find it, you simply go back on the app and unfreeze your account so you can begin using your card again.

This is great because otherwise you have to call in. This is a problem though because many times you don’t know the number to call since it is on the back of your card – the card you can’t find or don’t have!

The entire process of freezing or unfreezing your account takes a few seconds.

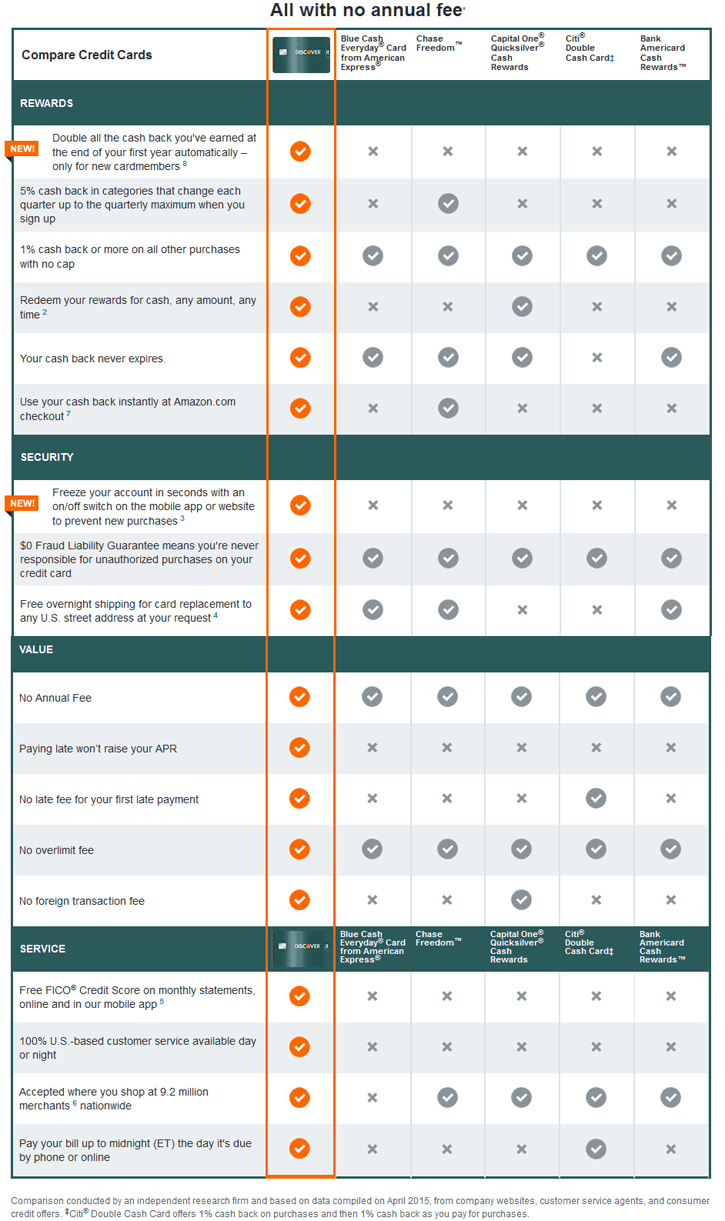

Below is a great comparison chart of all of the features the Discover it™ Card offers compared to the competition:

Other great features include:

- Purchase Protection

- Price Protection

- Built-in Fraud Protection

- Extended Warranty Protection

- Return Guarantee

- Cash at Checkout (this features allows you to get cash when you use your Discover card. It works the same as using your debit card and choosing to get an amount back in cash. Doing this saves you from running to the ATM. It also saves you money. Choosing this option with your Discover card avoids the cash advance APR. You are simply charged your normal purchase APR. Note that the feature is not available at all retailers. You can check out this regularly updated list do see where you can take advantage of this.)

- Flight Accident Insurance

- Auto Rental Insurance

Two other really cool features Discover offers are their Spend Analyzer and Paydown Planner. The Spend Analyzer organizes your purchases you made so you can see which categories you are spending your money on and even shows your your spending over time in these areas. This helps you to get a clear picture of your spending habits.

The Paydown Planner is for those in debt. It allows you to play around with your monthly payments so you can get an idea of when you will be debt free and the impact of making larger or smaller payments.

Final Thoughts

Overall, I really like my Discover card and from what I have seen from their new card offering, the new Discover it™ Card will be a huge hit for them. I continue to use my Discover card primarily for the 5% rotating bonus as well as overseas assuming it is widely accepted. If you are in the market for a good credit card, I recommend the Discover it™ card.

Right now, Discover is offering an amazing deal to new card members. As a new member, you will earn double your cash back at the end of the first year. This means Discover will double the amount of cash back you earned during your first year. So if you earned $500 during the first year of having the card, at the end of that year, Discover will give you an additional $500.

Another added bonus for you, you can get $50 when you open an account and make 1 purchase in the first 3 months. It’s not a lot, but hey, it’s better than nothing! Click here to take advantage of this offer.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Discover rolls out some really great and quality products. I’ve been a card holder for nearly four years and am extremely satisfied. Although my Amex has replaced Discover as my go-to card of choice, I still utilize Discover’s business through their online savings account options (grandfathered in at a .90% APY, which is a feeble rate but still better than most.)

This card is quite tempting. But I already have a discover card so I don’t think I can just get another one.