THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you living paycheck to paycheck and want to break the cycle?

Are you making a good income but just can’t seem to save any money?

You’ve come to the right place if you want to learn the best creative ways to save money.

In this post, I will show you how anyone can start saving money quickly regardless of their financial situation.

Even if you have a hard time saving, I will show you 117 simple ways to make it happen.

Table of Contents

117 Creative Ways To Save Money

Now we get to the good part, where I share the most creative ways to save money right now.

I’m sharing with you 117 simple money-saving tips.

You can use these savings tips for both short-term goals and long-term goals.

- Read now: Learn the benefits of saving money

And you can cherry-pick and stack the ones that will work for you best.

In other words, you don’t have to pick one from the list.

You can pick 5, 15, or more money-saving tips and skyrocket your savings.

I’ve broken these simple tips down into groups so you can easily find the tips you are looking for.

In this list, you will learn:

- How to save money fast

- Ways to save money on groceries

- How to save money on a wedding

- Ways to save money in college

- How to save money on food

- Ways to save money on a car

- Ways to save money on a house

- How to save money on gas

You can use these tips to save each month, no matter your income.

I promise if you follow these tips, you will be amazed at how much extra money you save.

So let’s get started!

General

#1. Save First

Make it a point to put a portion of your income into a savings account when you get paid.

It doesn’t have to be a lot. Just get in the habit of saving something every time you get paid.

Even if you live on a tight budget, you can still save $5 or $10 a month.

When you save first, you are free to spend whatever is left over.

Doing this means you don’t make the mistakes others make, trying to save what is left at the end of the month.

#2. Automate Your Savings

As important as it is to save first, it’s not always ideal to remember to make a savings transfer when you get paid.

The solution is to set up automatic transfers.

When you automate, you ensure you save all the time and never forget.

Just set up a plan to move $10 into savings every month.

If you can afford to save more, then do it.

As an added bonus, set up a yearly reminder on your phone to increase the amount you save by $5 or more so you are always saving as much as you can.

#3. Create A Monthly Budget

A budget, or a spending plan, is huge if you want to save money each month.

By following a monthly budget, you see your spending habits, and in some cases, this may shock you.

- Read now: Click here to learn how to get started budgeting

- Read now: Click here for 15 free budget templates

- Read now: Click here to learn why Tiller Money is the best budget

But the benefit of knowing where you are spending is critical if you want to save.

You will realize where you are spending money and make it a point to reduce it.

In fact, some of your monthly bills will surprise you now that you pay attention to them!

#4. Make Savings Goals

Saving money is easier when you have a goal to aim for.

But before you make your goal a huge number, step back and create milestones along the way.

This process ensures that you stay motivated to achieve financial success.

For example, if your goal is to have $5,000, create milestones and try to hit $500 first.

- Read now: Click here to learn how to save $100,000

Saving this smaller amount is more manageable and will keep you engaged.

#5. Create Long Term Goals

A great trick to saving money each month is creating long-term financial goals.

What is it you want to achieve financially?

Do you want to retire by age 50? Maybe take a year off work to travel the world?

Whatever your dreams are, stop letting them be pie in the sky ideas, write them down and turn them into goals.

- Read now: Learn how to build stealth wealth

You will be less likely to spend on things you don’t need when you do this.

Instead, you will ask yourself the question as to whether or not buying the item is getting you closer to your goal or farther away.

#6. Understand Needs Versus Wants

Do you know the difference between a need and a want?

Over the past few years, this line has blurred, and many wants are confused with needs.

This confusion results in us having much higher living expenses and much less in savings.

Take some time to sit down and look over your budget.

Look at everything you spend money on and determine what a need and a want are.

Then try to eliminate the wants from your budget slowly.

But don’t get rid of every want.

You still need some wants to enjoy life.

But if you find you are overspending on wants, it is time to find ways to cut them down.

#7. Review Your Habits

What are your habits?

You probably never thought about this, but take some time and be mindful of your habits and how they cost you.

For example, maybe you stay up late to watch a television show, causing you to get less sleep and make poor financial decisions.

The solution could be to record the show and watch it another time.

Or maybe you go to happy hour for drinks after work.

Maybe you can cut this out a few times and stash the cash instead.

- Read now: Learn good money habits you should have

By reviewing your habits, you can find areas where you spend and opportunities to save that you otherwise never realized.

#8. Understand Your Values

Earlier I talked about looking over your budget and finding needs versus wants.

You should also take some time and figure out what your values are.

What things in life add value to your life and make you happy?

You will find that many of the things you spend money on add zero value to your life.

- Read now: Learn how to live a life of wealth

- Read now: Here are the things money can’t buy

In other words, they may give you a temporary high in feeling good, but long term, they do not add any value.

Once you figure out what you value, you can spend on things that matter to you and stop spending on things that don’t matter.

#9. Follow A 365 Day Challenge

This savings challenge has you put aside a set amount every day of the year.

Most people taking part in this challenge have a goal of $1 per day. At the end of the year, you grew your savings by $365.

The great thing is that you can choose any amount.

If your budget is tight and $1 per day is doable, save that amount.

But if you can put away more, then do that.

Just remember to automate this, so you never forget to save!

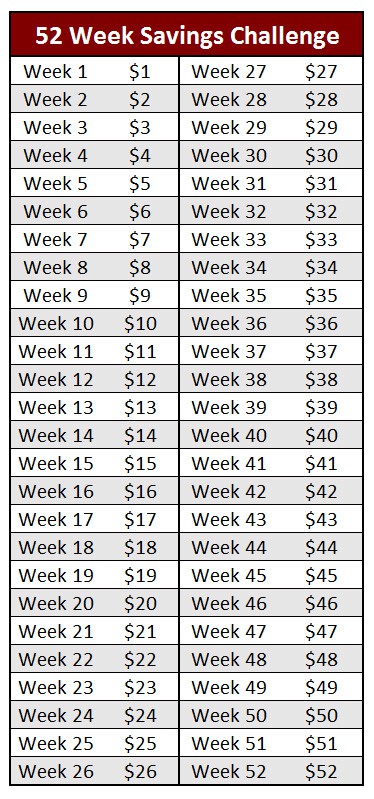

#10. Follow A 52 Week Challenge

This challenge is the same concept as the 365 challenge above but with a twist.

Instead of saving $1 per day, you save $1 during the first week, then $2 the second week, and $3 the third week.

Eventually, you get to save $52 for the last week of the year, getting you to $1,300 for the year.

This challenge starts easy but gets challenging as the year progresses, so you have to pick the right amount to begin.

#11. Save Windfalls

What do you do with the cash you weren’t expecting?

Most people do nothing with it other than deposit it into their checking account.

Then they end up spending it.

Make it a point to save instead.

Put it into an account and forget about it.

You won’t miss it, and having it stashed away will earn you more interest, growing your wealth.

#12. Save Tax Refunds

Getting a tax refund is incredible because you weren’t expecting it.

And if you are smart with how you use your tax refund, it can launch your finances into better shape quickly and easily.

Unfortunately, most people waste their tax refund by spending it on things instead of saving money.

I’m not here to tell you to save your entire tax refund but set up a plan instead of just spending the whole thing.

For me, I divide my refund into groups.

The first 10% I spend however I want. The other 90% I put away.

Doing this allows me to enjoy buying something and, at the same time, save a lot and improve my finances.

I put 10% towards anything I wanted when I was in debt. I took 70% of what remained and put that towards my debt.

