THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Did you know you can make money in your sleep?

You can make money while you are lounging by the pool or while watching television.

Even while on vacation!

Sounds too good to be true doesn’t it?

As I typed that, I felt like I was typing the intro for some scammy late-night television infomercial.

The crazy thing though is that you actually can make money while doing nothing.

Compound interest is the secret way to earn money for doing nothing.

Now, you aren’t going to become a millionaire overnight through compound interest.

You aren’t going to be become the world’s richest person by the end of the year either.

But as you will see, compound interest is a solid strategy for growing your wealth.

And you end up with a lot more money than you think, all thanks to compound growth.

Table of Contents

Ultimate Guide To Compound vs. Simple Interest

What Is Simple Interest?

Simple interest is when you only earn interest on your savings.

For example, let’s say you have $100 in a certificate of deposit that earns 5% annually for 2 years.

At the end of one year, you have earned $5 in interest and you have $105.

After the second year, you earn another $5 in interest and have an ending balance of $110.

This is simple interest.

What Is Compound Interest?

Compound interest is interest you earn on your savings, as well as on the interest you earn.

For example, let’s use the same example as above.

You have $100 in a certificate of deposit and earn 5%.

However in this case, the interest compounds annually.

At the end of one year, you have earned $5 in interest, just like before.

But at the end of the second year, you have $110.25.

Where did the extra $0.25 comes from?

The $5 you earned the first year earned interest and this is the extra $0.25.

This is the power of compound interest. You earn interest twice.

First on your savings. Then on your earned interest.

Let’s take this example out farther.

At the end of the third year, still earning 5% interest, your original $100 is now worth $115.76.

In this case, you earned interest the following ways:

- On your original $100 savings

- On the $5 of interest you earned the first year

- On the $5 of interest you earned the second year

- On the $0.25 of interest you earned on the interest you earned

If you think that is good, let’s dive deeper so you can see what happens with a different compound period.

Compounding Over Various Time Periods

As great as compounding is, it gets better.

This is because most banks don’t compound on an annual basis.

They compound your money more frequently.

Most offer monthly compounding and some even offer daily compounding.

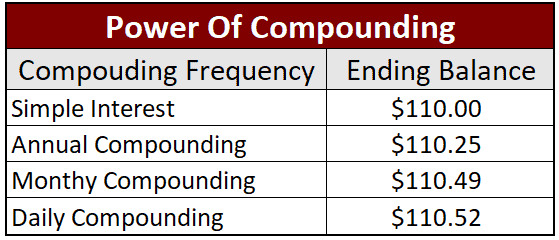

Let’s take a look at how frequent compounding periods effects your savings.

Monthly Compounding

Let’s say you have $100 saved and it earns 5% annually for 2 years and compounds monthly.

At the end of the first year, your $100 grew to $105.12.

At the end of the second year, you end up with $110.49.

If you remember the example above with annual compounding, at the end of 2 years, your $100 was worth $110.25.

With monthly compounding, you earn interest in addition to the interest you are earning more frequently.

Daily Compounding

If you understand the example above, you know that if you increase the compounding period to daily, you are going to end up with even more money.

So, $100 invested for 2 years, earning 5% interest will be worth $110.52.

Here is a breakdown of each ending balance for the various compounding periods.

Now, if you are like most people, you see that you end up with more money the more often compounding happens.

But it only adds up to a few pennies, so it’s not that important.

This is where you would be wrong.

As with most things in life, good things start off slowly and build upon growth.

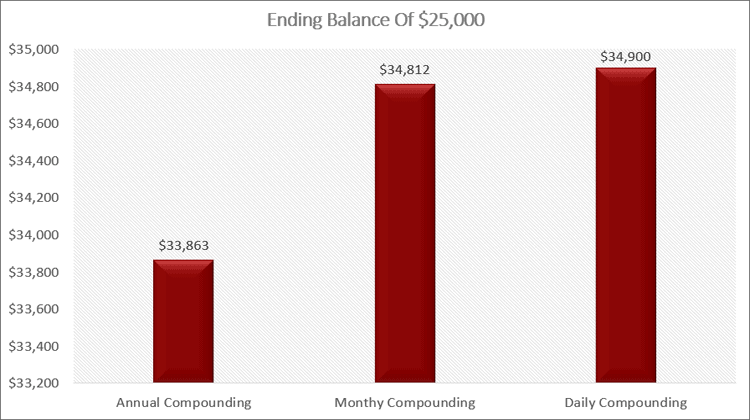

Let’s look at the following example.

You invest $10,000 for 25 years. Your annual percentage rate you earn is 5%.

Here is what each compounding period looks like.

By having more money compounded for a longer period of time, you end up with over $1,000 more.

There is one more thing you need to understand about compound interest.

