THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There is a lot of information out there and if you talk to 10 people about the stock market, you will get 10 different answers.

As a result, many people don’t try to learn about investing.

This is a critical mistake because investing your money is huge when it comes to getting ahead financially and personal finance in general.

Because of this, I created this intro to investing guide to help you better understand how the stock market works.

If you have zero investment knowledge, do not worry.

I will keep this post as an entry level investments 101 topic so everyone can follow along.

Table of Contents

Investing Basics You Need To Make Money

What Is Investing?

Investing is when you put your money into various vehicles with the goal to earn a return on your money.

In other words, you give money to someone else so that you can get back more money.

For example, you invest $100 for the expectation that when you get it back, you will have $150 or more.

When it comes to investing, many people think about the stock market.

While this is the most popular way to invest your money, there are other ways as well.

For example, you could invest in art or collectibles.

- Read now: Click here to learn how to invest in art with Masterworks

- Read now: Learn how to build wealth investing in farm land

But for the sake of this article, we will stick with the stock market.

Basic Investing Terms You Need To Know

There are a lot of various stock market investing terms I will be talking about and are important you know.

Here is a quick rundown of each.

Broker: A financial intermediary between a buyer and seller of securities.

Financial advisor: A licensed professional that invests your money for you. They take a small fee to help you reach your investment goals.

Stock: Equity ownership of a company. As a shareholder you are entitled to a share of the company’s earnings.

Bond: Ownership in the debt of a company. In return for buying a bond, you earn a stated interest rate over the term of the bond.

Mutual fund: A basket of stocks and bonds to invest in. Mutual funds allow investors to own shares in a large numbers of companies without the need for a lot of money.

Options: These are investment vehicles that allow investors the right to buy or sell a stock at an agreed upon price and date. The use of these is more advanced than what I am covering in this post. However, selling covered calls is a great way to boost your returns when investing in stocks.

Security: A basic term used for various investments. This includes both stocks and bonds.

Diversification: Investing in a variety of stocks and bonds to reduce investment risk and increase the potential return.

Robo Advisor: A financial advisor that provides online financial management with little human interaction.

Market Volatility: The swings in prices the stock market experiences. Over the short term, this volatility can be severe. However over the long term, it is much calmer.

How Does Investing Work?

To get started investing, you need to open an account with a broker, investment advisor, or mutual fund company.

This is a company that is registered to trade in the stock market.

There are many brokers out there, and I go into more detail about them below.

For now, here is a basic outline when it comes to investing.

Step #1. You open a brokerage account and deposit $100 into it.

Step #2. You instruct the broker to invest $100 in a security.

Step #3. In time the security you invested in grows in value to $200.

Step #4. You sell the security and $200 is placed into your brokerage account.

These are the four basic steps to investing.

But the goal isn’t to buy and sell quickly.

When you do this, it is called trading and not investing.

Investing is for the long term.

You buy a security and hold it for a long time. You even buy more of it as the years pass.

The most common way to invest is through your retirement plan or 401k through work.

You are taking money from your paycheck to buy an investment.

Every time you are paid, you buy more shares and over time, as the price of the investment grows, so does your investment account.

Types Of Investments

There are many types of investments out there.

For the majority of people, you will come across these basic ones.

- Individual Stocks

- Mutual funds

- Exchange traded funds

- Bonds

- Alternative investments

The easiest ones to start with for beginning investors are mutual funds and ETFs.

This is because both are a basket of stocks or bonds that make up the investment.

The benefit here is you can invest in a large number of companies with very little money.

- Read now: Click here to understand how mutual funds work

- Read now: Learn why ETFs are a good investment choice

Stocks are also a good investment, but you typically need more money to build a diversified portfolio.

Plus you have to do a lot of research to find the best stocks to invest in.

Then of course you have to watch the market and follow the company to make sure it remains a good investment for you.

With bonds, it is far easier to invest in these through mutual funds and exchange traded funds.

This is because buying individual bonds costs a lot.

For the same amount of money, you can invest in a handful of bonds within a mutual fund or ETF.

Finally, there are alternative investments.

These would be real estate investment trusts (REITs) and commodities, like gold and other precious metals.

These are not as easy to invest in and should only make up a very small percent of your overall portfolio.

Asset Classes

There are different asset classes when it comes to investing.

You have large cap and small cap stocks.

You have domestic and international stocks.

And you have growth and value stocks.

With fixed income investments, you have types based on how long until it matures.

This includes bonds, bills, and notes.

You also have municipal bonds and corporate bonds.

And each asset class has their own rates of return.

