THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

While it wasn’t always easy to admit that I screwed up (it would have been a lot easier to ignore it actually), it was what needed to be done. Below are some tips for you to take a proactive approach with your investing so that you can be a better investor moving forward.

Table of Contents

5 Tips For Being A Better Investor

You Are Not As Good As You Think

We as humans have a tendency to overrate our skills. We do this when it comes to driving and even when we invest. We tend to only focus on the times when we drive well, not when we have an accident. When investing, we only focus on that one stock that tripled in value and not on the 10 others that are barely treading water.

In fact, Allstate conducted a survey that showed 64% of drivers rate themselves as excellent or very good in terms of driving ability. They rated their friends and drivers from other states driving ability much lower. I fall into this category. I think I am a great driver. I am from Pennsylvania and we always talk about how bad drivers from New York and New Jersey. But then when I visit those states, all I hear is how bad Pennsylvania drivers are.

The same stats reflect our investing ability as well. When State Street recently asked investors to rate their investing knowledge, close to 66% rated themselves as advanced. But when they took a test to show how knowledgeable they were, the average score was 61%, which is basically failing the financial literacy test.

So what can you do about this? Admit you are not as good as you think. It’s tough but it has to be done if you want to be successful. When I first started investing, I was trading stocks all of the time. I was barely making any money. The light bulb went off and I asked myself why am I spending all of my time researching and trading when I can just buy some index funds and take what the market is giving me? It certainly isn’t sexy, but 8% is a heck of a lot better than what I was earning each year. And when you add the time cost into the equation, it made 8% look even better!

Keep A Journal

If you choose not to go the passive route like I did, then keep a journal. Write down every investment you make and why you are doing so. Then read back through it when you are about to make another trade and see if you can see any similarities.

Doing this helps us to remember those bad investments we made, even when we “selectively” decide to forget about them. Just doing this step could save you a bunch of headaches. The key though is to re-read through the journal.

Look At Both Sides Of The Coin

We tend to only see what we want to see when making decisions in life. We want that new car because it will be fun to drive. We ignore the fact that we can’t afford it and it will bury us further into debt. Investing is the same thing. We see the potential of a hot new product a company is coming out with, but we ignore that it might not be what people want.

To overcome this, talk with a friend or family member. Tell them why you want to invest in a company and then listen, and take into account, what they say when they play devil’s advocate. Let me say that again, you have to take into account what they are saying, otherwise you are just wasting both of your time.

Have A Plan

I’ve talked about the importance of having a plan if you want to be a successful investor before. It is of utmost importance. Before you buy your first stock, mutual fund or ETF, you have to have an idea of what you are doing and why. This will help you to buy at the right time for your situation and to sell when you should sell, not when your emotions get in the way.

For me, I only trade stocks in a play account. When I want to buy a stock, I write down why I want to buy it. I also have a rule that if it drops 10% in value, I sell it. But there is a caveat to that. I look at why it has dropped 10%. If the overall market is going through a correction, then I don’t sell as nothing fundamentally with the company has changed. But if the company comes out with news saying they are delaying their hot new product due to safety concerns then I will cut my losses.

Know How Comfortable You Are With Risk

With risk comes reward. The more risk, the greater the potential reward. But you have to know just how much risk you are comfortable with. I mentioned in a previous post about risk tolerance surveys and how they are flawed. If you find yourself getting worked up when the market declines, you might be in a portfolio that is too risky for your tastes.

To fix this, you might have to dial back the risk and invest less in stocks and more in bonds. But at the same time, you have to put things into perspective. The market will decline at times and you will lose money. There is no 100% safe investment for you to invest in. You need to educate yourself on the market so that you can accept some of the risk that comes along with investing in it.

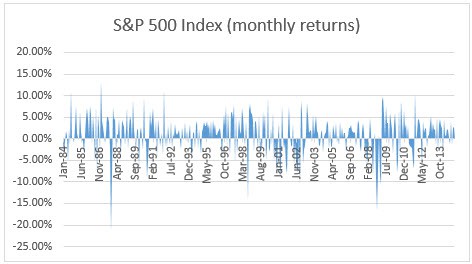

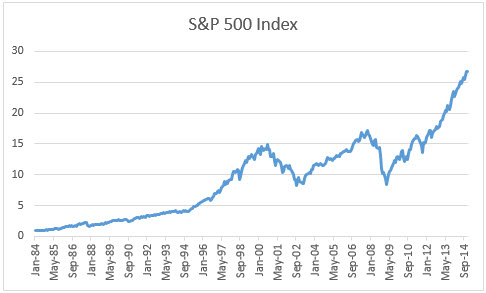

From there, you need to take a long-term view of the market. Here is a chart of the stock market:

Pretty scary looking, right? Here is another picture:

That one looks a lot better. The thing is though that they are charts of the exact same time frame, it’s just that the first chart is looking at the monthly change of the stock market and the second chart is yearly. Over the short-term, things will be choppy. But over the long-term, things get less choppy.

It is just like with driving. When driving on a trip, there will be some parts of the drive where the road is in bad shape and it will be bumpy and maybe even uncomfortable. But the entire drive won’t be like this, just a portion. Investing is the same. Your entire investing career – which will be decades long won’t be bumpy and uncomfortable all of the time, just portions of it.

[Photo Credit: A-Spec]

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Your comments about people’s perception of other drivers are spot on. It’s ubiquitous the world over I think :-).

My hubby sometimes drives me crazy because he tends to worry when the stock market drops. We are relatively young and can afford to take risks in terms of our time horizon- and he knows this and would probably categorize himself as having a fairly aggressive investing style for this reason- but he still gets all anxious sometimes when the market drops. He’s just not very good at focusing on the big picture.

I love how you pointed out the we sometimes selectively forget our bad decisions and investments. That is dangerous even though it can make us feel better about ourselves. There have been times that I’ve read notes that I’ve made and I don’t even remember having those thoughts (but it’s in my handwriting, ha). Keeping a journal and READING it again and again is a great way to course correct. Nice work.