THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

A common complaint I hear a lot from would be investors is how to start investing with a small amount of money.

Most people don’t have a few grand laying around to put into the market and so they just sit on the sideline.

They think $10 or $100 won’t matter in the long run.

If this describes your situation, I have great news for you.

This post is going to show you the many ways you can start investing with small amounts of money.

You don’t need thousands to get started down the path of financial freedom.

In fact, in some cases, you can start out with just $1!

And with another, you can simply invest your spare change!

I will show you how to get started investing with very little money and how I grew my wealth to close to $1 million today by simply investing the small sums of money I had.

Table of Contents

How To Start Investing With A Small Amount of Money

Years ago, if you didn’t have a few grand laying around collecting dust, your investment options were slim to none.

But thanks to technology and some government regulation, small investors can get started with an initial investment of just a few dollars.

In fact, many of these options allow you to start investing $25 a month or less.

Below are my favorite small investments that make money.

#1. Invest In Your 401k Plan

Many of us that work are covered by a 401k plan.

As a result, his is the easiest way to get started investing.

And for many reading this, it is the best way you can start doing so with less than $10.

How? You decide how much of a percentage of your salary you save in your 401k plan.

If you make $20,000 and save just 1%, then you are saving $3.85 per paycheck if you get paid weekly.

Now, don’t make the mistake of thinking that $3.85 won’t turn into anything big, because it will if you stick with it.

Compound interest is truly your best friend when it comes to building your wealth.

Here is how I used my 401k plan to invest very little money and allowed compounding to work its magic.

When I started out working, I was making $25,000 a year.

I was investing 5% from each paycheck in my 401k plan.

Since I was paid biweekly, I was investing about $48 per paycheck.

Nothing huge and at the time, I even questioned if it was even worth investing.

As time went on however, compounding started to work its magic and grow my account value.

After 1 year of contributing $1,250 to my account, it had grown to just over $1,500.

The next year it grew to more than $3,500.

I quickly became excited watching my investments grow in value.

As great as compound interest is, there was another factor at play too.

I was getting raises on a regular basis.

Fast forward 5 years and I was making $40,000 a year.

Still saving 5% of my paycheck, I was now investing over $75 instead of $48.

This along with compound interest kept my account balance growing.

At this point I began to increase the amount I was saving to grow my balance more.

If you want to get started investing, your 401k plan is the easiest way to make smaller investments and watch it grow.

Just start by contributing 5% and then make sure you increase the amount you save each year.

An added bonus here is many employers will offer to match your contribution, giving you free money!

#2. Invest In Mutual Funds

If you aren’t covered by a 401k plan at work, or you want to invest somewhere else in addition to your 401k plan, you can look into mutual funds.

While many mutual funds have large account minimums, there are many that have much lower minimums.

This allows first time investors to invest with a small amount of money.

- Read now: Learn the basics of mutual funds

My favorite is Charles Schwab.

You can start investing $1 in their mutual funds.

And you can make additional purchases with as little as $1. That isn’t a typo.

Schwab has a large variety of funds, and many of their index funds have good returns and low expense ratios.

When I started to invest outside of my 401k plan, this is the brokerage ago I opened since it allowed me to invest without needing a lot of money.

In addition to their mutual funds, you can choose to invest in Schwab ETFs.

There is no commission and you can buy just 1 share at a time.

They even have a large collection of other no fee ETFs you can trade for free.

One other thing to look at with mutual funds is automatic investment plans.

Many fund companies will waive the normal minimum initial investment if you sign up for a monthly investment each month.

In this case, the mutual fund will electronically transfer money from your linked checking account and invest it on the day of the month you chose.

This can be done with as little as $50 and there is no charge.

Be sure to inquire with the mutual fund company to see if they will waive the minimum for you in exchange for a monthly automatic investment.

#3. Automatically Invest Monthly

Your next option for small investors is going with a robo-advisor.

In this class of investing firms, I like Betterment.

To understand why they are called robo-advisors, you need to understand how they operate.

In basic terms, you open an account and then choose a goal.

This can be to buy a house, fund your retirement, save for your kid’s college or just plain investing.

Based on your goal, risk tolerance, and the time until you reach your goal, Betterment will assign a portfolio with an asset allocation for you.

- Read now: Click here to understand why your asset allocation is critical

- Read now: Discover what your risk tolerance really is

Once you have everything picked out, you link your checking account and the amount you want to invest each month and you are done.