You build a portfolio mix of these classes to come up with your asset allocation.

While you could just pick growth stocks, this would give you a very high amount of risk.

As a result, it is important you understand your risk tolerance.

By knowing how comfortable you are with risk, you can build a long term investment strategy that will help you meet your goals.

How To Manage Investments

When it comes to managing your investments, you have a handful of options.

In the past, I’ve used many brokers as none offered me all the things I was looking for.

In recent years however, new online brokers have come out and offer everything you need.

I am listing the best brokers for beginning investors below.

There are a lot more brokers out there.

- Read now: Click here to see my full online broker comparison chart

- Read now: Learn the best broker for every investor type

But I am only offering a couple to keep things simple for you.

The online brokers below are easy to use and keep investing simple.

Plus you can learn more about stock market investing as you go, making them an even greater value.

Betterment

Betterment is one of the original robo advisors.

If you are not familiar with that term, a robo advisor is a company that automates investing for you.

You spend 10 minutes opening your account and telling Betterment your goals.

They then put you in a diversified portfolio.

All that is left for you is to set up a regular investment, which can be as little as $10 a month.

Betterment will invest your money and make sure it is working to grow all while keeping fees low.

Click the link below to get started.

Acorns

Acorns is another robo advisor but they do things a little differently.

For starters, you can choose to invest a set amount each month, as little as $5, or you can skip this investment.

Instead you can have Acorns round up your purchases and invest the change.

Before you think that investing your spare change is pointless, think again.

I’ve built my account up to $750 in a year simply by investing my spare change.

Acorns offers others features too that boost your investment.

New users get $5 when you open your account by clicking on the link below.

Investing For The Long Term

One of the most important tips of investing success is to stick to the long term.

- Read now: Click here for the best types of long term investments

- Read now: Find out the best types of short term investments

This means you need an investment time horizon of 10 years or longer.

This doesn’t mean you need to be buying and selling all the time for 10 years.

Rather you need to pick high quality investments and stick with these investments for 10 years or longer.

When you do this, you give your money time to compound and grow.

The easiest way to do this is to invest on a consistent and regular basis.

This is also known as dollar cost averaging.

By investing a small amount of money every month, you take advantage of time and this helps you to grow your wealth.

This is how your 401k plan works.

You invest a little bit of money every time you are paid.

And this is how the robo advisors I mentioned earlier work best too.

Don’t get caught up thinking investing $10 a month is pointless.

It’s not.

That $10 a month can grow into a lot of money.

At an 8% return in 40 years, you end up with over $33,000!

Just imagine if you slowly increase that amount every year!

Investing For Beginners: Tips For Success

When it comes to success investing, there are a few things you need to understand.

There are things you can control when investing and things you cannot control.

By understanding these things, you will reduce your frustrations when investing and ultimately, will be more successful.

Here are 8 investing tips for success.

What You Can Control

#1. Reducing Expenses

Both mutual funds and exchange traded funds (ETFs) charge management fees.

These fees are paid to the people who run the fund as their job.

The fee, or expense ratio as is sometimes called, varies by investment.

Some are as low as 0.03% and can go as high as 3%.

Why is it important you pay attention to this fee?

Because you pay the fee.

You won’t get a bill in the mail for it as the fee is taken from the investment returns you earn on your money every year.

Over time this fee adds up.

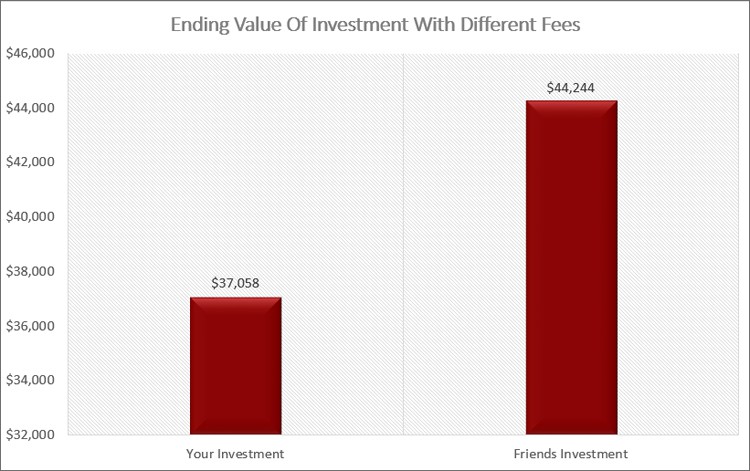

Here is a quick example of how much fees cost you.

You have $10,000 that you can invest.

You choose Fund A, which has 1.14% expense ratio. In 20 years, you paid $4,921 in fees.