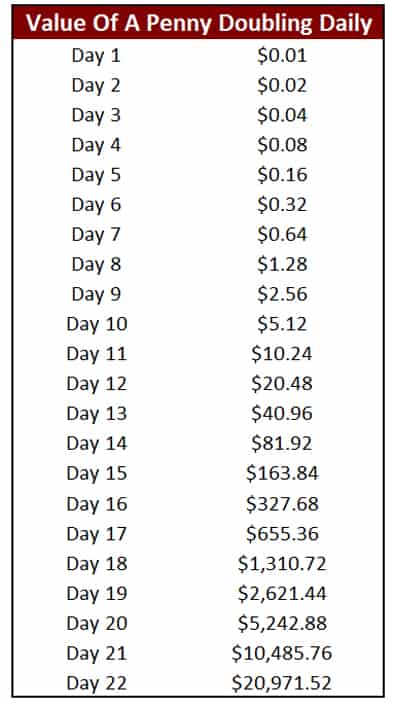

The Compounding Penny Test

To see if you master the concept of compound interest, let’s look at a simple scenario.

I offer you one of the following options:

#1. $1 million dollars in 30 days

#2. the value of a penny doubling (compounding) a day for 30 days

You can either take $1 million dollars in 30 days, or I will give you the value of a penny in 30 days assuming it doubles in value every day.

Which option will you choose?

Most will take the $1 million. But is this the right choice? Let’s find out.

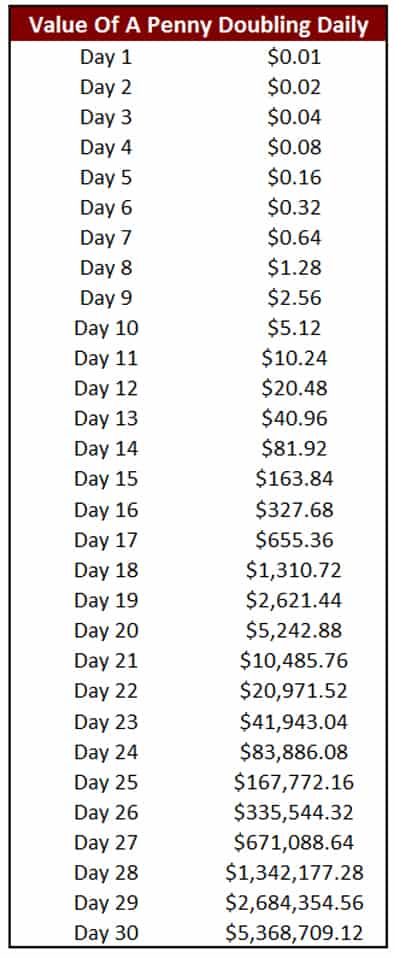

Below is a chart of the value of that penny doubling in value every day.

You can see that by day 15, halfway through the experiment, you are only at $163.84.

It’s looking like the $1 million dollars was the correct choice.

Now we move ahead to day 22. Still, our penny doubling every day is looking like a bad choice.

We only have $20,971.52.

In the end, wouldn’t you know, the penny doubling in value wins!

You end up with $5,368,709.12 after 30 days.

So what does this have to do with compound interest?

When you double your money every day, you are taking advantage of compound interest.

Instead of earning 5% interest annually, here you are earning 100% interest every day.

Now, understand that earning 100% interest is absurd and doing so every day is even crazier.

But it shows you how powerful compound interest is.

So how do we go about using this superpower to our advantage?

Using Compound Interest To Build Wealth

How do we start taking advantage of the power of compound interest?

Most people make the critical mistake of trying to earn 100% interest rate like in the penny test.

To have compound interest work to its greatest benefit for you, you need to do two things:

1. Save as much as you can

2. Earn a decent interest rate

Let’s talk about each of these and then get into some examples so you can understand the importance of both.

Save. Save. Save.

When it comes to saving, there are a lot of things you can do.

The two major things are to cut your expenses and earn more money.

But there are lots of things in each of these categories that you can do to beef up your savings.

First, you can set up an automatic transfer to a savings account.

I use CIT Bank for this reason.

They offer one of the highest interest rates in online savings accounts in the country.

But transferring money to savings is just the tip of the iceberg.

From there, you can look at cutting some expenses out of your budget.

Can you reduce your cable package? I’m sure you don’t need 300+ channels.

With other services like Apple TV, Fire TV and Sling, you can save money on cable.

Another option is your cell phone.

Why spend over $100 a month when you can get the same thing for a fraction of the cost?

Look into prepaid plans or other carriers that offer lower monthly payments.

What about reducing the amount you spend eating out each month?

I’m not asking you to be miserable and not have any fun.

But there are some things you can cut back on or go without and still be happy.

