THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Do you want to be wealthy?

Most people say they do, but few people take the steps necessary to become wealthy.

Many people think it’s all about having a high-paying job or making wise investments, but other factors are also at play.

So what are the habits of wealthy people that set them apart?

In this post, we’ll explore some of the critical habits of self-made millionaires who have built wealth and maintained it over time.

It’s important to remember that becoming wealthy doesn’t happen overnight.

It takes time and effort to amass wealth.

But if you’re willing to work, these rich habits will help get you there.

And the good news is anyone can develop these habits and start seeing a positive change in their financial situation.

Table of Contents

25 Must Have Habits Of Wealthy People

#1. Live Within Your Means

This one is pretty straightforward.

If you have to go into debt to buy something, you cannot afford it.

Granted, a house and a college education are exceptions, within reason, of course.

But you should not be going into debt for things like clothing, gifts, flat-screen TVs, etc.

You need to keep your living expenses in line with your income.

In other words, don’t spend money you don’t have.

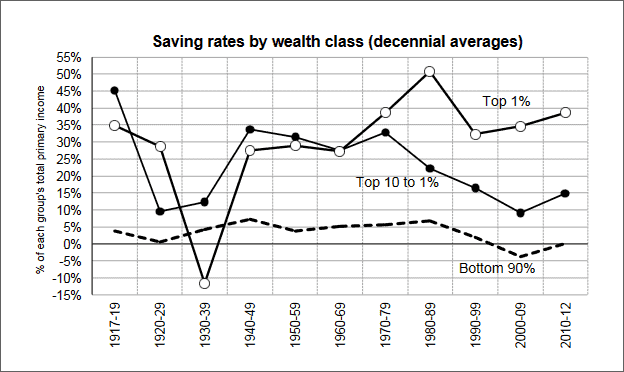

According to studies, the wealthiest people save between 20% and 40%.

The top 10% of wealthy people save between 10% and 30% of their income.

The rest save between 0% and 5% of their income.

In other words, rich people make it a point to save their money.

Almost every poor person who is struggling financially spends more than they earn.

And by not saving anything, you will never get ahead financially.

If you don’t save, your life today will be the same in 20 years.

And if you spend more than you earn, you’ll be in even worse financial shape in 20 years than you are today.

In addition to making saving money a priority, you can also do a few things to lower the cost of things you are spending on now.

- Read now: Click here for the best tricks to slash your monthly expenses

- Read now: Learn over 100 creative ways to save money today

For example, if you have student loan debt, you can refinance this debt and save money monthly.

If you have a mortgage, you can also look into refinancing this.

You could easily save hundreds every month by refinancing.

And if you have credit card debt, you need to make it a priority to pay it off as quickly as possible.

I encourage you to read through my pay off debt archives for help with all of your debt needs.

By making a little effort, you can start building your savings faster than you thought possible.

Action Step

Make it a point to save money every single month.

Don’t worry about the amount at this point. Right now, just make it a habit to start saving.

Set up a reminder in six months to increase the amount you save by $20 a month.

Then set up another reminder once a year, every year, to increase this amount by at least 1% until you are saving 15% of your income.

#2. Don’t Gamble

I gamble, but I don’t gamble.

What I mean by this is that I participate in a weekly football pool picking the winners of each week’s games.

I also will spend $100 on slots and blackjack when my wife and I or my friends and I head to Atlantic City.

And sometimes, when the Powerball lottery gets to $500 million, I’ll blow $20 and play.

The keys here are:

- The money I spend is small in amount

- The money I spend is money I can afford to lose

This is important because too many people play the lottery daily, hoping to change their financial situation or use the money they cannot afford to lose.

If you choose between buying a loaf of bread and buying two scratch-off lottery tickets, you need to seek help.

The main difference between rich people and poor people here is having the right mindset.

The poor mindset relies on luck to improve their financial situation. The rich mindset has the person rely on themselves to improve their financial situation.

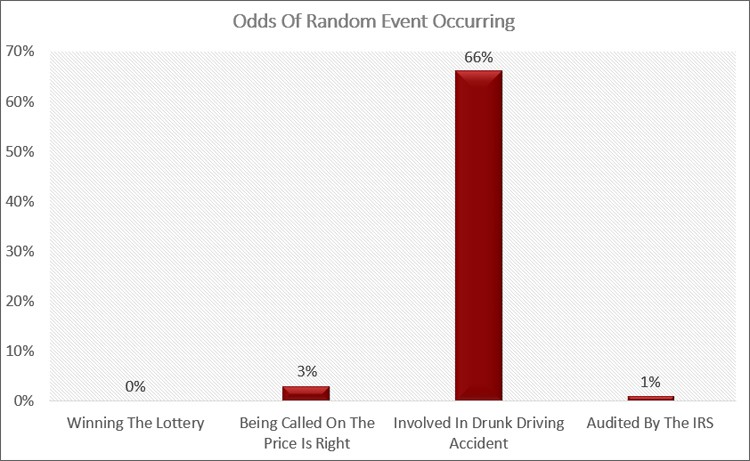

The reality is you have odds of being audited by the IRS or getting called onstage at The Price Is Right than winning the lottery.

