THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Is becoming rich and not having to worry about money is a dream of yours?

But you’ve tried to figure out the secrets of building wealth and have come up empty every time?

Maybe you even tried out some get rich quick schemes that sounded too good to be true, but couldn’t resist the opportunity to becoming rich.

You want the money, the houses, the lifestyle. You believe that when you are rich, you will have the world at your fingertips.

You want to forget about the struggles of not having money, the stress and the headaches.

You just want to become rich.

But you are losing hope. Nothing seems to be working in your favor.

Until today.

Today I am going to show you the steps on how to become rich from nothing.

If you follow these simple steps for attaining wealth, you will be shocked at how you can live a life of wealth beyond your wildest dreams.

Just understand that these steps aren’t what you typically see.

I won’t be telling you the latest fad you need to get in on.

Instead, I am presenting you the guide to build wealth that will give you financial freedom.

If you can master these 15 steps, then you will be able to buy whatever you want whenever you want.

Table of Contents

15 Steps To Become Rich Beyond Your Dreams

#15. Set Goals

The most successful people set goals.

Not only do they know what they want out of life, they develop the steps to get there.

Don’t think this is a process that takes a lot of work.

You just need to know what you want and then work backwards.

For example, let’s say your goal is to have $1 million dollars in 25 years.

To reach this goal, your first step is to break it down.

If we divide $1 million by 25 we get $40,000.

So we need to earn and save roughly $40,000 a year.

This isn’t completely accurate though, because as your savings and investments grow from compound interest, you will have to save less.

But to keep things simple, let’s just go with this number for now.

The next step is to figure out how you are going to save $40,000 a year.

This could be cutting expenses, starting a side hustle, etc.

The final step is to keep track of your progress as the year progresses to make sure you aren’t falling behind.

#14. Develop A Wealth Mindset

We all have a money mindset.

Some have a poor mindset while others have a wealth mindset.

Whichever your typical thought patterns are about money is how your life is turning out.

For example, if you have a scarcity mindset, you are going to have a hard time building wealth.

You will always be thinking about how little money you have and how when you do get some money, something is right there to take it away.

If you have an abundance mindset, you will be able to grow wealth much easier.

You need to be grateful when money comes into your life and believe that it always will.

I’ll admit, having the right money mindset doesn’t come naturally to some people.

So you have to work at it.

Using money affirmations is a great first step.

From there, it all about be thankful on a daily basis for what you have and what is yet to come.

#13. Live Below Your Means

I know, nothing groundbreaking here.

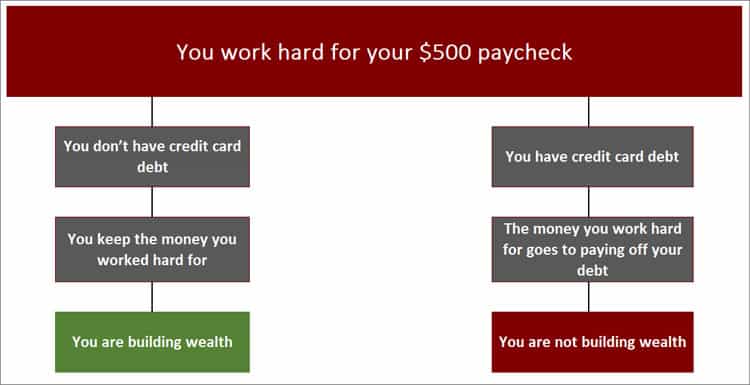

But if you want any shot at becoming rich, you can’t be in consumer debt.

When you are, you are working to pay other people and not pay yourself.

Think about that for a minute.

If you are in $500 worth of credit card debt and you get paid $500 a week after taxes, you just worked 40 hours to pay off your debt.

None of that money you earned is yours. It’s going right to the credit card company.

It’s hard enough to get out of bed some mornings and fight traffic.

If you are in debt, you are doing it simply so you can hand your paycheck over to someone else.

That needs to change.

You need to get out of debt and start living within your means.

But it doesn’t end there.

Being in debt strangles your options in life as well.

If you had no debt and kept your spending in check, you could work at a more rewarding job and even get paid less.

You would be infinitely happier because you would be doing something you love to do.

Your first step for becoming rich is to get out of debt.

The question is, how do you go about getting out of debt the quickest?

Luckily I have detailed this information out for you.

#1. First you have to see how much debt you have and where it is.

Write down your current balances and what type of debt it is, like credit cards, student loans, etc.

Be sure to list the interest rate you are paying as well.

#2. The next step in the process is to start paying off your debt.

I prefer the snowball method since it is best at keeping you motivated to pay off your debt.