Whatever amount was left, I saved.

It is up to you to determine how much you save or put towards debt, but the key is to make it a substantial amount.

The average tax refund is over $3,000.

If you save 70% of this, which is $2,100 each year for five years, you have more than $10,000 saved!

And this isn’t taking into account the interest or growth of your investments.

Saving your tax refund is a simple thing to do and significantly impacts your finances down the road.

- Read now: Learn the difference between a tax credit and deduction

- Read now: Use the tax strategies the wealthy use to save on your taxes

#13. Save Loose Change

What do you do with the spare change you get if you still pay with cash?

Keep it in your car’s cup holder? Toss it in a jar?

When I spend this way, I put my loose change in a jar.

- Read now: Here are the best places to turn coins into cash

- Read now: Find out where to find spare change

Then at the end of the year, I take the loose change and save it. It usually works out to be a few hundred dollars.

In the past, I would take it to my bank, which had a free coin counting machine.

But they got rid of it, and now banks or stores want a fee for counting my loose change everywhere I go.

Instead of paying a fee, I bought some coin sleeves, rolled up the change myself, took it to my bank, and deposited it into my account.

#14. Save Your Raises

This idea is the same concept as saving windfalls and your tax refund.

If you get a raise at work, save some portion of it.

Seeing as you were surviving on your old salary, you should be able to put away a portion of your new, higher wage.

The easiest way to do this is to increase your 401k contribution.

When I would get a raise, I would email my human resources department for the form and increase my contribution by 1%.

It’s a simple thing to do that took me less than 5 minutes.

But it helped me to quickly grow my 401k balance into one much higher than average.

- Read now: See how much $20 an hour is annually

- Read now: Find out how much you make per year on $15 an hour

#15. Find A Mentor

Successful people find others who have achieved what they want out of life and use them as a mentor.

Your task is to figure out what you want out of life and then find some people who have reached that goal.

Then seek them out and see if they will mentor you. Don’t be shy about it.

Most successful people are willing to mentor others who show drive and determination to reach their goals.

#16. Find Like-Minded People

Find others who are financially wise to keep your motivation high.

By being part of a community, you can lean on others when you don’t feel like saving.

If you hang around with people who have bad financial habits, you will waste a lot of money.

But if you spend time with people who are good with their finances, you will learn from them and start making smarter financial decisions.

#17. Get Some Sleep

Sleep is huge in accumulating wealth.

The more tired you are, the more likely you will give in to your urges.

Your overtiredness could mean eating out for lunch or not thinking through a purchase.

Plus, getting sleep is excellent for your long-term health.

Aim for 7-8 hours each night. If this is hard at first, here are some great tips to help you get more sleep.

#18. Exercise

In addition to eating well, you also need to exercise.

And you don’t have to have a gym membership to get a good workout. You can walk and do bodyweight exercises.

By exercising, you will make yourself healthier over the long term, saving you a ton on health-related expenses down the road.

And you will tend not to put on weight, which is another way bad health ends up costing you.

#19. Read More

Reading books expands your mind and helps you grow as a person.

As you learn and grow, you will start making smarter decisions in life and with your money.

Pick some topics that you find interesting and find some books you would like to read based on those topics.

Eventually, you will watch less TV as you read more and more, making it easier to cancel cable and save the most long term.

You’ll lower your energy costs by having the TV turned off as well.

If you are interested in personal finance or success, check out my recommended resources section for my favorite books.

#20. Stay In

Here is a creative way to save money that most people overlook.

Do you tend to go out a lot with friends on the weekends?

Dinner and drinks can add up.

Of course, I am not suggesting you become a hermit and never leave your house, but pick a couple of times to stay in instead.

Here is how my friends and I make this work.

We rotate between each of our houses.

The host makes dinner, usually something simple and cheap, then we play board games or watch movies.

It is always a great night, and we never miss out by not going out.

We began to enjoy staying in more than going out!

- Read now: Here is how to have a money free weekend

- Read now: Learn cheap fun things to do when bored

#21. Cancel Emails

You probably get a mountain of emails from various companies, all trying to sell you something.

Many times, these emails work too.

You will be enjoying your day and then get an email that says 40% off.

You click through, and suddenly you have a cart full of impulse purchases.

The solution to stop spending money? Unsubscribe from the mailing lists.

You can keep the emails from the companies you shop with regularly to take advantage of sales when you need something, but unsubscribe for all the others.

- Read now: Find out how to stop buying things

You can often find a coupon code online that will be just as good as the sales in the emails so that you won’t miss out.

#22. Save On Monthly Subscriptions and Memberships

How many memberships and subscriptions do you have that you rarely use?

If you are like many, the answer is a lot.

To stop wasting money, you need to cancel them.

But how do you do this? Use a free service called Rocket Money.

They will scan your expenses and highlight those they think you can cancel.

They look for magazine subscriptions, gym membership, streaming services, etc.

They will also highlight other expenses on which they believe you can get a discount.

They even will negotiate your cable bill for you too, with the average savings of $300 a year!

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

#23. Stay Off Social Media

It used to be that social media was a great way to stay in touch with old friends and relatives.

Now it is a marketing machine.

Advertisers are clever in advertising on these platforms and entice you to spend.

Just as bad, most people only post the positives in their lives, giving us a false sense of reality.

As a result, we want the same great things they appear to have and go into debt to get them.

Be smart with social media.

Understand how it works and how it robs you of your wealth without realizing it.

The less time you can spend on social media, the more money you will keep in your pocket.

#24. Use A Flexible Spending Account

If your employer offers you a flexible spending account, you need to take advantage of it.

When you do, you pay less money on taxes.

Here is how it works.

You determine an amount you want to put into your account for the year, and your employer will deduct a portion of that amount from each paycheck.

Then when you have a medical bill, you use this account to pay it.

The only catch is that you have to use the funds in the account by the end of the year, or you will lose it.

To avoid this, make sure you are conservative in your estimate of how much you spend on medical care in a year.

#25. Use A Health Savings Account (HSA)

This option is even better than the flexible spending account.

You can save money in an HSA if you have a high deductible health plan at work.

This plan works much the same as a flexible spending account, but you don’t have to use the funds in the account by the end of the year.

You can keep the money for as long as you want.

You can even invest it in the stock market.

I invest my money, making my HSA account a Roth IRA.

#26. Know Your Perks At Work

Do you know all of the benefits you get at work?

You probably know about health insurance and paid time off, but your company offers other discounts.

I was clueless about these additional discounts until I read through our human resources department’s email.

I was shocked at the various benefits.

I could get discounts on theme parks, movie tickets, car washes, dry cleaning, flowers, auto insurance, and cell phone plans.

The next thing you should do is email your human resources department and ask if there are any discounts you can get through work as an employee.

#27. Use Online Banks

Online banks provide higher interest rates on savings than your typical brick-and-mortar bank.

And the difference adds up.

So if you aren’t using an online bank, you need to find one immediately.

My favorite is CIT Bank because they have one of the country’s highest-yielding online savings accounts.

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

If you want to consider other online bank options, here are the best ones to look into.

#28. Open Bank Accounts

Another way to accumulate cash is to open up bank accounts.

Many times, banks offer bonuses on new accounts.

And all you have to do to earn the account bonuses is to open the account with a certain amount.

Many times, you might need to complete a direct deposit too.

You can earn a couple hundred dollars in some cases, but you will have to deposit a larger amount.