If you are going to play the lottery, do so for fun.

Action Step

Whenever you get the itch to play the lottery, save the money instead.

Look at how much money you spend in a year if you spend $10 a week on lottery tickets.

A whopping $520!

If you buy a scratch-off ticket once every two weeks and save the rest, you will have $500 in savings after just a year.

Chances are you don’t win $500 or more a year playing the lottery.

So instead of relying on luck to change your finances, take action and improve your finances yourself.

This means setting up a budget and saving money, as I pointed out in the first tip.

You could go back to school for more education or read more about personal finance.

The point is you need to take meaningful action to improve your life.

You can’t just sit there and expect things to change or hope that winning the lottery will answer your prayers.

- Read now: Here are the best budgeting methods to use

- Read now: Learn how to invest in yourself

#3. Develop Good Money Habits

Wealthy people become rich and successful because they are smart with their money.

Looking back on the point above about not gambling, if poor people win the lottery, there is a high chance they will end up broke in a few short years.

Wealthy people who win the lottery will not end up broke.

One reason for this is that wealthy individuals have good money habits.

They aren’t going to make dumb decisions with their money.

They save and invest the majority of it and spend the rest.

These millionaire habits extend to all areas of personal finance too.

They take advantage of tax planning, so they pay as little in taxes as possible.

They are smart when they borrow money, only borrowing what they need.

And since they have good credit, the interest rates they pay are low.

Action Step

Work hard to learn the basics of personal finance and apply rich people habits daily.

In time you will see an improvement in your wealth.

- Read now: Here is how to build good money habits

- Read now: See the best Ted Talks about money

#4. Read More

I’ve gotten better at reading in my free time.

Why is reading important? A few reasons come to mind:

- It makes you think

- It helps you to learn

- It grows your vocabulary

- It keeps your mind sharp

The more you work to better yourself, the more it will overflow into other areas, like your career and income.

The key, though, is to read things that will improve you.

A small percentage of wealthy people read regularly read for entertainment purposes.

Most read career-development material, personal development books, current events, and biographies.

But don’t think you can only read things to improve yourself.

I mix up my books, read a great fiction novel, and then read non-fiction books that help me improve myself.

Then I usually go back to another fiction novel.

Action Step

If you don’t think you have the time to make reading one of your daily habits, you do.

Turn off the TV 30 minutes or an hour before bed and read.

Stop binge-watching a TV show and pick up a book to read instead.

Another option is to buy audio books and listen to them during your commute or lunch break.

You can even listen to an audio book while going for a walk or doing work around the house.

You can try Audible out for free for 30 days by clicking this link.

You have the time. You just have to commit to reading.

#5. Turn Off The TV

This wealth-building habit is one of the more interesting ones I have encountered.

The higher a person’s income, the fewer hours of TV they watch.

One reason is probably that they are out of the house more.

Not necessarily working, but networking and participating in groups, seminars, industry events, and volunteering.

Also, they tend to read more, leaving them little time for too much TV watching.

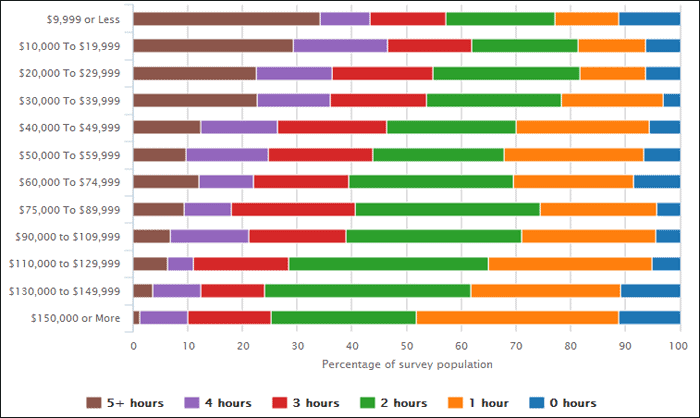

Check out this excellent chart from the General Social Survey to consider how little TV the wealthy watch.

As you can see, the wealthiest people watch 2 hours or less of television daily.

While the survey doesn’t break down what they are watching, it would be interesting to know.

Most likely, the wealthy watch news and finance programs, as well as documentaries, and don’t watch many reality shows.

The trick I found to help me watch less television is to DVR the shows I am interested in.

Instead of watching the shows while they are airing, I do projects around the house, read, or spend time with my family.

Then I check out the DVR every once in a while and will watch some of the shows.

I find that most times, I delete the majority of things I recorded and never watch them in the first place.

Deleting the shows tells me that I would have wasted my time watching the shows live since I wasn’t interested in them in the first place.

Action Step

Make it a point to try to watch less TV.

Here is a simple test to know what to stop watching.

If you are more interested in your phone or something else while a show is on, chances are you can stop watching this show and not miss it.

From there, record the other shows you watch and set a time every day or every couple of days to watch TV.

The bonus part of this is that you might be able to cancel your cable bill or downgrade and save money.

#6. Stay Off Social Media

Have you noticed how the country seems at odds with all the issues we have right now, like never before?

I’m not here to say who is right and who is wrong.

But I will tell you why I think things are like this.