Once you organize your debts and create a plan to follow, you can start paying off your debt and start building wealth.

My only suggestion would be to keep this debt out of the plan for now since you can deduct the interest and the balance is most likely your largest.

#3. Don’t become obsessed with your mortgage.

Yes your mortgage is debt, but I don’t recommend you pay it off any time soon.

This isn’t to say I don’t think you shouldn’t pay it off early.

I believe you are better off investing your money where it will grow faster.

This is because a mortgage rate might be 4% whereas the stock market can earn you 8% a year.

Why put your money into a 4% investment when you can earn double that amount?

But you have to be disciplined and actually invest the money.

Since you are reading this post, I will assume you are.

Now, while you are focusing on investing, you can still put a little extra towards your mortgage.

For example, whatever your monthly payment is, round it up to the next $100.

So if your payment is $1,234.54 write your check out for $1,300 and have the extra go towards principal.

You won’t notice it and it will shave off some years and a lot of interest.

#12. Spend Smart

Another factor in becoming rich is to spend smart.

What does this mean?

It means not only keeping an eye on your spending, but also is about buying quality items, even if they cost more.

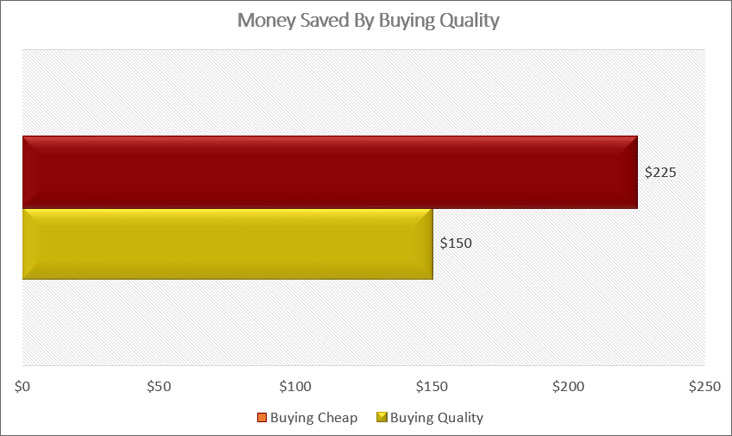

A great example is one I learned recently.

I tend to wear a lot of t-shirts.

Since I don’t value them that much, I would go to a store and buy their shirts for $9 each.

My thinking was $9 is much better than $30 that another store charges.

But my thinking was flawed.

The $9 shirts were made poorly.

I ended up needing new ones every year because they would get holes in them.

The $30 shirt on the other hand was made better and lasted many years.

Over time, the $30 shirt is a better buy because in 5 years, I’d have bought 5 shirts at $9 each, meaning I spent $45 every year on new shirts.

In that same time, I could have bought three $30 shirts and kept them for 5 years.

The savings? $135 just on t-shirts.

Think of all the times you base your purchase on price alone.

My guess is you could be saving a decent amount of money on more expensive things even though the upfront cost is more.

Granted, there are times when lower priced is better.

For us, we buy the store brand frozen vegetables. They taste the same and are much cheaper in price.

Before you buy anything, look at the quality of the item first.

See if it makes sense to spend the least amount of money possible or if a higher priced version is a better value over the long term.

This is a secret rich people use all the time.

They rarely focus on just the price. Instead they focus on the value.

When it comes to keeping an eye on your spending, you can do this easily thanks to technology.

For example, you can use the app Trim.

It will scan through your purchases and make recommendations on lower cost options and suggest bills you can cancel.

This includes bills like gym memberships or that long lost music service you subscribed to.

Trim even will negotiate your cable bill for you! Most users see a $30 drop in their monthly bill and they didn’t do anything.

Trim did all the work for them!

Click the link below to try Trim out and see how much money you can be saving.

In addition to Trim, you can take some simple steps to keep your spending low too.

I like to review my spending, from large to small to keep things in check.

- Read now: Click here to learn how my approach will slash your spending by $1,000 a month

- Read now: Discover over 100 ways to save money today

By using this approach, you save the most money in the least amount of time.

Once you do this, you will have more money not doing anything.

Don’t make the huge mistake of letting it sit on your checking account.

This guarantees you will find something to spend it on and the result is you never will become rich.

Instead, save the money.

Open your free online savings account with CIT Bank and earn one of the highest interest rates in the country.

This will allow you to grow your wealth at a faster rate.

#11. Track Your Net Worth

Earlier when talking about goals, I mentioned you need to track your progress throughout the year.

One great way to track your progress is to calculate your net worth.

Your net worth is simply your assets minus your liabilities.