Betterment will invest the money each month, reinvest any dividends, rebalance your portfolio and perform any tax-loss harvesting for you.

This is why they are considered a robo-advisor. Everything is done for you, like a robot.

They take out emotion from investing, which is the main reason most investors fail.

Click the link below to get started investing with Betterment.

#4. Invest Your Spare Change

As great as the options have been so far, what if you are in a situation where money is beyond tight?

Do you skip investing until your finances improve?

The answer is no because by waiting you lose out on the power of compound interest.

But with money tight, how can you survive financially and invest?

The answer is Acorns.

Acorns is a micro investing app that rounds up your spare change and invests it for you.

For example, if you spend $48.25 on groceries, Acorns will round up this purchase to $49.00 and invest the $0.75 for you.

I know what you are thinking, investing your spare change isn’t worth it.

But remember my 401k example earlier.

This is the same idea and it works thanks to compounding.

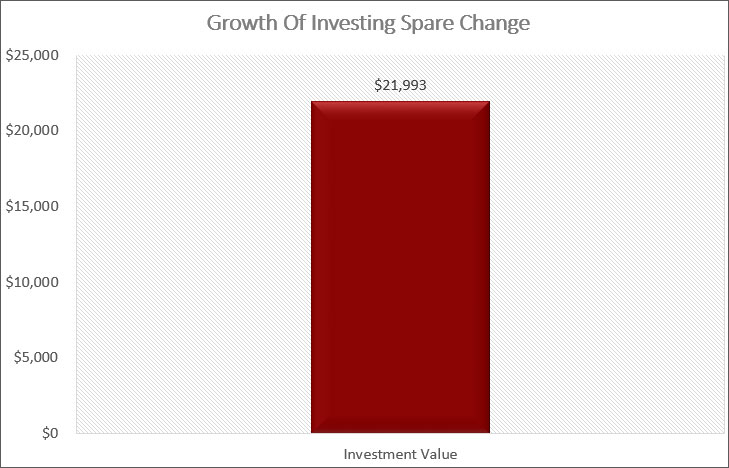

I tested this out by asking some people to share their expenses with me for 1 year. I took the amounts and rounded them up.

The average round up amount for 1 year worth of spending came to $750.

If you invest $750 a year for 15 years, you end up with close to $22,000!

As I said, compounding works magic for you.

So the next time you think your spare change doesn’t have any value, think again.

Aside from the round up feature, Acorns works like other robo-advisors by picking an asset allocation for you, reinvesting dividends, etc.

They are a great option to consider when you are looking for small investments that make money.

To get started with Acorns, click the link below.

#5. Direct Stock Purchase Plans

Direct stock purchase plans allows people who want to make a smaller investment invest directly into individual stocks.

Years ago, these plans were all the rage.

There were two reasons for this.

First, you needed enough money to buy a good number of shares and you could only buy whole shares.

The second issue was trading commissions.

In order to buy a stock, a broker had to place the order for you. They charged a fee for this.

A better solution was to buy stock directly from the company themselves.

Doing this allowed you to buy small shares of stocks without getting slammed with fees.

- Read now: Learn the power of dollar cost averaging

Today, these plans still exist but there are some investing apps that make it easier and charge less fees.

If this option interests you, here is how they work.

You open an account with the company’s transfer agent.

The minimum initial investment varies from company to company, and could be as high as $500.

You will pay a first-time purchase fee, usually $5, then will pay roughly $2.50 for each purchase you make thereafter.

Some charge a fee of $10 when you want to sell as well.

There are many companies however who don’t charge a fee for additional purchases as long as you set up a recurring purchase.

The great part is that you can buy fractional shares.

So, if you have $50 to invest, you could buy 2.25 shares of a stock.

You can find a ton of companies by searching through a popular transfer agent, Computershare.

If you can’t find your favorite company there, you can go to the investor relations section on the website of the company you want to invest in and see if they have a plan and a link to join.

#6. Invest In Dividend Paying Stocks

As great as direct stock purchase plans sound for buying small shares of stock, there is an even better option out there.

It’s called M1 Finance.

They are a twist on the robo-advisor market by allowing you to invest in stocks without paying any fees.

That’s right, you can invest with M1 Finance for free!

You can choose from a custom built stock portfolio based on your goals or interests or you can build a completely customized stock portfolio yourself.

Once you have your portfolio, you set up a monthly transfer and then M1 will buy stocks for you.