The reason is social media.

And the sooner you can kick this habit, the better off you will be.

Here is why.

Think about talking to someone in person.

You not only see them, but you see their facial expressions.

Since the majority of language is non-verbal, this is critical.

You also can understand the tone of their voice.

Put these two things together, and you better understand where they are coming from when having a conversation.

Now have the same conversion online, and you are lost.

You have no idea when they are serious or joking.

A perfect example of this is work email.

I’ve often sent an email, thinking nothing of it, and the other person read it the wrong way.

This misunderstanding even happens with text messages.

The other big issue with social media is you get to hide behind a screen.

Most people wouldn’t say mean or hurtful things to another person if that person were standing in front of them.

The point here is that you need to stay off social media.

You quickly get sucked in you lose hours of your day.

Action Step

One of the best daily success habits you can develop is to limit the amount of time you spend on social media.

In the beginning, limit yourself by setting an alarm for ten minutes.

When the alarm goes off, you have to log off.

Over time, work on staying off for a day or two and keep extending this period longer.

Pick up a book instead or go for a walk.

Your mental and physical health will be better off as a result.

- Read now: See how Facebook is stealing your money

- Read now: Learn how lifestyle creep keeps you poor

#7. Focus On Your Health

Studies show that poor people eat the second most amount of junk food. The middle class eats the most.

What does the food you eat have to do with building wealth?

A lot more than you think.

When most of your diet is built around junk food calories and drinking too much alcohol and soda, your body is not working for optimal performance.

It is trying to rid itself of the junk and survive on the little good stuff you are putting into it.

It’s like being in a bad relationship.

It sometimes feels good, but it feels terrible a lot of time too.

When you eat bad food, you can’t focus or concentrate and don’t have the energy you should.

Your sleep is poor, making you tired the next day.

When this happens, you are prone to giving into poor habits and making bad decisions.

When you eat healthy food, your body performs better, and you sleep better, which results in more willpower and better decisions.

Action Step

You need to start a healthy eating routine so you can perform better.

Don’t think you can never eat junk food again.

Rather limit it.

When I eat poorly, I notice it because I am not my usual self the next day.

I’m tired when I wake up or have a harder time focusing.

In some cases, I crave sweets.

As with the other ideas on this list, take it slow to develop these wealthy habits for long-term success.

- Read now: Learn how to eat organic on a budget

- Read now: Here is how to buy cheap produce

- Read now: Discover how to lower healthcare costs

#8. Start Your Day Off Right

While most wealthy people wake up on the early side, usually around 5 am, you don’t have to.

What you do have to do is start your day the right way.

Why do rich people wake up so early?

There are various reasons, including:

- Fewer distractions, so more work can be done

- Exercise, including weight lifting and aerobic exercise

- Meditate

- Less time in traffic, so you are in a better mood

- More time for breakfast

Instead of changing your daily routine so you too can wake up early, make it a point to take advantage of the morning.

This might mean you do wake up a little earlier than usual.

Or it could mean you are more intentional with your time.

Action Step

Figure out what time you have to be awake to get to work on time, then work on moving your wake-up time one hour earlier.

Do this slowly, in 15-minute increments over a month or two.

Have a plan for this extra time and use it to exercise, read, or improve your finances.

Over time, you will notice a big difference in how much better off you are.

#9. Control Your Emotions

Most of us get ourselves into trouble when we say something at a time when we are highly emotional.

If you take five minutes right now, you can think of a few such times.

Before you say what is on your mind, take a step back and think things through.

Chances are you will be thankful you didn’t say what you thought.

Why is it important to control what you say?

You never know what will come back to haunt you. It’s as simple as that.

So while you may want to tell your boss who is letting you go where to stick it, you are better off biting your tongue.

You never know when you might need a reference for a future job.

Another emotion that separates rich people from poor people is fear.

Wealthy people lean into their fear and build self-confidence. This confidence gives them the courage to keep pushing forward.

On the other hand, the poor give into their fear and never build their confidence.

This causes them to get stuck in their situation and never improve.

Action Step

If you can learn to think before you speak and lean into fear, you will see a monumental shift for the better.

One great way to get started is by reading The Magic Of Thinking Big.

- Read now: Here is how to stop buying things

- Read now: Learn how advertisers get you to spend

#10. Network And Volunteer Regularly

Of all the rich habits, this one has the greatest payback.

Over 66% of wealthy people network and volunteer their time, and another 78% take part in charitable giving, according to studies.

Why is volunteering important? There are a few reasons:

- Volunteering makes you feel good. Studies show that volunteering a few times a month provides the same feeling as if the person was earning a salary of $75,000 a year.

- It’s all about who you know. The more people you know, the more opportunities will come your way. These could be job opportunities or even the opportunity to go to conferences and other events where you can meet other like-minded people. You might even find new customers or clients when you network.

Volunteering and expanding your network allows you to take advantage of situations when they present themselves to you.

When you are happy and in a good mood, you are more likely to act on an opportunity than when you are unhappy.

Talk to successful people, and they will tell you that preparation was the key to their success.

They did things to put themselves in a position to take advantage of opportunities.

Action Step

Get out there and start volunteering.