It gives you a great insight into how you are progressing towards your financial goals.

In addition to your net worth, I like to track one other ratio.

I look at my annual income and my net worth.

For my annual income, I look at my tax return to get my annual income and divide by my net worth.

For example, let’s say my annual income is $75,000 and my net worth is $100,000.

I take $75,000 divided by $100,000 to get to 0.75 or 75%.

This tells me that my income is equal to 75% of my wealth.

The lower this number the better.

For example, let’s say 10 years later my income is $80,000 and my net worth is $900,000.

My ratio is now roughly 9%.

I am relying less and less on my income as my wealth grows.

#10. Know What Matters

Advertisers are good at getting you to part with your money.

If you want to be rich one day, you have to know what matters to you.

In other words, develop some good habits with money.

This means not getting sucked into the marketing for a product and buying on a whim.

Make sure you know who you are and what you like.

This is a big step in not falling for their tricks.

Unfortunately, you will still fall victim at times. The key here is to make as few poor financial decisions as possible.

Everything you want to buy needs to be thought about first.

Write it down, make a note in your phone, whatever.

Then wait a week and see if you still want it.

Odds are you won’t and you will have completely forgotten about it.

This trick works because of the way our brain is wired.

Our emotional side fires up first, which makes us buy without thinking.

Then some time later, our rational side kicks in.

We know this happens when we regret a purchase.

By writing it down, we give our rational brain a chance to process the information and save money.

#9. Invest

You will never become rich unless you invest.

OK, you can win the lottery, though not likely, or get a million dollar inheritance from a long lost uncle, again, odds not so good there.

But realistically, your best shot is to invest in the stock market.

I know some reading this would rather walk over hot coals than invest in the stock market, but it isn’t so bad.

In fact, if you follow the tips I talk about in my investing posts, you will be a successful investor.

This means that over time, you will grow your wealth.

If you are serious about becoming rich, you need to read the investing posts I’ve written.

I offer simple, easy to follow advice on how not only to get started investing, but also how to overcome your fears and be successful.

For example, you want to focus on the following:

- Invest in a low cost index fund. This can be either mutual funds or exchange traded funds.

- Invest on a regular basis. It’s a good idea to invest monthly. This creates a positive habit over the long term.

- Know your risk tolerance. Getting wrong your comfort with risk is the best way to destroy your wealth.

From there, all that is left for you to do is to invest.

You can go about this one of two ways: either DIY or hire someone.

For many, the DIY approach works best.

Don’t think for a minute that you can’t invest on your own.

Thanks to technology it is easier than ever.

All you need to do is know what your goals is and this will help you to understand the perfect fit for you.

If you would rather just have me recommend an online broker, then you can’t go wrong with Betterment.

They are a perfect option for most as they automate 99% of the things you need to do in order to make money in the stock market.

In as little as 5 minutes, you can have your account opened and Betterment will take care of everything for you.

All you have to do is sit back and let your money grow.

To get started with Betterment and build your fortune, click the link below.

If you aren’t the DIY person, you can hire someone.

While this is an option, many won’t have the money most advisors require.

This is because most advisors deal with people who have a good amount of money to invest, like $250,000 or more.

This is why robo-advisors like Betterment came along and are so great.

They allow the little guy to invest and build wealth in the stock market.

If you do find an advisor that you like, make certain they are a fiduciary.

This will ensure they are investing your money that is best for you.

Sadly, not all advisors put your goals first and as a result, make money off you.

Finally, I want to talk to you about how to set up your investing strategy.

Using this guide, you will save money on taxes and grow your savings faster.

#1. Start investing in your 401k plan. Invest up to the company match.

#2. Invest in a Roth IRA. Put in as much as the IRS allows.

#3. Invest more in your 401k plan. Ideally you want to get to 15% contributions.

#4. Invest in a taxable account. Start investing in a regular brokerage account.

By investing in retirement accounts first, you lower your taxable income and defer or avoid taxes on capital gains and dividends.

#8. Consider Real Estate Investing

Real estate investing is another great way to build wealth.

The biggest downside is it can take you a long time to build your savings.

But once you do this, you can put wealth building on auto-pilot.

Of course, there is an alternative to owning rental properties directly.

You can get involved with real estate crowdfunding.

This service has a bunch of investors pool their money to buy properties and then earn a share of the profits based on their ownership percent.

The best one I’ve found is Diversyfund.

It’s easy to get started with a lot less money than you otherwise would need.

#7. Be A Lifelong Learner

I don’t care what your age is, you need to be educating yourself at all times.

We live in a fast-paced world and technology is changing all of the time.

If you don’t stay on top of evolving your skill set, you are going to get left in the dust.