If your monthly investment isn’t enough to buy a whole share of stock, M1 will buy a fractional share for you.

This broker is hands down my favorite when it comes to dividend investing.

I created a portfolio of the dividend paying stocks I wanted to own and transferred $25 to open my account.

Then I set up a monthly transfer to invest more.

Finally, I took advantage of their dividend reinvestment plans and use the dividends I earn to buy more shares.

To get started with M1 Finance, click the link below.

#7. Invest In Small Businesses

Up until now, the ideas I list all involve investing in the stock market.

While the stock market is a great place to grow your wealth, you don’t need to invest 100% of your money into it.

The only problem with not investing in the stock market is finding a decent return on your money.

This is where investing in small businesses come into play.

There are a bunch of ways you can go about this, but my favorite is Worthy Bonds.

Worthy Bonds invests in small businesses by funding their inventory needs.

To do so, small investors like you invest in Worthy Bonds.

Here is how this works.

You invest $100 and buy 10 bonds. Worthy turns around and gives the $100 to a small business to help fund their business.

By loaning the $100 to the small business, Worthy has the business pay interest on the loan.

Worthy then turns around and pays you a portion of this interest.

Right now, you earn 5% on your investment and you can start investing with as little as $100.

They also allow you to round up your purchases to buy additional bonds using your spare change.

In my opinion, they are the best way to get a good interest rate and keep your money safe at the same time.

You can click the link below to get started with Worthy Bonds!

#8. Real Estate Crowdfunding

Many people are interested in real estate investing, but the problem has been you needed a huge investment to get started.

With crowdfunding, you can get started with a low minimum investment and earn a nice return.

It works by having multiple investors put up money to buy a property.

Depending on how much you invest, you will receive distributions equal to your equity percentage.

A great company to look into is Diversyfund.

They are one of the best real estate crowdfunding apps out there.

If you are old school, you could also invest in a real estate investment trust, or REITs.

These are investments that trade on the stock exchange.

Mostly they own commercial property, however some are starting to invest in residential real estate as well.

You buy shares and then earn a monthly dividend.

The catch here is to make sure you buy this investment in a tax sheltered account, like a Traditional IRA or a Roth IRA.

The reason is because the dividends are taxed at ordinary income rates.

This can really impact your taxes, so by putting them in a retirement account, you avoid paying taxes on the dividends.

#9. Peer To Peer Lending

Like investing in small businesses, you can invest in other people.

This is known as peer to peer lending.

You go on a website like Prosper or Lending Club and find people looking for a loan.

They might be trying to pay down debt, buy a car, or start a business.

Instead of using a bank to get a loan, they are crowdfunding.

If you find a person you want to loan money to, you pick an amount and every month, you earn interest until the loan is paid in full.

Understand you are not funding the entire loan.

For example, if the person is in need of $10,000 you can loan them $100.

If the interest rate on the loan is 7%, you will earn that return on your $100.

When the loan term is up, you will have your $100 plus the 7% of interest.

There is a risk of default here, but if you pick loans wisely, you can limit this risk.

#10. Start Your Own Business

Did you know most of the wealthy run their own business?

There are so many benefits to being an employer over being an employee.

I’m not going to get into all the details here, but just know you can save a lot more for retirement and pay a lot less in income taxes as an employer.

The key to all this is to keep your business separate from your personal finances.

This shows the IRS that it is a true business, and it will help you keep track of things comes tax time.

Of course, you don’t want to go into thousands of dollars worth of debt to start a business.

You want to find some ideas you can start on the side and build up over time.

You can find some ideas in the build wealth section of my site.

Alternatively, you can check out SideHustlingMoney.com for a huge library of ideas.

#11. Pay Off High Interest Debt

If you have debt, the good way to invest your money and get a higher return is to pay off your debt.

Here is why this is a good idea.

Let’s say you have $10,000 in credit card debt charging you 17% interest.

If it takes you 5 years to pay off this debt, you paid a total of $14,896.

But if you put extra cash towards this debt and pay it off completely in 2 years, you paid $11,868.

That’s a savings of roughly $3,000.

When you pay off debt early, your return on investment is the interest rate you are paying.

In this case, it is 17%.

Good luck getting this high of a return in the stock market.

The other benefit of paying off your debt is you free up more money to save and invest.

If you have $300 a month going towards debt repayment and you pay it off, you can now save and invest that $300 every single month.