Volunteer for causes that have meaning to you and will find happiness and grow your inner circle.

You never know the great opportunities it may bring.

- Read now: Learn how much happiness costs

#11. Go Above And Beyond In Work And Business

Going above and beyond is a common point, but so few people practice it.

They wonder why they are only getting the standard 3% when it comes to their annual raise.

You have to become valuable at work if you want to earn a higher income.

Here is my personal experience with this habit.

I was at work one day, and I finished my project. I went into my boss’s office and asked him what work he had that I could do for him.

After talking for a bit, I found out there were a few tasks he had to do that he disliked.

He showed me how to do them, and I took over doing them going forward.

When it came time for my review, he remembered how I stepped up and took some of his work off his plate.

I earned a 5% raise that year.

But it didn’t stop there.

I was the first to get offered new opportunities and projects that would put me in front of executives and other directors within the company.

In other words, simply helping my boss with his workload springboarded my career forward.

Suppose you are someone who punches in and out, only doing your responsibilities.

In that case, chances are you aren’t getting ahead, and neither will your salary.

I’m not saying you must be at work 24 hours a day.

But you do have to step out of your job description and take on more challenges and responsibilities if you want to earn a higher salary.

This means that sometimes you will have to come in early or work late, but not every day, and the benefits of doing so are tremendous.

Action Step

Ask your manager what duties of theirs you can take ownership of, or ask if there are any projects you can be a part of.

At the very least, keep an eye out for bottlenecks in the current workflow and think of ideas to run the system more efficiently.

The more value you can provide, the more income you will be able to earn.

- Read now: Here is how to ask for a raise

- Read now: Learn why you need to negotiate your next salary

- Read now: Discover the high income skills to learn

#12. They Work On Self Improvement

Wealthy people make self-improvement a priority.

This includes not only striving for good health and good relationships but also learning new skills.

The more they work on themselves, the better they will be at work and in relationships.

This personal development will flow over into other areas as well.

Action Step

Make it a point to try to better yourself every day.

If something bothers you regularly, take the time to understand why and then work on making it, so it doesn’t bother you.

The more you become a better person, the happier and more successful you will be.

#13. Invest Your Money

The rich realize that the stock market is their friend.

To grow their wealth, they need to earn a decent return on their money.

So they learn the basics and begin to invest their money.

On the other hand, the average person puts their money into savings accounts, assuming they save any money.

They feel this is a safe investment since they worked hard for their money.

But the problem is they won’t be able to grow their wealth by using a bank account.

Here is why.

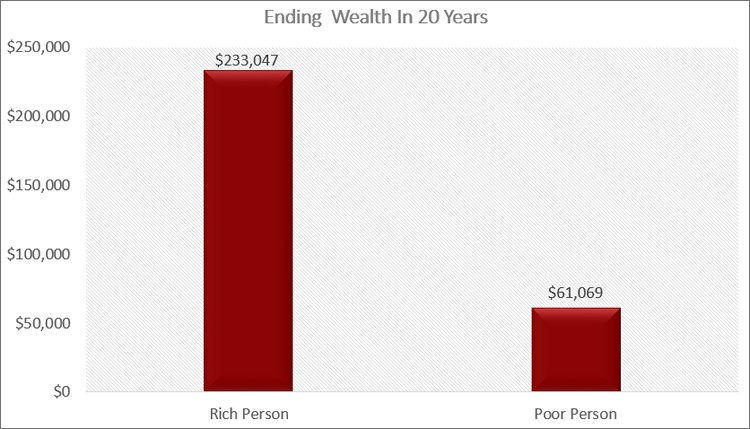

Let’s say you are smart with your money and can save $50,000.

You put this money into a savings account that earns 1% for the next 20 years.

At the same time, the rich person takes her $50,000, puts it into the market for 20 years, and earns 8% annually.

At the end of the 20 years, you have a little more than $61,000.

The rich person has over $233,000!

They grew their wealth by over $180,000, and you grew yours by $10,000.

Even if investing scares you, you still need to do it.

You can invest conservatively and still earn a decent return.

Or you can invest in real estate, which tends not to have wile price swings like the stock market.

Owning rental properties is a great way to build wealth.

Even if you earn 4% on your money, you are in better shape and will have fewer financial struggles.

Here’s proof.

With that return, your $50,000 would grow to over $109,000, meaning you would have another $60,000 of wealth.

The bottom line is that when you invest your money, you grow your wealth, which opens the door to a better future.

Action Step

Learn about investing your money.

This doesn’t mean you have to buy stocks, as you can invest in real estate instead.

The key is learning enough about these topics, so you feel comfortable investing.

The more money you invest and keep invested means higher amounts of passive income in the future.

And this income will open the door to many new opportunities.

#14. Set Goals

What is the difference between a goal and a wish?

A goal is something you can control the chances of it becoming a reality. With a wish, you have zero control over.

This is closely related to playing the lottery from before.

For example, I can wish for 5 million dollars.

If I keep doing the same thing I’ve been doing up until this point, the odds are slim that I will have $5 million.

But, if I set up a goal to have 5 million dollars, things change.

I set up my action plan and took steps to better my chances of reaching my goal of $5 million.