You can see a complete list of current offers here.

#29. Open Credit Cards

Like opening up bank accounts for bonuses, you can also get bonuses for opening credit cards.

In most cases, you have to spend a certain amount each month for a few months to score the bonus.

You can click on the link below to find the best credit card offers available.

#30. Have An Accountability Partner

If you can’t find a community of like-minded people, reach out to a close friend or family member.

Tell them your savings goal and keep them updated on your progress.

They will instinctively ask about your progress from time to time, helping you stay on track.

Or better yet, see if they want to join you and try to build their savings too.

This way, you can support and encourage each other.

#31. Find Free Entertainment

Looking for something to do?

Instead of doing the same routine and paying for things, see if you can find free events in your area instead.

On almost any weekend, you should be able to find free things to do in your community or close by.

For example, in the summer you should be able to find free movies or music in your local park.

Community days and car shows are also great things to do for free.

To find free things to do in your area, look through your local newspaper or follow your community online.

#32. Take Advantage Of Your Local Library

Your local library is a fantastic place.

Instead of spending money on a book, you can borrow it from the library.

The same holds for movies too.

You can borrow them from your library and lower your entertainment costs.

The best part is that more libraries are now partnering with Amazon.

This partnership means you have an extensive collection of digital books that you can download and borrow on your device for free.

While you won’t have access to it forever, it is another way using your library saves you money.

#33. Use Community Sites

Instead of buying everything you need, you might be able to get it for free.

Many sites like Craigslist and Freecycle have people post things they no longer need and offer them free.

You could even use Facebook Marketplace to get deep discounts, saving you hundreds of dollars.

You will have to check out the item’s condition and make sure it meets your needs, but this is a simple way to save money.

#34. Take Advantage Of The Sharing Economy

Related to the point above is to take advantage of the sharing economy.

Many community sites have members sharing tools.

So instead of spending $50 on a tool, you can borrow it for free.

This option is great, especially if you only use the tool once.

But it doesn’t stop there.

You can go in with your neighbors too.

We shopped at warehouse clubs at our last house, bought fruit in bulk, and split the cost and the fruit with our neighbors.

We even shared trash collection too.

There are many ways you can save extra cash by splitting costs with your neighbors.

You have to think outside the box.

Finally, you can take advantage of free services and discounts too.

For example, you could go to the local coffee shop and use their free wifi.

Or you could visit a dental school and have your teeth examined and cleaned for a fraction of the cost of a dentist.

#35. Understand How Much Your Time Is Worth

Do you equate your time with money? Most of us don’t.

But once you do, you will be able to save a lot more.

How does this work?

Look at how long things take you to complete and how much it costs to hire someone to do the job for you.

Then look at what you could do instead.

For example, it takes me 2 hours to mow my lawn.

If I hired a landscaper, it would cost me $75.

Is my time worth that $75? What would I do instead?

I could use that time to spend with my family. Or I could use it to enjoy one of my many hobbies.

Only you can answer the question if it is worth it or not to pay someone instead of doing it yourself.

- Read now: Learn how to value time vs. money

But don’t just assume that it is less expensive to do everything yourself.

In many cases, you get more value and satisfaction from life by doing what you enjoy and paying someone else to do the other stuff.

Investing

#36. Invest In Your 401k

Your 401k is the easiest way to start saving money for retirement.

But it also helps you by reducing your tax burden, meaning you can keep more of the income you work so hard to earn.

If you aren’t investing in your 401k plan at work, you need to start as soon as possible.

#37. Auto Invest

As powerful as automating your savings is, so too is automating your investing.

When you invest regularly, you take advantage of the ups and downs of the market and don’t risk your emotions clouding your judgment.

The most important thing to growing your wealth through investing is how much you save.

So if you don’t have an investment account, open one up today and start putting something away every month.

Don’t know where to start?

Here are my two favorites:

Betterment

You can start with as little as $10, and they will build a portfolio and handle everything for you.

All you have to do is create an automatic transfer.

Betterment is one of the original robo-advisors out there. And they are still thriving thanks to their belief in always innovating. When you invest with Betterment, you know you are making a smart choice.

Acorns

Acorns will build you a portfolio and take care of everything for you, just like Betterment.

But instead of setting up an automatic transfer, they round up your purchases and invest that amount for you.

You can also choose to set up a recurring transfer, but this isn’t required.

Acorns changed the game when they allowed you to start investing your spare change. With a simple to use app and effortless ways to invest, Acorns is a solid choice for many investors just starting out without a lot of money to invest.

#38. Invest In Low-Cost Investments

You can save a lot as a result of investing in low-cost investments.

When you invest in mutual funds or exchange-traded funds, you pay a management fee to the company for running the fund.

The lower this expense, the better.

Try to keep it under 0.50% for all of your investments.

This strategy will typically mean you move over to a passive investing approach, which is good.

The lower the fee, the more your cash stays invested and can compound and grow.

If you don’t know how much you are paying in fees, use Personal Capital.

It’s a free service that will show you how much you are paying in fees and help you get a detailed picture of your finances.

Using this app, my wife and I have skyrocketed our net worth.

Want to know where your investments stand? Interested in a free financial plan to see if you are on track for retirement? Personal Capital has you covered. It's the best free tool for the average person to analyze their investments.

#39. Invest Tax Efficiently

Sticking with the investment theme, make sure you are investing in the types of investments in suitable kinds of accounts.

Doing this ensures you pay the least amount of taxes.

And this not only saves you money but the more you keep invested can grow and compound quicker.

Read now: Here is how to invest in a tax-efficient manner

Debt

#40. Pay Extra On Debt

When you are in debt, you pay back the amount you borrowed plus the interest on that debt.

So if your interest rate on your debt is 17%, you are paying $0.17 on every dollar of debt you have.

While that might not sound that bad when you look at the total debt you are in, that $0.17 adds up quickly.

For example, if you have $1,000 worth of debt, that $0.17 in interest comes to $170.

And if you are in debt $10,000, you are paying $1,700 in interest.

Therefore, the more you can pay towards your debt, the more you save.

When you pay extra on debt, you get a 17% return.

And you can’t get this kind of return anywhere else.

So make it a point to pay as much as you can towards your debt every month.

#41. Pay Off Debt

Related to the point above, you need to get out of debt and then stay out of debt for good.

You can take the cash and put it into a dedicated account to quickly grow your wealth when you are out of debt.

So what is the best way to get out of debt?

First, you need to make sure you know what got you into debt in the first place.

From there, you need a plan.

The best plan for most people is the debt snowball method.

Once you know how to attack your debt, you can start the repayment process.

Just remember that you won’t become debt free overnight.

It will take time, but it is worth it.

#42. Pay Your Bills On Time

Yes, you can lower your bills by paying on time.

How is this possible?

In some cases, utility companies offer a discount when you pay before your due date.

This idea is also accurate many times for property taxes.

But there is an even bigger reason for making sure you pay your bills on time.

It’s your credit score.

The more you pay on time, the higher your credit score.

Having a high credit score is essential when you take out a loan on a house, as you will get a lower interest rate, thus saving you money.

Insurance companies also look at your credit score when determining your annual premium.

With a higher credit score, your premium will be lower.

If you don’t know what yours is, find out your credit score for free with Credit Sesame.

Credit Sesame offers your credit score for free, with no credit card required. Simply provide your email and get started learning your score.