#12. Invest In I Bonds

Series I bonds are debt issued by the U.S. Treasury.

What makes these unique are there are two components to them.

- A fixed interest rate

- A variable interest rate

The fixed rate is set at the time you purchase the I bond.

The variable rate is also set when you buy the bond, but adjusts every 6 months based on inflation.

You can hold the bonds anywhere from 12 months up to 30 years.

If you plan on using them as a short term investment, know that there is a 3 month interest penalty if you redeem them within 5 years of buying.

You can make a one time purchase, or purchase small investments every month.

There is no risk of losing your money and historically you will earn more than you would with a bank account.

#13. High Yield Savings Accounts

Putting your money in a high-yield savings account is a smart move for the short term and emergency funds.

You aren’t going to get a high rate of return putting money into a bank account, but you will have cash liquid, which is never a bad thing.

Another benefit is don’t have the potential of losing money like you do in the stock market.

It isn’t sexy or exciting to talk about bank accounts, but having money in savings is a smart idea.

#14. Bank Certificates Of Deposit

To earn a little higher return compared to a savings account, you could look into bank CDs.

Here you lock up your money for a defined period of time and earn a higher interest rate.

But when interest rates are low, even this investment isn’t going to pay well.

You can get around this by building a CD ladder.

This is when you take you money and divide it evenly and invest it into CDs with different maturities.

This allows you to earn a slightly higher interest rate and as the CD matures, you can reinvest the money back into a longer term CD to hopefully earn more interest.

#15. Invest In Cryptocurrency

Cryptocurrency seems to be the hot investment at the time.

While you could earn a large return on your money, you can also lose a lot as well.

So if you plan on going this route, make sure you are OK with losing all your money you put into crypto.

There are a lot of options of what to invest in, but most people are familiar with Bitcoin and Ethereum.

With a high price, you can buy factional shares, making it more affordable to invest.

If you really want to risk money, you can look into the Pi Network.

This is a new cryptocurrency that has no value yet.

But you can mine it from your phone and potentially make a return.

#16. Use Credit Cards And Invest

This idea is not for the faint of heart.

You could get yourself into a lot of trouble, meaning debt, if you aren’t smart.

But it can be a great way to build wealth.

Here is how it works.

Find a 0% balance transfer credit card and request an amount of money against your credit limit.

For example, if your limit is $10,000 you could get a check for $8,000.

You request a check since you don’t have and debt to do a balance transfer.

You cash the check and invest it.

Where you invest it is up to you.

Some might choose the stock market, but that is a little risky since you don’t know what the market will do.

A better idea is Worthy Bonds since your money is safe and you earn 5%.

Each month, you pay the minimum due on your credit card from your income.

When the balance transfer offer is going to expire, you take all the money out of Worthy Bonds.

You pay off the the credit card and keep the remainder.

In this example, let’s say you took out the $8,000 and the 0% offer is good for 12 months.

In 12 months with Worthy Bonds, you earned $400 in interest.

If you find another 0% offer, you can do this all over again.

Here is a great resource to find credit cards with 0% balance transfer offers.

How I Built My Wealth By Investing Very Little Money

As I mentioned, I started off investing a small amount of money in my 401k plan.

At first, I didn’t invest additional money because I was trying to pay off my student loans.

But as I saw my 401k balance grow, and grow faster than I thought possible, I was interested in investing more money.

The only catch was I still didn’t have a lot of money to invest.

In fact, I only had around $25 to spare.

I did my research and that is when I found Schwab mutual funds.

I saved up $300 and bought 3 mutual funds.

Then each month I invested $25.

The first month the $25 went into one mutual fund. The next month it was invested in another one. Then the next.

After the third month, I started back with the first mutual fund. I kept doing this until I had more money to invest.

Eventually, I was investing $100 a month in each fund.

The path to $1 million wasn’t a straight line, but I made it in less than 20 years.

The most important factors that helped me were:

- I believed in compound interest and knew investing small amounts of money would pay off

- I kept investing, regardless of what was happening in the stock market

- I increased my investment amount as often as I could

By doing all of these, I grew my wealth much faster than I ever thought possible.

And it all started by investing very little money.

Your Best Option Investing Small Amounts Of Money

Now that you know your options for investing small amounts of money, which is the best one for you?

For most of you reading this, I think that using a combination of options like I did is your best option.

Here are the best small investments for beginners that will grow your wealth.