I also start to track my progress.

Here is the best part of this.

Say I fail on my goal. Does that make everything I did to reach the goal a waste of time?

Hardly.

Chances are, I am earning more money now and have a lot more savings.

I might have failed on my goal of reaching $5 million, but I am in a better financial place than I was before.

Additionally, I learned a lot about myself and grew as a person.

In other words, trying to reach the goal made me much better off than I was before financially and through personal development.

Let’s say you aim to earn an extra $1,000 a month.

How would you achieve this goal?

For starters, you could work smarter at your job and earn a larger salary.

While this is a good start, you must also think outside the box.

What things could you do to easily earn money on the side?

You could spend a few minutes daily taking surveys and make an extra $200 a month.

If you are good at writing resumes, you could make money editing resumes for people looking to change careers.

- Read now: Learn the best ways to make $1,000 fast

- Read now: See over 51 ideas to start making extra money

These are just a few ideas to show you how to set some goals.

Action Step

Learn to set goals and improve yourself.

Start with something small, like reading for 30 minutes before bed for a month.

When you achieve this goal and build some momentum, set another goal.

Another goal you can set is to say 10 money affirmations a day.

This will help you get in the right frame of mind to achieve more of your goals.

As you achieve your goals and learn from your mistakes, you can begin to set loftier goals.

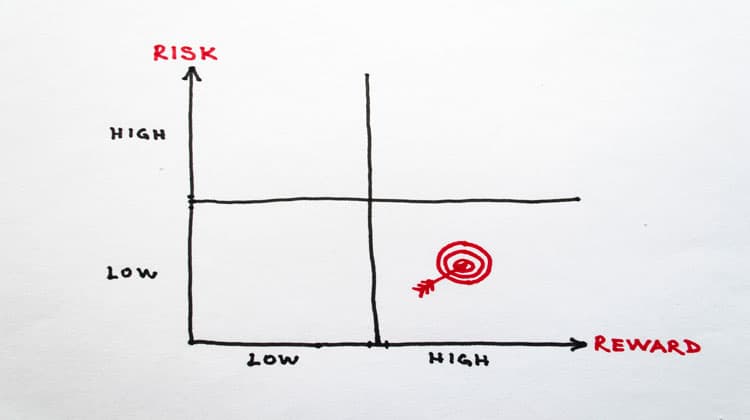

#15. Take Calculated Risks

Taking risks is a part of life.

But some risks are stupid, and others that are intelligent.

Wealthy folks tend to take more calculated risks, the smarter risks

Before doing something, they weigh the pros and cons and see if the risk is worth taking.

If it is, they take the risk and are OK with the result, even if it means they lose money.

This doesn’t mean they don’t look to see where things went wrong and try to correct the mistake.

It means they have accepted failure is a possibility.

Action Step

Before you do anything, weigh the pros and cons for five minutes.

The more you do this, the fewer dumb things you will do.

The result will be an improvement in your overall life.

#16. Use Long Term Thinking

The way you think has a significant impact on your financial success.

For example, rich people think long term.

Before they buy something or do something, they take the time to figure out the long-term benefits and consequences.

The poor think in the short term.

They give into emotions and don’t fully understand the long term effect of their actions.

Here is an example to help you better understand this.

A poor person will walk into a car dealership and tell the salesperson they can afford a monthly payment of $500.

An intelligent salesperson can work the numbers out, like the length of the loan and interest rate, to get you into a $40,000 car for $500 a month.

This sounds great.

But when you factor in how long you will be paying for the car, your total cost is over $45,000.

This might not sound bad.

But a rich person will walk in and say they will pay $30,000 for a car and buy the vehicle that fits this budget.

In the end, the rich person paid $15,000 less for a car.

They can now take this money and invest in growing into more money.

Or they can use it when an opportunity comes their way.

The goal for you is to look at the long term impact of things before you do anything.

The more you can do this, the better off you will be.

Action Step

Be more like wealthy people and look at the long term.

Analyze the entire picture, so you are comparing apples to apples.

Make sure you take into account the long term benefits as well.

Too many times, people focus on the upfront cost and think something isn’t worth it when the long term payoff is much greater than the upfront cost.

#17. Track Your Progress

One of the most underrated habits of rich people is tracking their progress.

They make it a point to monitor their progress to keep doing what is working and stop doing what is not.

The easiest way for many people to take advantage of this is to track their net worth.

This is a simple habit that will have a tremendous impact on your future wealth.

List your debts, like auto loans, mortgage, and credit card debt.

Then write down your liquid assets, like cash, bank account balances, and investment balances.

Finally, subtract your debts, also called your liabilities, from your assets.

The number you get is your net worth.

The higher this number, the better.

This exercise tells you how well you save and grow your wealth.

And if you calculate it regularly, it will put you into the right mindset to make intelligent financial decisions.

For example, I had a negative net worth when I was younger.

My student loan debts were a lot more than what I had in savings.

I worked hard, and one day my net worth turned positive.

It was around this time I was looking at a new car.

The problem was if I bought the car, my net worth would become negative again because of the car loan.

I ended up not buying the car and kept saving money.