Take some time to run through how you spend your money and see if there are some things you can go without or cut back on.

- Read now: Click here to learn 115 ways to save money

- Read now: Learn how to reduce your monthly bills $1,000 a month

I’m sure there are some things you can do without and not impact your daily life.

The key is to make sure you save that money and not spend it.

Finally, you can look at earning some more income.

If you get a raise, save the difference.

For example, if your paycheck was $500 a week and is now $515, save that $15 and keep living on the $500.

- Read now: Learn the simplest way to becoming wealthy

- Read now: Click here to learn how to easily get larger raises at work

Do this every time you get a raise and you will guarantee you save a ton of money.

Another option is to do things on the side to make some extra money.

Thanks to technology, it is easier than ever to make more money.

You can take surveys, surf the net or even charge people to sing “happy birthday” to them.

- Read now: Click here to learn the best survey sites for making money

- Read mow: Click here to learn over 50 ways to make extra money

Your options for making money on the side are almost endless.

As you can see, you have many options when it comes to cutting expenses and earning more money.

Let’s now look at the importance of your interest rate.

Understanding Interest Rates

While it would be great to have your money double every day, it is just not possible.

Sadly, too many people still try to do it.

They think if they just find the highest interest rate, they will get rich quick.

Unfortunately, they don’t understand the risks that come with such a high interest rate.

Remember, the higher the interest rate, the higher the risk you assume.

This means losing the money you saved.

So what are some good interest rates you can earn while not taking on too much risk?

For starters, there is your savings account and bank CDs.

Unfortunately right now, you are going to be earning close to nothing interest on these.

If you go with an online bank, you can get 1% on your savings but that is pushing it.

Your next option is the stock market.

If you invest in a portfolio of low cost index funds, you can comfortably earn on average 8% per year.

Anything more than this, you are taking on great risk.

Always remember that risk and return go hand in hand.

The investment that earns you 50% a year will grow money faster.

But you also have a higher risk of losing all your money too.

I fell for this idea years ago.

I had some money to invest and trying to make a killing, I invested in a tech mutual fund that had been returning 60% a year.

I put in $2,500 and by the end of the year, the fund lost 60%.

My account now only had $1,000. It hurt a lot and reminded me how risk and return work.

I now invest in funds that track the market.

Do I still lose money?

Some years, but over the long-term, I have earned a decent return.

So let’s see the impact interest rates have on our saved money.

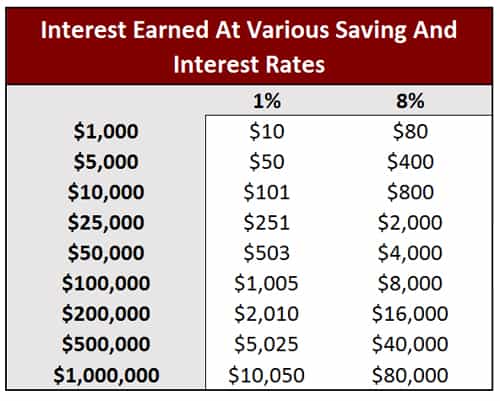

Below is a chart. The left side shows you various saving amounts.

The right side shows you how much interest you would earn in a year with a 1% interest rate and then an 8% interest rate.

Note that I rounded out the cents to make it easier to follow.

There are two things to take notice here.

First, when you have a large amount of money, earning 8% annually results in a nice return of your money.

For example, if you have $1 million saved and you earn 8%, you will make $80,000 for doing nothing!

Second, the amount of interest you earn on a large amount of savings with a smaller interest rate is a lot of money.

If you saved $1 million dollars, and it is earning just 1%, that is $10,000 a year.

For most of us, this amount isn’t enough to live off of.

But you can take less risk, earn a smaller return and make a decent amount of money. All thanks to compound interest.

For example, if you earned 3% on that $1 million, that is over $30,000 in interest.

This is the beautiful thing about compound interest.

Once you save a decent amount of money, you can earn a small interest rate and still make a lot of money.

The lesson here is to save as much as you can.

While earning a higher interest rate is nice, saving as much as you can will allow you to take less risk and still earn a lot of interest.

Your Compound Interest Plan

So now you know that compound interest is the lazy man’s way to earn money.

You also know when starting out, you need to focus on saving as much money as you can.

Then you need to focus on the interest rate you earn.

We are now going to put everything into action.

As I mentioned before, you start out saving as much money as you can.

Do whatever you have to do, cut expenses and make more money, so that you can save as much as possible.

How much should you be saving?

Depending on who you ask, you will get various numbers.

I would suggest trying to save 25% of your income a year or more.

This might be a shock to some, but you can work up to this number.

For example, if you have a 401k plan at work, set your contribution to 10%.