Now, your friend has the same amount, $10,000 and chose to invest in Fund B, which charges 0.26% in expenses.

In 20 years, he paid $1,245 in fees.

But there is more.

Because he paid less in fees, more of his money was able to stay invested and compound.

So, if both of your funds returned the same amount, in 20 years, his account would be worth $7,186 more than yours.

When it comes to investing in individual stocks, you are not charged a management fee.

But many brokers charge you a fee to trade.

Luckily many now offer free trades, so this fee isn’t as big of a deal.

However, you will still incur small trading costs, but these are a few cents per trade.

The bottom line is fees make a difference.

#2. Diversifying Your Portfolio

Making sure you have a diversified portfolio is a big deal.

Diversifying is a fancy way of saying you need to invest in a variety of investments.

For example, if go to the bar, you won’t find they only sell one brand of beer.

They sell many brands, as well as many different types, and even sell other alcohol like wine and liquor.

The bar is diversified in selling different products.

Investing is the same way.

You should have your money spread out between large and small cap stocks, domestic and international, and include a mix of bonds.

Case in point, from 2000 until 2010, had you only invested in the S&P 500 Index, you would have earned almost nothing on your money.

This means if you invested $10,000 in 2000, in 2010, you still have roughly $10,000.

However, had you diversified your portfolio, you could have returned just over 6% during this same period.

Make sure you are investing in a variety of investments to maximize your investment returns and minimize your risk.

#3. Minimize Taxes

Just like fund expenses, taxes are your enemy.

You pay taxes on any dividends you receive and any capital gains you realize.

There are funds out there that focus on tax efficiency.

This means they will do their best to keep your tax expense low. Seek out these funds.

Additionally, you should choose to hold taxable bonds in your retirement accounts and equities in your taxable accounts.

The reason for this is because bond funds pay out monthly distributions that are taxed at your ordinary income rate.

Capital gains from equity funds on the other hand, assuming the holding period is long enough, get taxed at a lower, capital gain rate.

Take advantage of this and structure your portfolio so that you minimize taxes.

#4. Discipline

You need to be disciplined when investing in the stock market.

You cannot control what happens in the market over the short term.

When looking at the market on a short term basis, there is a ton of volatility, or movement in prices up and down.

It comes with the market.

But over the long term, the trend of the market is positive.

Stay focused and stay disciplined. Stay in the market.

Don’t let the media or others try to talk you out of investing for the long term.

You need to focus on the long term and you will meet your goals be doing this.

Do whatever it takes to put blinders on when it comes to short term volatility.

What You Cannot Control

#1. Picking Winning Stocks

Everyone gets lucky when it comes to investing.

You pick a stock that doubles in price. Congratulations.

Unfortunately, sooner or later, you are going to pick a loser. It’s inevitable.

You cannot consistently pick winners all the time. No one can. Not even fund managers.

Studies have shown that fund managers who beat the market one year are less likely to repeat that feat the following year.

If they do accomplish it, the odds are even lower they will do it again the following year and so on.

Since no one consistently beats the market, you are better off investing in mutual funds or ETFs that track the market.

These are known as index funds.

They simply track the performance of the stock market and give you a comparable return.

Don’t chase returns. Invest for the long term.

#2. Picking Superior Managers

This ties into the point above.

I said fund managers cannot beat the market every year.

So don’t make the mistake of looking for a fund manager who beat the market and think they will do it again.

Click on the link above for the reasons why.

Of course there are exceptions.

The best example of this is with Bill Miller of Legg Mason.

From 1991 through 2005 his fund beat the market every year.

But even Mr. Miller said “As for the so-called streak, that’s an accident of the calendar. If the year ended on different months it wouldn’t be there and at some point, the mathematics will hit us. We’ve been lucky.”

It was determined that the odds of beating the market each year during this period was 1 in 2.3 million.

And you think you can pick a mutual fund that will consistently beat the market? You can’t.

Mr. Miller’s fund ended up performing worse than the market for 2006-2008 until beating it again in 2009.

Again, you are better off investing in mutual funds or ETFs that track the market.

#3. Timing The Market

No one knows when the market will rise or fall. No one.

There are examples of the stock market dropping by huge amounts only to rise higher a few days later.

- Read now: See the difference between market timing and time in the market

- Read now: Learn how to handle stock market volatility

Then there are times when the market is moving higher on a regular basis only to drop out of the blue.

Because of this, there is no point in trying to jump in and out of the market at set times.

You need to ride it out.

Think of the market like a thunderstorm. It’s bad out there, but you ride it out knowing the storm will pass and the sun will come back out.