#1. Invest in your 401k plan. Start by investing 5% if money is tight. If you can afford to invest more, then do so. Eventually, you want to get to 15%.

#2. Open a Roth IRA with Betterment. You can get started for $10 and then invest $20 a month from there.

#3. Invest with Worthy Bonds. Opt to have them round up your spare change and effortlessly grow your wealth.

By following this plan, you can get started investing and in time, will see your money grow into larger sums.

But as simple as it is, you have to keep a few things in mind to really make it work.

Key Points To Success

Here are 3 things to keep in mind to truly make investing small amounts of money work for you.

#1. Change your mindset.

Don’t make the mistake of thinking investing a few dollars a month isn’t going to pay off. It will in time.

You have to learn to stop focusing on the now.

Just invest and stop checking your balance everyday.

#2. Stick with it long term.

You have to keep investing for the long term. This means when the market is rising and falling.

This is made easy by setting up an automatic investment plan.

It ensures you invest all the time. You can’t let fear overtake you and stop investing.

- Read now: Learn how to overcome your fear of investing

- Read now: Discover the best long term investments

If you do let fear control you, you will never see the results of investing.

#3. Invest more money.

As time goes on and you earn more money and keep your spending in check, you should have more money to invest.

Make sure you actively increase the amount of money you are investing.

Doing this puts compounding into overdrive and really offers results.

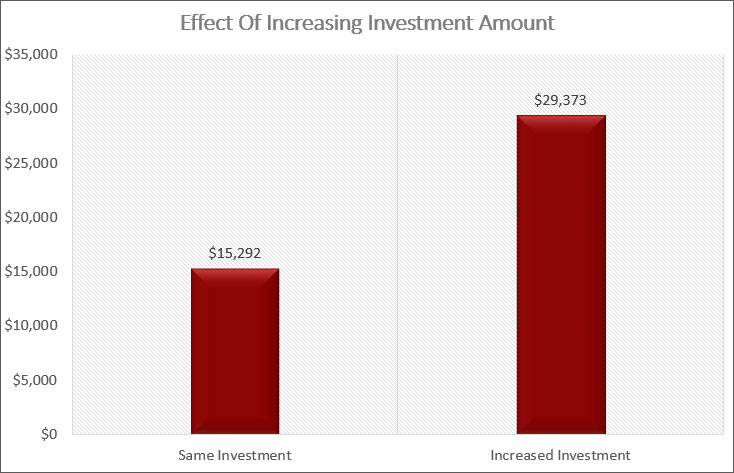

For example, let’s say you open an account with $100 and then invest $25 a month for 20 years. You end up with over $15,000.

But what if 10 years in, you were able to start investing $100 a month?

At the end of the 20 years you end up with close to $30,000.

You nearly doubled your wealth by investing a little more money!

Investing more money allows compound interest to work even faster, which means you grow your wealth even faster.

Final Thoughts

At the end of the day, you have options when it comes to investing with a small amount of money.

The easiest place to start is with your 401k plan at work and then do some research to see which of the other options will best meet your needs.

But whatever you do, don’t fall into the trap of thinking a few dollars here and there won’t matter.

Thanks to the power of time, your money will grow.

But it will only grow if you actually take that first step and start investing.

It won’t become a million dollars tomorrow, but in time, you will be amazed at how much your investments grow in value.

- Read now: Click here to learn the pros and cons of target date funds

- Read now: Find out the pros and cons of investing in index funds

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I’m really glad you laid out the options for people. I heard this complaint a lot from my high school students who didn’t have a lot of money but wanted to get started investing. I think the 401(k) type option is the best place to start if a person’s company offers that.

I agree that a 401k is the best – and easiest – place to start. Once you have that going, then you can look at the options.

Investing should NOT be so difficult that the use of a robo-advisor, or a human adviser, is warranted. The end result is either type of adviser will stick you in expensive, poor performing mutual funds. Since most advisers and mutual funds under-perform the market, investors ought to heed John Bogle’s advice and just buy the market. Every 401k should have a large cap index fund that replicates the S&P 500. Investors could just dollar cost average into that fund without needing anyone’s advice. In fact, they would have done very well had they been buying the dip in 2008-2009. Investors can also use a longer term chart and buy when the S&P 500 dips below the 200 day moving average.

The thing is though, that many investors can’t control their emotions, so going with Betterment or hiring a financial advisor makes sense for them. They have someone else to keep them invested for the long term and to not give in to their emotions. After all, I’d rather someone pay a little higher fee by going with a financial advisor than pay no fee and not make any money because they let their emotions get the best of them.