Why does this matter?

Because your career is the greatest asset you have in becoming rich.

- Read now: Discover how you are your greatest asset

Nowhere else will you earn as much money as you can from your career.

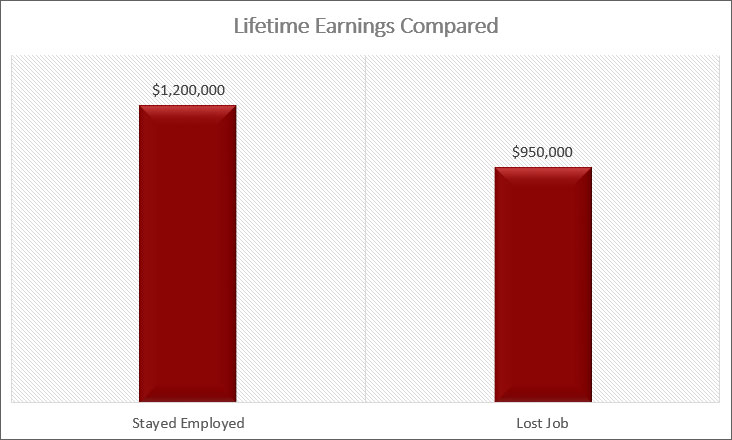

For example, if you are making $40,000 a year and are 35 years old, you will make a total of $1.2 million by age 65, assuming you never get a raise.

If you don’t keep learning though someone else who is hungrier for success will come along and put you at risk of being let go.

If you do get let go in 5 years, chances are you will have a tough time finding a comparable job because you haven’t stayed up to date with technology.

This means you will have to take a lower paying job.

If this new job only pays you $30,000 you just cost yourself $250,000 in lifetime earnings.

Therefore, it is critical that you are always learning about your industry and making sure you are at the forefront of new technology.

How do you do this?

Read industry magazines. Go to conferences and networking events.

The more knowledge and information you consume, the better your chances of keeping your job, earning raises and becoming rich.

#6. Start Your Own Business

A lot of financial success comes from starting your own business.

You don’t have to start a franchise or invest a ton of money here either.

In fact, the smaller you can keep it, the better.

When I did this, my own business was just a side hustle.

I was doing something on the side I enjoyed and it was bringing in some extra money.

I didn’t use this money for living expenses. I saved everything.

A few years later, I was laid off, took a chance and turned my side business into a full time job,

Now I have other side hustles I do for extra cash as well.

I don’t ever plan on making these a full time job, just use them as extra income streams.

Here is why this is important.

When you have multiple streams of income, you grow your wealth a lot faster.

You can take your income from your side business and use it to boost your savings.

When I was doing this, I was making at most $10,000 a year.

This is not a lot of money, but after 3 years, I had over $30,000 in savings.

This was in addition to the money I was saving from my regular job.

The point is, it is never a bad thing to have money coming in from different places.

It lowers your risk if you were to lose your job and it allows you to save even more money.

#5. Work Hard

Along with being a lifelong learner is to work hard. You can’t just skate by even if you stay on top of the trends in your field.

You have to work hard.

This means getting a lot done. Take on new projects. Help out anywhere you can.

I am not saying you have to work 80 hours a week, though working 50 or 60 wouldn’t be a bad thing.

In addition to putting in hard work, find ways to work smart too. See if there are ways you can improve your time management skills.

I suggest you read Getting Things Done. This is especially true if your emails are out of hand.

Another good time management skill is to cut out distractions.

Close your door at the office or block off time in your work calendar so others think you are busy and won’t bother you.

Other options include:

- Only check your email twice a day, at set times

- Use the Pomodoro Timer to focus for short periods of time

- Get in to work early so you can work uninterrupted

The better you become at being efficient with the small day-to-day things that eat away at your time, the more time you will be able to spend on other areas.

These include projects, finding new business, or anything else that will make you stand out from the crowd.

And this in turn will lead to larger raises and more wealth.

#4. Become Valuable

Related to the point above about working hard, is to become valuable at work.

By becoming valuable to your boss and your company, you lessen the threat of a layoff and earn more money.

Just how do you do this?

Your boss needs to see you as someone the company cannot survive without.

To do this, create new ways of doing things.

For me, it was all about speed. In one job I had, we dealt with Excel a lot and it was all manual work.

In other words, really boring stuff.

I ended up learning about Excel macro formulas and applying that to my job.

Suddenly the work that would take me 8 hours I was getting done in 3 hours.

The culture of our entire department changed overnight.

No longer were we stuck doing boring reports manually.

We have hours of free time to spend on growing our department.