The stock market is the same way. The sun always comes back out in the long run.

You just have to ride out the short term. Do your best to tune out the short term hype or doom and gloom.

#4. Financial Press

This ties into timing the markets.

If you listen to the news or read the headlines, you would think the world is coming to an end.

I think the newspapers and magazines have stock photographs of traders showing anguish on their faces.

Do your best to ignore the media. They make money preaching doom or exuberance. They work your emotions.

Think about it.

Wall Street makes its money on trading fees and commissions.

The more you trade, the more money they make.

Therefore, it is in their best interest to get you to trade.

How do they get you to trade?

They scare you or they excite you. Once they get you emotionally hooked, they have you.

If you can tune out these stories and stay focused and committed to your long term goals and staying invested, you will come out OK in the end.

Best Investing Books Of All Time

While I tried my best to explain the basics of investing to you, I understand some might have more questions.

I encourage you to click on the links I added throughout the post for more information on many of the topics so you can get a better understanding of them.

But some might still need more.

So here are the best investing books of all time.

These books are highly recommended by investment professionals and readers.

All links point to Amazon as their prices tend to be the best.

Live It Up Without Outliving Your Money

The writing is simple to understand and the chapters are short.

You can even skip around and still understand what the author is talking about.

A Random Walk Down Wall Street

It is written by Burton Makiel, an economist and professor.

The book is a great dive into efficient market hypothesis and how to be a long term investor.

The Intelligent Investor

While you don’t have to specifically follow a value investing approach, the information you gain from this text will help you out as an investor.

The Little Book Of Common Sense Investing

It is an easy read and arguably the best investing book for beginning investors.

7 Investing Steps That Will Make You Rich

By simplifying investing and making it as foolproof as possible, you won’t make critical mistakes that can cost you dearly.

Frequently Asked Questions

I get asked a lot of investing questions.

No matter your investment background, we all have questions and this guide will answer the most common questions when it comes to investing.

Why is investing important?

Investing is important because it is one of the best ways to build wealth.

While there are other ways to grow your wealth, many have high barriers to entry, such as real estate.

With investing, you can get started with as little as $5 and invest on a consistent basis to build wealth.

Why do people invest in stocks?

People choose individual stocks because they offer the highest potential returns when compared to mutual funds or ETFs.

If you invest in a stock and it explodes in value, you earned a huge gain.

But if that same stock is part of a mutual fund, you will have earned a much smaller gain since the stock only makes up a fraction of the value of the mutual fund.

Are stocks the best investment for beginners?

Not necessarily.

They get a lot of the attention because you can invest in a company you love.

But you need a decent amount of money to build a diversified portfolio.

For beginner investors, better options would be mutual funds or exchange traded funds since you can invest in a large number of companies at once.

How much money should I invest?

As much as you can afford to invest.

If you have $10,000 to invest, then invest that.

Even if money is tight for you, you can still invest for as little as $5.

While it will take you longer to build a portfolio worth a substantial amount of money, the amount you can afford to invest not should not stop you.

Should I invest actively or passively?

Passive investing is the optimal choice for most investors.

This is because it is a lot less work to earn what the market earns.

As an active investor, you constantly have to monitor the markets and make trades.

Luckily, there is stock trading software that will help you make things easier.

However, there is no guarantee you will come out ahead.

In fact, most people who actively invest end up with less money than if they just invested passively.

How can I be a successful investor?

The first step is to have an investment objective.

In other words, why are you investing?

By knowing what you want to get out of investing, you will have a better idea of how much risk to take on and what types of investments you should be putting your money into.

From there, you need to stay invested for the long term so your money can grow and compound.

Should I invest in retirement accounts first?

Ideally, you are best served investing in your 401k at work.

This is because it is simple to do and you will invest money every time you are paid.

Additionally, investing in your 401k plan will reduce your taxes, saving you even more money.

From there, depending on your financial situation, you can invest in a Roth IRA or a Traditional IRA and then invest in a taxable account.

Final Thoughts

There is your introduction to investing.

I tried to keep things simple to understand so you can start investing today.

And that is the last nugget of advice I give you.

Start investing today.

Every day you waste by putting off investing is one day less your money can compound for you.

The more time your money has to compound, the larger the sum it will turn into.

If you have questions or want to learn more, be sure to click on the links I included throughout this post.

They will help you continue your investing education and ultimately help you be successful.

- Read now: Click here to learn the pros and cons of index funds

- Read now: Learn the biggest target date fund pros and cons

- Read now: Discover how to rebalance your portfolio

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.