I made smarter financial decisions by tracking my progress with my net worth.

Action Step

Make it a point to calculate your net worth annually.

Use this number to help guide you to making smarter financial decisions, so you grow your net worth over time.

#18. Avoid Procrastination

Procrastination is a big issue for poor people, but not wealthy people.

You know you have to do something, but the DVR has the latest episode of your favorite show.

It would be easy just to put off that task for an hour and watch TV instead.

The next thing you know, you’ve spent the entire night watching TV and got nothing done.

This is a problem because it will never get done if you keep putting something off.

Shocking, I know.

But if you never do it, then you will never be better.

Everything will stay exactly the same.

How boring is that?

And if your life is a mess now, it just means the mess will still be there in the future.

To overcome procrastination, you need to do two things:

- Create a to-do list

- Have a partner

Having a to-do list lets you keep track of the things you need to get done and then be motivated as you cross things off your list.

Just make sure you prioritize your list.

Action Step

Here is how you avoid procrastination.

Make sure that you put the things that will have the most significant impact at the top and the least impactful at the bottom.

This will take some thinking.

For example, the laundry might seem easy, and you should do it first.

But if your goal is to build your relationship with your spouse, then it is more important to set up a time to spend with your spouse.

The laundry can wait until later.

You could even throw a load in at night, read for 30 minutes, move the clothes to the dryer, read some more, then take them out and go to bed.

In addition to a list, find a partner to be accountable for helping you reach your goal.

This can be your spouse, family member, or even a friend.

By having someone to help keep you in line, motivate you when times get tough, and celebrate with you when you reach goals, you will more than likely see your goals through.

Having an outside influence goes a long way to helping you avoid procrastination.

#19. Listen More By Talking Less

We are horrible when it comes to listening.

We love to talk about ourselves. Heck, this is why social media is so popular.

We get to talk about our lives and how awesome things are.

But the key to becoming wealthy is to learn to listen.

You can learn so much just by listening to others talk.

And if you are in a room of people, you can spot the rich person because the wealthy listen more than they talk.

You can learn how not to approach a problem versus how to approach a problem.

You can learn tips and tricks other people use and the things they have done to become successful.

Action Step

The next time you are with others, stop talking and listen to them.

Ask them follow-up questions based on what they say and not try to tell a related story about yourself.

See what you can learn from them to make yourself better and more efficient.

#20. Avoid Toxic People

I’ll admit this is much easier said than done, but it is entirely accurate.

You are the company you keep.

This means that if you hang out with troublemakers, you too will most likely become a troublemaker.

You need to sit down and look over all of your relationships and cut out or limit those relationships that don’t improve your life.

Like I said, easier said than done.

If you have toxic friends, it can be easy to cut them out.

Stop calling and texting them and do something else.

But with family, it isn’t so simple.

While you might not want to cut them out completely, you can limit your time with them.

Only see them during the holidays or special events. Don’t get sucked into their stories when you are around them.

In other words, come up with a reason why you need to leave.

If you can’t leave, have a reminder on your phone.

This reminder should be a note of all the good you have and what goals you are striving for.

Doing this will help you wash away the negativity affecting you when talking to these people.

It is so vital that you go through this process if you want to become wealthy and successful.

Studies show outside influences, such as the people in our inner circle, impact us.

Action Step

Make a list of the people in your life and then rate them.

Are they positively benefiting you, or do they have a negative impact on you?

If they have a positive impact, spend more time with them.

If they have a negative impact, start spending less time with them.

What if you don’t know any successful people? You need to find them.

Luckily, they are everywhere.

Join groups on meetup.com. Volunteer and network. Join a recreational sports team. Find a mentor at work.

The options are endless.

#21. Don’t Give Up

Let me break it to you. You are going to fail.

You will fail a lot.

For many of us, we see failure as a bad thing.

We think of failure as getting a bad grade or not being good enough.

We must change how we view it and see failure as a good thing.

When you fail, you are trying something new and growing as a person.

You are trying to be the best you that you can be.

There will be times when you stumble and fall, and this is OK.

Take a few minutes, think about why you failed, and try again.

You tried again after falling off your bike, didn’t you? And again, when you failed your driver’s test?

This failure is just another bump in the road.

Look back on what you did wrong and make adjustments and try again.

Odds are you will see success if you can objectively look at what went wrong and work on correcting it.

Learn from your mistakes and stop looking at failure as a bad thing.