#43. Negotiate Credit Card Interest

If you have credit card debt, an easy savings tip is to call your credit card issuer up and ask for a lower interest rate.

By doing this, you will lower your interest costs as you work to pay off your debt.

There is only one catch here.

When you ask, make sure the lower interest rate is applied to your current balance and not only to new balances.

#44. Refinance Your Debt

An easy way to free up cash in a tight budget, or any budget, is to refinance your debt.

Refinancing includes high-interest credit card debt, student loans, auto loans, medical bills, etc.

You lower the interest rate you pay when you refinance, saving you money.

You save because you will pay less in interest charges over the life of the loan.

A great option here is to use a personal loan.

They usually have a lower interest rate, so you will be sure to save money.

#45. Use Cash Back Credit Cards

If you use credit cards, you need to take advantage of cash-back and rewards credit cards.

As long as you pay your balance in full each month, you can easily earn money.

I use three credit cards that all offer cash-back, and over a year, I easily average $1,000 in income.

I take this money and put it into an investment account and let it grow for the long term.

If you travel a lot, you can get a card that offers reward points.

Use these points to pay for some of your travel expenses and save.

Here are some of the best credit cards to earn cash back and rewards.

#46. Use Credit Cards Strategically

I just told you I use three credit cards.

But not all the time. I use each card strategically.

I use my Discover card when it offers 5% cash back on certain purchases.

These purchases include gas stations, warehouse clubs, and Amazon.

- Read now: Learn more about the Discover It card

I use my American Express card for groceries and gas when I don’t get the bonus cash back from my Discover card.

Finally, I use my Citibank card on everything else.

By strategically using my credit cards, I earn more cash-back than I would if I stuck to one card.

House

#47. Refinance Your Mortgage

For most people, your mortgage is your largest monthly expense.

How can you reduce your payment each month?

The easiest option is to refinance your mortgage.

When you refinance to a lower interest rate, you end up paying less over the life of the loan.

And if you can swing it, try to shorten the term of your mortgage.

Doing so will save you even more overall. However, this could cause your monthly payment to increase.

#48. Fake Refinance

Maybe you don’t qualify for a refinance. Or you can’t get a lower interest rate.

No worries. Just do a fake refinance.

What is this?

Pretend you did a refinance and start paying the monthly payment you would have if you refinanced.

When your mortgage bill comes in the mail, start paying this amount.

Just make sure the extra amount you are sending in goes towards the principal.

While you won’t be saving money due to a lower interest rate, you will be saving because you are paying extra each month.

#49. Challenge Your Property Tax Assessment

Did you know you can challenge how much you pay in property taxes?

I didn’t realize this until we bought our current house.

Our realtor pointed out that our taxes were much higher than other houses in our neighborhood.

After doing some research, I found out how easy this is and that many attorneys offer this service.

The way they challenge an assessment is incredible.

Here is how it works.

You provide the attorney with the paperwork they need, and they take care of the rest.

If they do not get you a reduction, you pay nothing.

If the attorney does get you a reduction, their fee is a percentage of the savings capped at a certain amount.

For us, our attorney fee was 25% of the first year’s savings, capped at $500.

In their initial letter to us, they said what they thought they could get the assessment and our property tax down to.

In the end, they reduced our property taxes by $1,200.

We paid them the $300 and are saving the rest.

#50. Cancel Cable TV

How much television do you watch?

Chances are you are paying for a lot of channels you never watch.

You could try to negotiate for a lower cable package price, but that usually ends in headaches.

- Read now: Click here to learn how to negotiate with Xfinity

- Read now: Find out how to save money on your FiOS bill

- Read now: Here are the best alternatives to cable TV

Another option is to have someone negotiate your cable TV bill on your behalf.

Consider using Rocket Money for this.

They will actively work to get you a better price on your cable bill.

Even if they can’t, they will try the following month again.

They are very successful at getting a reduced price too.

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

The solution to lowering your cable bill the most is to cancel the cable altogether.

But canceling doesn’t mean you can no longer watch television.

There are a lot of lower-priced streaming services out there that allow you to put your channel package together.

Here are a few popular ones:

- SlingTV: offers various packages depending on your likes and starts at just $20 a month.

- PureFlix: this is a package that offers family-friendly shows and movies.

#51. Declutter

Take a weekend and clean out your house.

Go through room by room and get rid of things you no longer use or want.

If the items are in good condition, you can try to sell them for extra money, or you could donate them.

If they are in poor condition, you can just throw them out.

How does this help you save?

It helps you see how much you wasted on things you rarely use. It is a real eye-opener for many people.

#52. DIY When You Can

If something breaks, is your solution to call someone for help or just replace the item entirely?

If so, you can save a good amount by learning to fix and repair things yourself.

And thanks to the internet, it is easy to learn how to fix things.

Your first step is to do some research to see if the issue is a problem you can tackle and if it is even worth it.

If so, you can jump on YouTube and watch countless videos on how to make the repairs.

I’ve replaced toilets, replaced attic access stairs, a screen door, and more just by watching some videos.

And fixing things myself gives me a huge boost of self-confidence too.

So before you shell out your hard-earned money to have someone else fix something, see if you can do it yourself.

In addition to this, you can also make your own cleaning supplies, laundry detergent, and more.

We stopped spending money on all-purpose cleaners, made our own, and pocketed the savings.

We even make our greeting cards.

Have you noticed how they now cost over $5?

Keep more money in your pocket and make your own instead.

#53. Be Smart With Laundry

Please don’t make a mistake thinking that your clothing needs washing once you wear an item.

You can easily wear some outfits a couple of times before washing them.

Doing this saves you money on water and electricity and on the life of the article of clothing.

- Read now: Here are the best tips to save money on laundry

- Read now: Learn how to save money at the laundromat

For example, when I had to wear business casual, I would wear an undershirt under my dress shirt.

As a result, my dress shirts rarely got dirty. So, I only washed them after the second or third wear.

#54. Wash In Cold Water, Avoid The Dryer

Sticking with the laundry theme, there are other tricks you can use to reduce your costs.

The first is to wash your clothes in cold water.

Using hot water costs money to heat it.

Next, try to avoid using the dryer as much as possible.

It costs you to run it, and it also shortens the life of your clothes.

Instead, try to line dry your clothing or buy a drying rack.

If you must use the dryer, put a dry towel with the wet clothes to speed up the drying time.

#55. Downsize

This one is a bit on the extreme side, but one option is to downsize.

Maybe you have a house that is bigger than what you need.

If so, sell it and move into a smaller home.

Not only will you lower your monthly mortgage payment, but all of your utilities will be less, and your property taxes will be less.

In all, you will save a ton of money.

If you just can’t accept moving out of your house, another option is to rent out a room.

The rent you earn can offset the bills of keeping the house.

Electric

#56. Get An Energy Audit

An energy audit is the best money we have spent since we moved into our house.

Our electric company offers energy audits where a licensed professional comes to your house and points out areas where you are wasting money.

- Read now: See the biggest ways you waste money

For us, there were a few areas we could add insulation to keep the temperature in the house more stable.

I made the updates myself, and our electricity bill is now lower.

Another benefit is they gave us a bunch of LED light bulbs for free and coupons for discounts on other energy-saving appliances and devices.

They even gave us a smart power strip!

#57. Buy A Programmable Thermostat

Another simple money-saving tip to lower your electricity bill is to buy a programmable thermostat.