Next, set up an automatic transfer each month for another 10% of your income and you are already at 20%.

From there, focus on knocking down expenses and then find some ways to bring in more money.

Keep increasing the amount you save each year. Try to make a game out of it.

- Read now: Learn 41 money saving challenges to play

When you have 6-8 months of expenses saved up in a savings account, it is time to start investing in the stock market.

There are a lot of options when it comes to brokers.

I’ve reviewed a lot of them to help you find the right one for you.

But to save you some time, I’ll narrow the list down for you here.

For beginners and most investors, the best choice is Betterment.

They do everything for you.

You just set up a monthly amount to invest and they do the rest.

If you are on a tight budget and can’t invest a lot, consider Acorns.

You can invest as little as $5 a month.

But even better, you can invest your spare change.

Every time you make a purchase, Acorns will round up your purchase to the next dollar and invest it for you.

Remember when investing, the goal is to get a decent return.

This comes out to around 8%.

Don’t try for home runs, as you will strike out. Earn a decent return and still sleep at night.

As you earn a nice return from your investments, you have to keep saving money.

This will snowball the compounding process and allow you to grow your money much faster.

For example, let’s say you saved $10,000 and put that into the stock market earning 8% per year.

Each year, you also invest another $10,000.

How much money do you have after 20 years?

After 20 years, you have over $500,000.

But you can do better than this.

Let’s say you saved $10,000 and invested it for 20 years, earning 8% a year.

But this time, you are able to save $20,000 more each year.

After 20 years, you have over $1.5 million dollars.

So remember to save as much as you can and keep saving.

Then earn a decent interest rate to grow your wealth through compound interest with ease.

Frequently Asked Questions

As basic as compound and simple interest are, it can be confusing.

Here are the most common questions I get asked about this topic.

What is a good compound interest calculator?

There are a lot of calculators on the internet.

It’s simple to use and shows you in detail the interest you earn each compounding period.

What is a good simple interest calculator?

Not surprisingly, I like the same site for the simple interest calculator.

Here is a link to it.

What is the formula for compound interest?

If you want to do the math on your own, here is the compound interest formula you need to use:

A = P(1+r/n)^nt

Here is how to do the math:

- P is your initial investment amount

- r is the annual interest rate

- n is the number of times interest is applied during the time period

- t is the time invested in years

The important thing to remember here is the number of compounding periods you want to solve for.

What is the formula for simple interest?

The simple interest formula is the following:

A = P(1+rt)

Here is how to do the math:

- P is your initial investment amount

- r is the annual interest rate

- t is the time invested in years

When calculating this formula, make sure you are using years and not months for compounding frequency.

Is there a thing as continuous compounding?

Yes.

Continuous compounding is when you compound every second of the day.

You might think that this would end up earning you thousands of dollars more than compounding daily, but the reality is the difference in your ending balance is marginal.

Also, understand while this concept is real, it is not practical and no one offers continuous compounding.

What are the key differences between compound and simple interest?

There are two main differences between compound and simple interest.

First is that with compound interest, the interest you earn also earns interest.

As a result, your money will grow larger over time.

The other difference is that savings products, like savings accounts, use compound interest while loan products, like an auto loan, credit cards, student loans, etc. use a simple interest rate.

If simple interest loan products were to use compound interest, you would almost never get out of debt because of the ballooning interest that is accruing.

Final Thoughts

Compound interest is your best friend.

You can grow wealthy by using compounding to your advantage.

The trick though is to save as much as you can as well as not getting greedy.

Earn a solid return for your risk and in time, you will be rich.

It won’t happen overnight and it won’t happen in a year.

But 99% of people never become rich that quickly and the ones that do tend to end up broke just as fast.

Take your time and be smart with your spending and savings.

Before you know it, the power of compounding will take off and you will see the impact of your work.

- Read now: Discover the 15 steps to building wealth you need to know

- Read now: Learn how to create your own money tree

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Loooove compound interest… interest on interest and then "interest on interest on interest" and then… and then…

I love scoping out a Roth IRA calculator and looking at the end to see the interest v. money invested. I see it as a "reward" for just for being a little "smart" and sticking $5,000 a year into an index fund held in a Roth IRA. Yes, I know I'm a sad, sorry soul when I get more entertainment from a compound interest calculator than the Harry Potter movies (which I have no interest in seeing…).

Hahaha!! I guess I'm in the same boat as you. I love playing with financial calculators all the time too!

The perfect way to let your money go to work for you. Compound interest FTW!

"Compound interest is the most powerful force in the universe."

–Albert Einstein

Awesome quote!! I'll be adding it to my finance tweets!

Love the discussion as it is very detailed. Compounding interest is definitely very advantageous. We just have to be very determined and consistency is the key in here!