Also, not all advisors put clients in poorly performing mutual funds. Betterment only uses ETFs and even with their management fee added in, investors will pay less than they typically would if they bought the average mutual fund on their own. At the advsising firm I worker out, our average fee (with fund expenses included, so total fees) were less than 1%, again much better than the average mutual fund. Of course you could invest with Vanguard and this is a mute point.

Great list of resources. I will definitely be checking some of these out myself and sharing this article with my community.

Great!! I hope you find one that meets your needs!

Solid options Jon! It drove me nuts when I would speak with investors and they’d think they couldn’t invest because they had little to start with. There are quite a few options, you just have to look for them and today there are more options than ever. If I were in this situation I’d likely go with either something like Motif or a Direct Stock Purchase plan. Either are a great way to get started at simply building up something you can use as a jumping point.

I agree that with technology, there are more and more options. This can be good and bad as you can get “paralysis analysis” from looking at the options. Hopefully though most people will see that they can invest with little money and will start doing so.

MSG,

Starting early is important. But getting started can be intimidating for new investors. Mentioned above, I recommend Loyal3 over direct stock purchase plans because you can invest just $10 at a time and pay no fees, ever. It’s easier than the direct stock purchase plans because all your investments are in one place and the fees are consistent (none). The downside is investment choice, but a lot of the companies new investors would find desirable to own.

-RBD

Thanks for the info on Loyal3! Having no fees and such a low minimum to start is awesome! Do they have plans to expense the number of companies you can invest in?

I don’t understand this blog. Are you trying to reach out to new, young investors or those without a lot to invest? Why confuse the matter? Why not just send them to Vanguard or Fidelity and steer them towards index funds? Maybe even suggest a Roth if they’ve got earned income?

A lot of new, young investors don’t have a lot of money to invest in the first place. Yes, Vanguard is awesome and in many of my posts I recommend them, but a lot of people don’t have $3,000 laying around to invest right now. They need other options and this post was written for them so they can get started today.

Great tips! You really don’t need a big amount to start on your investing journey.

So true!

A few years back I wanted to get into investing but didn’t have a huge stack of cash laying around. I investigated my options and found some mutual funds through USAA that I could invest in for as little as $50 a month. That’s how I started, and then slowly increased that monthly amount when I could afford it. It was a great way to begin investing.

Great job!! There are some options out there, you just have to find them! That’s why I say to those looking to invest in mutual funds that you need to see if the fund company will lower the minimum if you set up an automatic investment each month. Many do and you can get started investing right away!

Great summary of the options. I gave pretty much the same advice to my nephew last year.

Personally, I’m leaning towards DRiPs since it makes it easy to invest with very low contributions, and has the lowest fees. There’s something visceral about having a direct investment connection with a company that you don’t feel when you’re using a broker or other intermediary that makes you feel like you own the company. As long as you’re a buy and hold investor and not a trader, it can help you weather the inevitable downs.

That’s awesome advice you gave. I think the reason you mentioned is one of the big reasons why so many people go with a direct investment plan.

Jon, I just increased my contribution to 401(k). Thanks for sharing the means in investing and making it more feasible, realistic, and personal for those with little money.

“Case and point are Schwab Funds. ”

It’s “case in point.” Mistakes like these seriously hamper a site’s credibility.

Thanks for pointing that out. I never will claim to have done great in English class!

It gives no one excuse not to invest. With a small amount of money, anyone can invest and reach his financial good more easily.

Agree. As long as you are patient, investing a small amount of money will pay off.

Big beginnings start in small things. Just the way it is with money investing! The important is how you create the habit of investing until such time you get what you want.

It is all about creating that habit.

It takes courage to start investing especially with a small amount of money. I guess before you invest, one should be ready and educated first to whatever it takes to be a successful investor.

I started with small amount of money when I invested, and now I think I have managed to improve how much I can invest in. It’s all about making progress along the way.

Nice article, Jon. I just hope that this article gives an idea to most people that they don’t have to have much money to start investing and encourage them to study how investment works.

Hi Jon,

This is my first visit to your blog. Fantastic post!

You have laid out the options very well.

There are robo-advisors like Betterment as you have pointed out investment options like Acorns that enable you invest your spare change into ETFs.

Technology has made investing available at a very low entry point.

–Michael