Pay attention to when you are home and away and then set it based on these times.

My favorite is this one from Honeywell. It is the same one I use.

If you want to lower your cost on electricity but don’t want to program a thermostat manually, the best solution is a smart thermostat.

These detect when you are home and adjust your thermostat accordingly.

You can even control it manually with an app on your phone too, so that your house is warm when you get home.

#58. Replace Lights With LEDs

The cost of buying an LED light bulb is more than an incandescent, but it is much more energy-efficient.

This energy efficiency means it reduces your utility bill each month.

And they last a lot longer too.

When we moved into our house, I replaced the main bulbs we used.

These rooms included the kitchen, the master bedroom, and the master bathroom.

The month after I did this, we saw a meaningful decrease in our electric bill.

I recommend LED lights and not CFLs because even though they say CFL lights last a long time, I’ve had many burn out after a few uses.

Add in the higher purchase price, and I lost money there.

So skip CFL bulbs and stick with LEDs.

#59. Buy A Smart Power Strip

When I bought my first house, the money was tight.

So I was doing everything I could think of to lower my bills.

One solution I stumbled upon was to turn off my power strip when I left for work.

Even though the television, cable box, and receiver were powered off, they drew phantom power.

Thanks to technology, you don’t have to do what I had to do manually.

They now have smart power strips.

You simply plug everything into the power strip and one device into a special port.

When that device is powered off, the power strip cuts off power to all the other devices.

It even has a port for a device you always want powered on.

For example, you want your DVR to stay on if you are recording an upcoming show.

My favorite smart power strip is this one.

#60. Raise Your Air Conditioner Temperature

In addition to controlling when your HVAC unit runs, you can also control the temperature to save money.

In the summer, raise the temperature of the air conditioner.

I keep ours at 74.

It feels great coming inside from the hot air, and as a result of keeping it warmer inside, our unit isn’t always running, which lowers our monthly bill.

#61. Use Ceiling Fans

When you raise your air conditioner temperature, turn on your ceiling fans.

They will move the air, making it feel cooler than it is, allowing you to raise your air conditioner temperature even more.

And if you have a ceiling fan over your bed, keep it on a low setting.

The cool air moving across your body at night will keep you cool.

#62. Lower Your Heat

Turning down the thermostat in the winter will help lower your heating bills.

I keep ours at 68. To some, this sounds cold, but only a few times during the day am I cold.

And when this does happen, I just grab a blanket or put on a sweatshirt.

It’s a small price to pay for big-time savings on my electric bill.

#63. Boil Water In Microwave

When you boil water on the stovetop, do you know how much electricity or gas you waste?

You can save a lot of time and money by boiling water in the microwave instead.

Just know how powerful a microwave you have so you don’t waste electricity and water by boiling it for too long.

Shopping

#64. Complete A No Spend Challenge

A no-spend challenge is where you challenge yourself to not spend in a given budget category for a set amount of time.

This challenge could be a week or a month, or even six months.

Run through your budget and see which category you want to try first.

You should pick categories that you can go through without spending money to be successful.

In other words, eating out would be an excellent place to start.

You could even break it down into smaller areas too.

Maybe you don’t eat out often, but you regularly purchase coffee.

Try going a month without buying and instead brew your own coffee.

On the other hand, your rent is not since you have to pay your rent to have a place to live.

The key to doing one of these challenges is to save the money you are not spending.

You have to transfer it over to your savings and not leave it in your checking account to spend at a later date.

#65. Try The Pause Test

Here is a great way to limit impulse purchases that we all make.

The pause test has you wait before you buy anything.

You can pause for 5 minutes or 30 days. You just have to find the length of time that works for you.

Here is how this works.

Advertisers get us to buy on emotion.

A few days later, when we think about the purchase we made, we frequently regret it because the thinking part of our brains needs more time to catch up.

By pausing, you give yourself a chance to think through purchases and decrease the chances of buyer’s remorse.

While this trick works on major purchases, it works best for small, everyday spending.

Many of us buy on emotion, and this overspending makes getting ahead financially hard.

This test is powerful, and I encourage you to try it.

#66. Use The ‘Would You Rather’ Test

This game is a variation on the pause test.

Instead of pausing, you ask yourself if you would rather have the item you are thinking about buying or the cash.

If you decide on the cash, then don’t buy the item.

As with the no spend challenge, transfer the extra money to your savings account if you skip buying something.

#67. Use The ‘Right Now’ Test

Another option to curb impulse shopping is the right now test.

Here you ask yourself, if you could, would you use the item right this moment.

This test works best for clothing.

When you are thinking of buying something, ask yourself if you would wear it right now as you walk out of the store.

If you answer no, then you should put the item back.

While this test doesn’t work 100% of the time, it has often saved me from buying clothes.

As I look at myself in the dressing room mirror, I know I wouldn’t wear the item out of the store, so I put it back.

#68. Remember The Affordability Rule

Thanks to our urges, the affordability rule is simple to understand but is tough to follow.

It states that if you can afford to buy something, you can afford to save instead.

So if you are looking at buying a new home theater system and can afford it, you can afford not to buy it and move the cash into your savings account instead.

This method works by making you think differently.

Too often, we don’t think we have enough money to save.

But we do. We just find reasons to spend it.

#69. Try Clothing On

Here is one of the best ways to help you easily save money on clothes.

Before I buy clothes, I try everything on first, which saves money fast.

I see how the shirt or pants look on me, and if they don’t look right, I don’t buy the item.

By doing this, I avoid taking the clothing home, trying it on there, and then running back to the store to return it.

And many times, I end up trying it on again and again, hoping for a different result.

It is too late by the time I admit I don’t want it.

#70. Use Cash

Cash is powerful.

We have a psychological connection with cash, and when we see it leave our hands, we are less likely to spend it.

On the other hand, there is credit, in which swiping a piece of plastic has zero emotional connection and is why we easily overspend with credit cards.

The solution then is to use cash whenever possible.

The more you use cash, the less stuff you will buy.

I now typically carry cash with me more often because of this.

#71. Round-Up Your Purchases

A simple way to reduce costs is to use technology.

There are two great options out there that round up your purchases.

The first is called Qapital.

They will round up your purchases to the nearest dollar and transfer them into a savings account from your checking account.

It’s incredible to see how fast your savings add up when you do this.

Use Qapital to round up your purchases and to transfer money based on rules you set up. It's fund and easy to use. Get a $25 bonus once you make your first deposit.

Another option is called Worthy Bonds.

They work a little differently than Qapital.

You are investing in bonds that Worthy uses to make loans to small businesses.

You earn a flat 5% return on your investment.

You can have Worthy round up your purchases to buy bonds and earn 5%.

I’ve been using them for a few years now and love how easy it is and how much more I earn.

Looking to safely earn a higher return on your money? Worthy Bonds offers 5% 7% interest on your money. Invest in small businesses and earn a return for doing so. New users get a $10 bonus when purchase your first bond.

Some banks even offer this service as part of your checking account, so ask.

#72. Ask For A Discount

Before buying anything, make it a point to ask for a discount.

You could ask for a discount for paying in cash.

Or it could be asking if the cashier has any coupons or discounts they can apply.

You will be amazed at how often this works.

On average, I save about 5-10% every time I am successful.

Of course, I don’t always get a discount, but I do get some discount on the items I am buying more often than not.

Asking for a discount even applies to buying a car.

You have to negotiate the price of a car if you want to save money.