We even tried to figure out other ways to automate some of our other tasks and were successful with a few.

Another way to become valuable is to do the work your boss hates.

Go into their office and ask them what they have been putting off doing and if you can take it off their hands.

They will love you for this.

At another job I had, my boss had to write a quarterly market review.

He hated doing this, and would wait until the last minute to write it.

He would be a bear all day because of how stressed he was.

I offered to take the quarterly review from him and he agreed. I was his go-to employee from that moment on.

Lastly, you can figure out ways to save your company money.

I have a friend that does this.

He is so skilled in it, that he now gets a percent of the annual savings as a bonus!

The more you can become valuable, the greater the chances you will see larger salary increases and lower odds of losing your job.

And keeping your job and earning more money is a key to becoming rich.

#3. Network

Some people don’t think networking is important but it is huge.

You never know when you will need the help of your network.

I’ll give a quick example of this.

My wife was training to become a life coach. In her program she needed a certain number of clients to start with so she could stay in the program.

The deadline was getting close and she was a few people short.

I suggested that she post on Facebook and LinkedIn.

She has a ton of friends on Facebook and worked in sales previously so she also has a lot of LinkedIn contacts.

She posted in both places on Sunday night and by Monday morning had 5 people reach out to her with interest.

Networking is a powerful tool to have at your disposal.

The larger your network, the more options you have.

This could mean getting help with something like finding a job or just getting help with a project you have.

To get started networking, keep it simple.

Reach out to some friends you haven’t talked to in a while. Find some clients of yours on LinkedIn and connect with them.

Then find old colleagues that have moved on and connect with them as well.

Make it a point to connect with people you meet at networking events on LinkedIn as well.

As time goes on, you should be able to build a solid network.

Just be sure to keep in touch with them occasionally, either through email or meeting for lunch.

#2. Marry Smart

Yep, I had to include this one on the list. The reason is simple.

Marriage can make or break your chances of ever becoming rich.

If you marry smart, you will work as a team and grow your wealth over time.

If you marry the wrong person, you will be at odds all of the time and will destroy your wealth.

To be more specific, you have to marry someone that has the same values as you do.

I know that opposites attract, but life and marriage is so much easier when you are both on the same page about the big things.

This includes family and money.

Some people are savers and some are spenders.

If you want to achieve financial independence and your spouse wants a new car every 2 years, you are going to have issues.

But if you both have a goal of wealth, you work together and achieve this goal.

If you do end up marrying someone with different values than you, here is another way you can destroy your wealth.

You will fight all of the time and rarely save anything.

Eventually the marriage will end in divorce and any money you did save will get split 50/50.

You just lost half of your wealth by marrying the wrong person.

From there, you will have an even harder time working to become rich because you may need to pay alimony and child support.

I realize that not all marriages end because of finances alone, but you have to make sure you are marrying the right person.

#1. Change And Adapt

The final step in the process of becoming wealthy is to change and adapt.

My idea of wealth is different now than 15 years ago.

- Read now: Click here to learn how to live a life of unlimited wealth

- Read now: Discover 23 things money can’t buy

This is a key point in becoming wealthy.

You have to change and adapt with the times.

Back then, I wanted tons of stuff and would have needed millions just to buy the things I wanted.

Then I would have needed many millions more just to afford the upkeep on everything.

This is why so many people end up destroying their finances.

They only think about needing the millions to buy everything they want.

They never think about the ongoing costs and how this requires them to keep earning millions every year going forward.

I realize now that I can be wealthy and have a lot less stuff and as a result, I need a lot less money.

This isn’t to say becoming rich isn’t a goal of mine.

I still want to have enough money so that I can live the life I want and not worry about money.

It’s just that with my updated views, a lot less money will determine whether I am rich or not.

I encourage you to not hold on to your specific idea of wealth.

Let it change as you grow. Most likely you will find the same thing I did. That in time, experiences are more valuable than things.

Final Thoughts

There you have the 10 steps to becoming wealthy.

If you seriously want to grow your money and become rich, these are the steps you have to follow.

From spending to investing, to earning as much as you can, even paying attention to who you marry and changing with the times.

All these things add up to lifelong wealth if you follow them.

And once you turned your dream into a reality, then you can sit back and relax and enjoy the wealth you built up.

- Read now: Learn 25 money mistakes you need to avoid

- Read now: Find out how to save $100,000 fast

- Read now: Discover 149 powerful personal finance quotes

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

From your writing, I can tell that most of these boil down to discipline. If you can’t reign in your expenses, and prioritize your allocation of resources (both time and money), then you can’t truly build wealth. The most helpful for me was to marry smart because without my wife, none of this would be possible.