And if you don’t like to negotiate, use Edmunds Dealer Quotes and score a fantastic deal.

If you are nervous about asking for a discount, remember that the worst they can say is no.

#73. Don’t Go Cheap

Do not buy the cheapest version of everything to save money.

It ends up costing you more in the long run because the quality of the lower-cost items is not as high, meaning it needs replacing much sooner.

I’m a perfect example here.

When I bought my house, I bought the lowest-priced bath mats. After a couple of washes, they were falling apart.

I ended up buying higher-quality mats that lasted me much longer.

So make sure you buy quality items that are going to last.

They may cost more upfront, but they will save you even more down the road.

#74. Shop Using Lists

If you don’t shop with a list, you throw money away.

And I’m not talking just a grocery list.

Whenever you go shopping, you need to use a list.

Using a list keeps you focused on what you need, so you tend to get your shopping done faster.

It also helps you from wandering down aisles and falling victim to clever advertising.

You can either write a list manually, save a list in the notes section on your phone or download a free shopping app.

So before you do any shopping, make sure you write down a list and follow it to avoid wasted spending.

#75. Shop Sales

If you aren’t shopping sales, you are a fool.

You can easily get a good selection of food on sale every week.

And after you shop sales for a few weeks, you will start seeing a pattern of how the sales work and rotate, making it even easier to save significant amounts.

- Read now: Here is how to shop grocery sales cycles

The other week, I brought home a mountain of groceries for $30.

My wife couldn’t believe all that I had bought.

Most items were buy one, get one free. Some were buy one, get two free.

And this doesn’t end at the grocery store.

Shop after the holidays or the end of the season, and you can score great deals on everything.

#76. Shop By Unit Price

When shopping, especially at the grocery store, don’t shop by the price but by the unit price.

The unit price is the smaller number near the bottom of the price tag.

What is the unit price?

It is the actual price of the item, considering the size.

The unit price makes it easy to compare two items that might be of different sizes.

In general, the bigger the size, the lower the unit price.

But in some cases, the larger the size, the more expensive the unit price is, making it a bad deal.

Understand that if you buy a larger size, the price tag will be more, but it is cheaper to buy the larger version than the smaller one.

Of course, you also have to consider how quickly you will use something up.

For example, a gallon of milk will have a lower unit price than a quart.

But if you don’t drink milk that often, it might be smarter to pay the higher unit price and get the quart.

#77. Shop At The Dollar Store

You can save a ton of money by shopping at the dollar store.

The things I buy most there are greeting cards as they tend to be 2 for $1.00.

I also buy party favors, including streamers, paper plates, cups, napkins, and plastic utensils.

I also get some small toys and coloring books for our daughters at the dollar store.

It’s a great way to save on a lot of different things.

#78. Use Promo Codes

I love using promo codes to save when I shop online.

My favorite is with Papa John’s.

After our local sports teams won, we used the unique promo code and got 50% off a pizza.

I got so many pizzas for $6, it was crazy.

But it doesn’t end there.

I am always on the lookout for promo codes to help me save.

You can find promo codes on product packaging, on the bottom of receipts, and in many other places.

Just keep your eyes open, and you’ll be amazed at the various ways you can save.

#79. Pack Snacks

Like with drinking water when running errands, you should also pack your snacks.

Doing so will help you save by not buying fast food or other sugary snacks.

The best snacks to pack are nuts since they do well in both hot and cold temperatures, and they keep you feeling full for an extended period.

#80. Take Advantage Of Your Birthday

Many restaurants and stores now offer deals on your birthday.

While you shouldn’t be shopping just because you can get a deal, if you are going out to eat for your birthday, it only makes sense to go to a place that offers you a discount.

Most places will offer you discounts and free items on your birthday.

Just do a quick online search, and you will find many options.

In most cases, you can sign up for free online.

#81. Don’t Buy Cheap Clothes

I know trying to save money can be taken too far.

I am a perfect example of this.

I was buying tee shirts for $3 apiece. I thought I was so smart.

But within a few months, they started to fall apart.

So I bought more.

A few months later, the same thing happened.

I quickly learned that paying more for quality is a way to save money.

I stopped buying the cheap t-shirts and instead bought some for $12. They have lasted me for years.

In the short term, spending $12 instead of $3 sounds foolish.

But I spent $3 twice a year versus $12 once every five years.

In 5 years, by purchasing quality t-shirts, I saved myself $22.

#82. Think About Potential Gifts

The next time you need to buy a gift for someone, don’t run out and buy just anything.

Stop and think about who they are and what they value.

Then try to find items related to this.

When I do this, I find gifts that are not as expensive as other gifts I had in mind.

And since I put thought into the gift, it has a much more significant meaning to the recipient.

#83. Change Cell Phone Providers

How much are you paying for your cell phone service?

If you switch to a reseller, you can save a ton and get just as good of service.

I did this a few years ago. I used AT&T and then used Cricket.

I got unlimited calls and texts and 10GB of data each month for $35.

Compared to my old plan, I am saving $60 every month.

Another option is Gen Mobile, which offers fantastic coverage for a low monthly cost.

Here is a detailed Gen Mobile review to learn more.

Take a few minutes to compare phone carriers, and you could lower your monthly bill by 20% or more.

#84. Try Home Remedies

Why not try some home remedies before you run out to buy costly medicine to nurse yourself back to health?

They can be more cost-effective, and they’ve worked for centuries.

Here is a great list of many home remedies to try.

#85. Sign Up For Rewards Programs

You can sign up for rewards programs to get discounts on what you buy at most places where you shop.

A classic example of this is the grocery store.

Using your club card gives you special discounts that non-members don’t get.

But it doesn’t stop with just grocery stores any longer.

More and more stores now offer some form of loyalty program.

The bad part of this trick is signing up for these programs and getting endless emails for sales to get you to spend more.

Here is my solution.

I sign up for rewards programs at the stores I shop at most.

For others, I simply ask for a discount.

#86. Leave Your Wallet At Home

A great way to save is not taking your wallet with you whenever you leave the house.

You should take your ID just in case, but you don’t need your entire wallet.

Leaving your wallet at home saves you from being tempted and spending on things you don’t need but fill an immediate urge.

Online

#87. Use Online Shopping Portals

There are a few shopping portals that you can use to save you a lot of money.

A few popular ones are Groupon, Restaurants.com, and Living Social.

You can get incredible deals on these sites all the time.

You just have to make sure you don’t get sucked into the deals and spend money you weren’t planning on spending.

My favorite is Restaurants.com because I can get discounted gift certificates to my favorite restaurants for a fraction of the cost.

#88. Take Advantage Of Deal Sites

When shopping, either online or in-store, you need to take advantage of discount codes, coupons, and cash-back.

When it comes to discount codes and coupons, I simply search the name of the retailer and the word coupon.

The result will be several sites with various coupon codes listed.

A easier and faster option is to install the free Honey extension.

This free app will automatically apply the best promo code to your order, assuming one is available.

Honey automatically applies the best online coupon to your shopping cart, saving you the most money. No more spending time trying to find promo codes. Use Honey and save time and money. Save an average of 17% on every online shopping trip.

If I don’t see a coupon, or to save even in addition to a coupon code, I make sure to shop through online cash-back portals.

These websites offer cash-back on your purchases, usually between 1% to 25%.

My two favorite sites are Rakuten and Swagbucks.

Both offer cash-back at hundreds of retailers.

The reasons I recommend both are because they offer different cash-back amounts.

This scenario doesn’t happen frequently, but I’ve found that one offers a better deal than the other a handful of times.

And since it is free to sign up for both, there is no reason not to.

Looking to make money online? Look into Swagbucks. Earn money for completing surveys, playing games, watching videos, and more! Get a $10 bonus for signing up!

Want to earn cash back shopping online? Look no further than Rakuten. Earn up to 25% on your online shopping. New users get $30 when you spend $30 in the first 90 days!

Over the years of using these two sites, I have earned well over $1,000.

The bottom line is you need to take 5 minutes to search for discount codes or cash-back.

Not doing so is spending more money than you should be.

#89. Shop With Amazon Prime

Amazon Prime makes buying online simple.

And it saves you money too.

If you order a lot of stuff from Amazon, the free shipping outweighs the annual fee.

But you also get other add-ons with Prime.

My favorite is Prime Videos because it allows me to watch tons of movies and television shows at no cost.

You can see all the benefits of Amazon Prime here.

Food

#90. Meal Plan

How do you determine what is for dinner every night? Do you just wing it?

If so, you probably have a lot of food waste and waste a lot of money by ordering out too much.

Instead, try to plan meals ahead of time.

Sit down on the weekend and figure out what meals you want to make for dinner based on what is on sale this week at the grocery store.

Then shop for these items and make your dinners.

You can either make the dinners the night you plan to eat them or spend a Sunday afternoon making food for the week.

We’ve used the weekends to make dinner for the week, making the evening much smoother.

I am no longer rushing around to get home to make dinner.

If I feel too tired to cook a meal, I reheat, and dinner is ready.

You can even take this one step further and do your meal planning based on the sales cycles.

If you buy at the right time, you will save the most money possible.

#91. Buy Generic

A simple tip to save money when grocery shopping is to buy generic or store brands instead of name-brands.

For most foods, I end up buying the store brand.

When I bought my house, and the cash was tight, I did this out of necessity.

I bought the store brand version of my favorite cereal and couldn’t tell the difference.

I then expanded to frozen vegetables, cheese, and milk.

I no longer shop generic as a necessity but as a tool to save extra cash.

#92. Buy In Bulk

Another trick to reduce your expenses is to buy in bulk.

I go to a warehouse club once a month and stock up on certain things that we use regularly.

But I don’t just blindly buy as you can spend more this way.

First is because not everything is a good deal at the warehouse clubs.

You have to shop smart.

Compare the unit prices to make sure it is a deal.

Then you have to assess whether or not it makes sense to buy in bulk.

Second, you can create food waste if you can’t eat all the food you bought.

For example, when I was single, I bought a tray of eggs.

But it just wasn’t any tray.

It turned out it was three levels of eggs or 128 eggs. I had to give eggs away to my family members because I couldn’t eat that many eggs.

But now, with a family, that many eggs make sense as we go through them quickly.

The bottom line is buying in bulk makes sense for many items.

You just have to make sure it makes sense for you.

#93. Eat Whole Foods

You can lower your grocery bill by eating whole foods like meats, dairy, vegetables, and fruit.

In other words, skip the inside aisles at the store and stick to the outside aisles instead.

Shopping like this will save you money, and it will protect your health too.

When my wife and I tried a Paleo diet for a month, we lost over 20 pounds combined.

And we had a lot more energy and slept better too.

Here is a great beginner’s guide to the Paleo diet.

#94. Plant A Garden

Eating organic produce doesn’t have to cost a lot.

You can save a ton of cash by planting a garden. It doesn’t have to be a large garden either.

My wife and I picked out some vegetables that we regularly buy and planted them.

- Read now: Learn how to eat organic on a budget

We only planted two tomato plants and ended up with a mountain of tomatoes.

The key is starting small and working up from there.

#95. Drink Water

One of the biggest wastes of money is buying soda and other flavored drinks.

- Read now: Here is how to save money on alcohol

The solution is to drink water instead.

In most cases, you can get water for free when eating out.

If you are out for the day running errands, don’t buy bottled water.

Take a reusable water bottle with you and drink from this.

There are two water bottles that I use.

This Camelbak water bottle is insulated and has a bite valve, so water never spills.

And this Contigo water bottle is also insulated and has an auto-seal feature, so it never spills.

Drinking water will save you money by not buying drinks, and it will keep you feeling fuller, so you won’t buy snacks.

And it is much healthier, which lowers your health care costs in the long term.

#96. Buy A Slow Cooker

A slow cooker is a small investment that will save you money.

Just put some food in the slow cooker before you leave for work, and when you come home, you have a meal ready to eat.

It makes meal planning a lot easier as you don’t have to spend as much time on the weekend cooking for the week.

Not only is it easy to make meals, but it costs a lot less too, versus using your oven all the time.

If you are interested in trying out a slow cooker, this is the one we use.

And here is a great resource of slow cooker recipes to try.

#97. Get Creative With Desserts

If you love to eat dessert after dinner, see if you can make your own instead of buying it.

For example, if you love ice cream, buy some ice cream at the grocery store and make a bowl for yourself.

You’ll get many more servings for much less doing it this way.

I do this with Oreos.

I love to get an Oreo Blizzard from Dairy Queen. But it costs me $5.

So I buy vanilla ice cream, and a pack of store-brand Oreo’s that I blend in my mixer.

For under $5, I can make 10 Oreo shakes that would cost me over $30 if I bought the Blizzard at Dairy Queen.

Of course, it isn’t the same, but it is close, and I love it.

Eating Out

#98. Eat Out Less

The cost of eating out is only increasing.

The solution is to simply eat out less often.

By eating out less, you save. You potentially save your health too.

Have you seen how massive the portions are at some restaurants?

When I traveled to Europe, I was blown away at how small the portions were.

Then I realized this is what an actual portion size should be for an adult male.

At first, I was starving after meals because I was used to eating more.

Fast forward to when I was back home. I went out to eat and couldn’t believe how big the portion sizes were.

I couldn’t finish it because I got used to the correct portion sizes.

#99. Split Meals When Eating Out

I know that not eating out isn’t an option for some people.

So I have a few solutions for you to enjoy your meal out and still save.

The first is to split a meal.

As I just mentioned, the portion sizes are massive.

You can easily split the meal into two, and both people can enjoy it without overindulging.

But before you settle on this option, be sure to ask the restaurant if this is allowed.

Many have started charging you to split the meal.

Depending on the cost, you might still be better off splitting.

#100. Only Eat Out At Happy Hour

Saving money when eating out is easy when you go during happy hour.

Most restaurants will offer discounts during this time.

Just make sure you only order things that have special pricing.

And make sure you don’t let your eyes do the ordering and order too much.

Order a small amount of food and if you are still hungry, order more.

Car

#101. Drive Smarter

When you take off from a red light or slam on your brakes as you approach a red light, you are wasting gas.

Instead, drive smarter and predict red lights. Coast to a red light instead of locking your brakes up.

Furthermore, drive slower.

If you are taking a short drive, going 75 versus 65 isn’t going to get you to your destination that much faster.

I can’t tell you how often I see someone race past me, only for me to catch up to them down the road because of red lights.

When starting from sitting at a red light, slowly ease onto the gas.

You’ll be amazed at how much better gas mileage you get.

#102. Empty Out Your Car

A big factor in getting good gas mileage is the weight of your car.

While you cannot control how heavy the parts of your car are, you can control added weight.

If you are the type of person who stores things in your car, take a weekend and clean it out.

The more weight you remove from your car, the lower your gas costs.

And here is another great reason.

If you are ever in a serious accident, anything in your car that isn’t tied down is a potential projectile.

While a piece of paper might not injure you, a book or a shoe lying in the backseat will hurt when racing towards you at 50 miles per hour.

#103. Inflate Your Tires

When you drive around with tires that are not properly inflated, you get poor gas mileage, and you shorten the life of your tires.

Underinflated tires force you to buy new tires sooner than you otherwise would need to.

So make it a point to check your tire pressure regularly.

And don’t settle on letting your tire pressure monitor on your car tell you when you need to add air.

The warning light often doesn’t come on until there is a variance of 10%.

So if your car tires should be at 32psi, the warning will not come on until you are below 29psi.

You have been wasting money on poor gas mileage all along.

Make it a point to check your tire pressure regularly.

The best time is when you are getting gas since it is frequent, and it will hopefully become a habit.

#104. Don’t Warm Your Car Up

Contrary to popular belief, you don’t need to start your car up and let it sit for 15 minutes to warm up.

Thirty seconds is all it needs to get the oil moving through the engine, then drive easily for a few minutes to allow it to warm up more.

Just having your car sit idling for 15 minutes wastes gas and decreases the engine’s life, which costs you in the long run.

#105. Shop Car Insurance Coverage

When was the last time you shopped for car insurance?

If it has been more than a year, you need to get some free quotes.

If you don’t shop around, odds are your insurance carrier is raising your premiums, and you are paying more than you should.

Getting free insurance quotes will take you 15 minutes, and you could save $500 dollars in the process.

Below is a great resource to help you compare multiple quotes at once.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

A few years ago, I saved close to $400 a year simply by getting some free quotes and switching my coverage.

If you decide to do this yourself, be sure you compare the same plans and features to get an accurate quote.

#106. Increase Your Deductible

Regarding the above point, make sure you raise your deductible to the highest amount you can afford.

Shifting more of the liability to you and away from your insurer will lower your premiums.

How much can you save? Anywhere from 5% to 30%. That is a huge savings!

So if your deductible is $250, try to raise it to $500.

Then after you save and build up your emergency fund, you can raise it again to $1,000 to save even more.

#107. Get Multi-Policy Discounts

Try to bundle all of your insurance policies with one company.

For example, you would insure your home and car with the same company and get a nice discount.

#108. Look Long Term When Buying A Car

Too many people focus only on their monthly car payments and not the overall price.

Focusing on the monthly price leads them to spend more money, possibly hurting their finances.

Instead, account for how much you want to spend in total and go from there.

Another common mistake is buying a car, thinking it will lower your car-related expenses.

For example, some people think buying a hybrid is an intelligent financial decision.

While it will lower your cost of gas, the total amount spent is more than if you just bought a gas-powered car in many cases.

The bottom line is to consider the whole picture, not just one or two points.

Wedding

#109. Buy A Used Wedding Dress

Yes, I am suggesting you buy a used wedding dress.

My wife did this and saved a lot of money.

Her dress looked brand new, she looked incredible in it, and it only cost $600.

Compare that to close to $2,000 for a new version of the same dress.

No one will know it is used other than you, and you will be so focused on your wedding that you won’t even be thinking about it.

#110. Pay For What Matters

Staying on the wedding theme, only spend on what matters and skip the rest.

My wife and I wanted good food and to have a party.

So we spent on the food and the music.

We spent on the venue, but just found the cheapest one with the biggest dance floor.

Five years later and people still tell us how much fun they had.

No one mentions or remembers that we didn’t have centerpieces on the table.

#111. Marry In The Off-Season

Another tip to save money on weddings is not to get married during the peak season starting in May.

If you can get married in the winter or on a day other than Saturday, you will save.

#112. Make Your Reception A Pot Luck

If cash is tight, pay for a wedding but throw your own reception.

If you know someone with some land or a large gathering room, you can have your reception there.

And to save even more, have your guests all bring a dish.

College

#113. Buy Used Text Books

The price of textbooks is insane. Buy used versions instead.

You can either do this at the school store or online. I’ve found online to be far less expensive.

Of course, when you are using a new edition, chances are you have to buy new.

Another solution for textbooks is to rent them instead of buying them.

This solution lets you save regardless of whether it is a new edition.

#114. Rent Textbooks

And in many cases, you can rent a digital version of the book, saving you from carrying a hulking book around.

#115. Move Off-Campus

This tip could save you each month throughout your college years.

It was more expensive to live on campus than rent a nearby house and share it with a friend when I did the math.

So we moved off campus, split the rent and utilities, and saved ourselves a lot.

#116. Use Your College ID Card

If you are in college, use your ID card as much as possible.

You will be amazed at how many places you get a discount by showing your college ID card.

I’ve saved money at the movies, restaurants, and even at sporting events and concerts by showing my ID.

#117. Check Out The Dumpsters At Year-End

Many college students throw furniture in good condition and other items at the end of the school year in the trash, so they don’t have to take them home or store them for the summer.

You can check out the dumpsters at this time of year to try to find good items to use.

Or you could even find items to sell and make a side income!

5 Creative Ways To Save $1,000 Fast

Here is the outline for you to save money fast and with little effort.

Using this template, you can quickly build an emergency fund or have the cash for other financial goals.

#1. Open a savings account

Again, I recommend CIT Bank.

It’s fast and straightforward and gives you a dedicated place to put your savings, and is a great first step to building your emergency fund.

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

#2. Take advantage of Rocket Money

The automated assistant Rocket Money will help you quickly find places to save money.

Even just using them to lower your cable bill is reason enough.

Just make sure you move the amount you save into your savings.

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

#3. Lower your auto insurance

Use another automated assistant, this time Insurify.

They will find you the lowest premium and save you thousands of dollars.

Again, make sure you move the money you save into your CIT Bank account.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

#4. Adjust your thermostat

Lower the temperature so your house is a little cooler in the winter, and raise the temperature so your house is a little warmer in the summer.

Saving money is fast when you do this because your heating and cooling make up the biggest part of your electric bill.

In the fall and spring, pay attention to the weather and turn off the thermostat to save even more.

#5. Pay extra on your debt

Most of your debt carries a hefty interest rate.

You can’t beat this return on your money if you pay off your debt faster.

Pick one debt and try to pay extra towards it every month.

Even if it is just $5, it is better than nothing.

Getting out of debt is a no-brainer because it frees up more of your monthly income to put towards savings, especially if you have a tight budget.

Final Thoughts

If you take the steps I’ve outlined above, you will set yourself on a path to creating wealth in your life.

And if you take just a handful of the 117 creative ways to save money I outlined, you can boost your savings and set yourself up financially for many years.

However, the key is to take that first step and get started today.

The sooner you start, the sooner you can realize your financial dreams.

Below is an excellent infographic of all the tips I listed here.

Feel free to download it and share it so others can start saving money too!

- Read now: Here is how to save $100,000

- Read now: Use these tips to save money like a millionaire

- Read now: Discover fun money facts you didn’t know

__TVE_SHORTCODE_RAW___

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I really like the FutureMe.org idea. So many times we get pumped up about doing something only to see that enthusiasm wane over time. Writing yourself an email to be delivered sometime in the future seems like a great way to remind yourself why you got so excited about something in the first place.