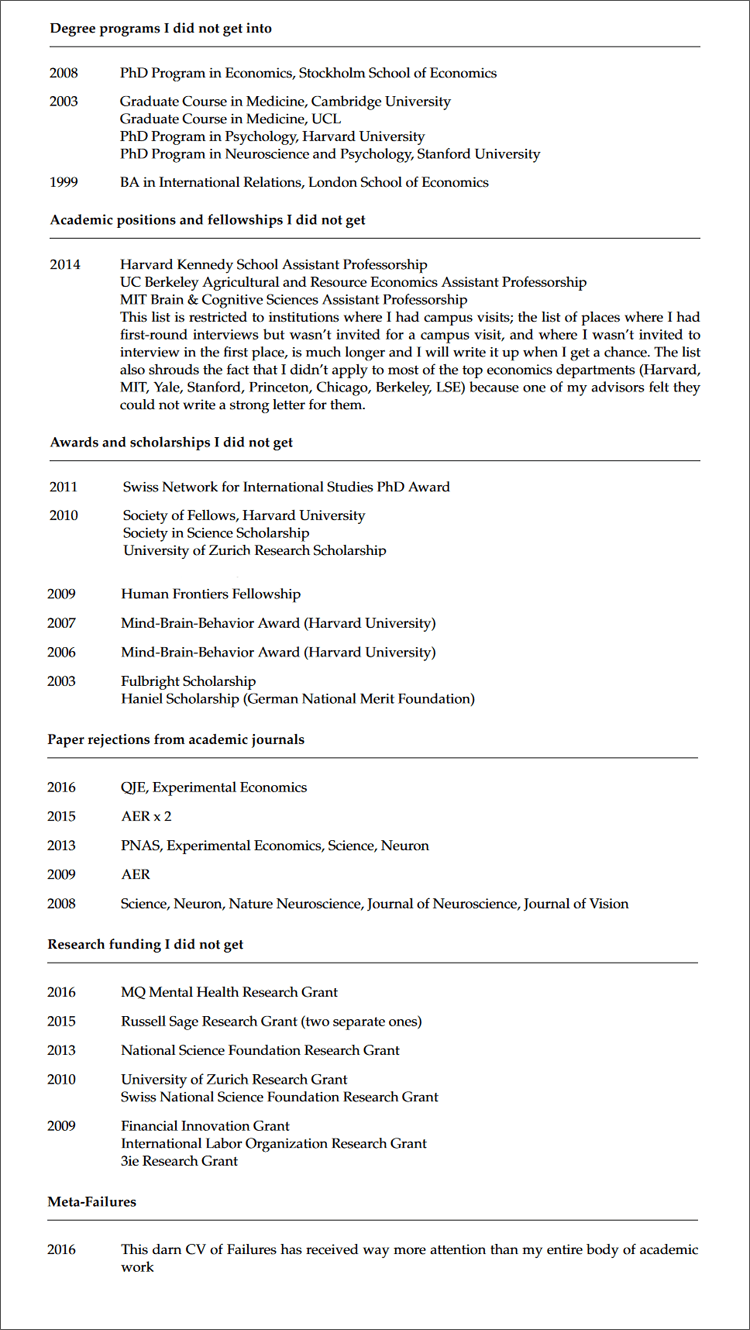

And if you need motivation, look at this CV of failures published by Johannes Haushofer, a a psychology professor at Princeton.

“Most of what I try fails, but these failures are often invisible, while the successes are visible. I have noticed that this sometimes gives others the impression that most things work out for me. As a result, they are more likely to attribute their own failures to themselves, rather than the fact that the world is stochastic, applications are crapshoots, and selection committees and referees have bad days.”

Action Step

Remember that failing is a part of personal growth and is a good thing, as long as you take the time to learn from it.

When you fail, figure out what went wrong and try again until you get it right.

By changing your mindset on failing, you can see tremendous personal growth.

#22. Set Aside Self-Limiting Beliefs

Some of us are great at putting ourselves down. Here are a few common ones:

- I’m not pretty enough

- I’m not smart enough

- I’m just poor, I’ll never become rich

- Things will never change

- I’ll never get the job or promotion

- I will always be a failure

- I will always be alone

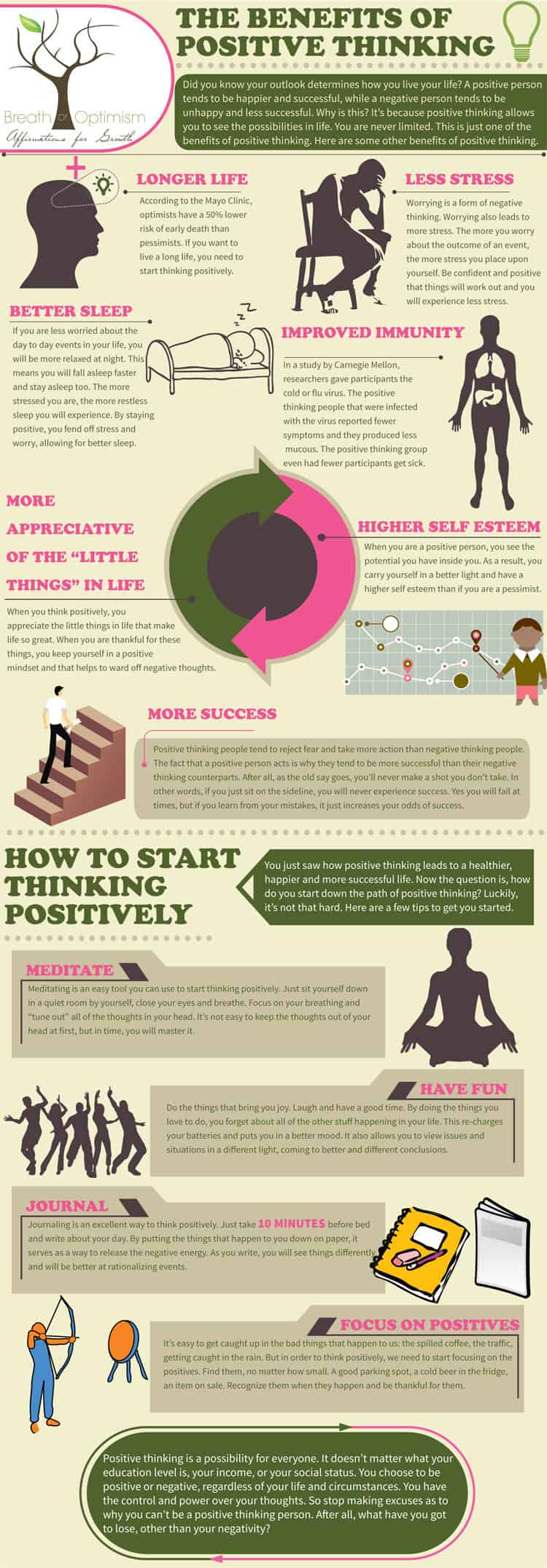

The key to becoming rich or even happy in some cases is to turn off this switch and start thinking positively.

Here is an excellent infographic on how to do this.

When you say limiting beliefs to yourself, you start to believe them.

The next thing you know, they become true.

You give up trying and just coast through your existence.

If you put in the hard work to have a positive attitude, start telling yourself that things can change, and your outlook and mood will improve.

You will start down a path of reaching and achieving your goals.

Remind yourself that many poor people have become rich.

Why not you? Remember that people are hired for new jobs every day.

Why not are you getting hired? Start looking at all the good things you have and get into a positive mindset.

Don’t tell me you can’t think of anything you have going for you either.

Watch this video, and then tell me how bad you have it.

Action Step

Try to find the positive in every situation.

The more you can focus on the good, the happier you will be.

And this happiness will extend into other areas.

This isn’t to say you can’t see the negatives, but don’t dwell on them.

Change your thinking to better things and experience the change.

#23. Get A Mentor

Earlier I mentioned how having a partner can help you reach your goals.

In that case, having a friend motivate you goes a long way.

In this case, having a mentor is like finding a gold mine.

Seek out and find successful people that have achieved the success you want to achieve. Befriend them and pick their brain.

You’ll be surprised at how generous they are with giving you information to help you succeed.

Over 93% of successful people have a mentor, according to studies.

It will be much harder to be wealthy or successful if you blindly chase it.

By having someone on your side who has achieved the goal you want, you greatly increase your odds of success.

After all, anyone who attempts to climb Mt. Everest takes along a team of Sherpa’s who have already achieved the goal.

So, take some time to find other successful people and see if they are willing to mentor you.

Action Step

Make it a point to find a mentor and start a relationship with them.

You can find a mentor at work, church, or anywhere else you frequent.

You can even ask friends and family if they know anyone successful that might be a good fit for you.

#24. Eliminate Bad Luck

There is no such thing as bad luck.

It is simply a state of mind. There is no such thing as good luck either.

But then why do some people appear to be lucky?

They prepare themselves for the opportunity.

No one knows what opportunities could come their way, but the people that catch the breaks and are lucky are simply in the right place at the right time.

They prepare and are ready when the opportunity presents itself.

They stay out of debt and save, so they have the financial resources to take advantage of an opportunity.

They network and keep a group of other successful people around so they can be the first to hear of new ideas and business to be part of.

Two times in my life significantly impacted my financial success, once when I was lucky and once when I was unlucky.

Both are because of what I did before the event occurred.

In the case of being lucky, I got laid off from my job two months before my wedding.

At the time, I was running a website on the side, slowly building it up and saving as much money as possible.

When I did lose my job, it wasn’t a time of panic.

Because I had built up another source of income and saved a lot my money, I was able to start working for myself.

Fast forward to today, and I am earning more working for myself and loving every minute of it.

The time I was unlucky, I didn’t prepare.

I had just bought a house I couldn’t afford, and some opportunities came my way to invest in real estate.

But because I was struggling to survive, I didn’t have the means to invest.

Those who were prepared and invested tripled their money in a few short months.

Action Step

Wealth and success aren’t luck. It’s preparation.

Follow all of the steps in this post. You will see more opportunities and can take advantage of these opportunities yourself.

You have to prepare so you are ready when the opportunities present themselves.

- Read now: Here is how to become financially stable

- Read now: Know the signs of financial independence

#25. Know Your Main Purpose

The happier you are, the more successful you will become.

The key then is to do things that make you happy.

If you are in a job you hate, the odds of you staying late to take on a new project or take over some of your boss’s work are slim.

This means your chances of earning a decent raise are slim too. Your best bet is to find a different job.

I can attest to this.

One of the jobs I worked, I hated. With a passion.

I would show up on time, sometimes a few minutes late, check out right at quitting time, and sometimes a few minutes early.

I would take a longer lunch break than I should have.

I would surf the internet. I would take extra bathroom breaks. I would call out sick when I didn’t feel like working.

It’s no surprise my raises were barely 2% each year.

Eventually, I started blogging full-time.

I work more hours now than I did when I had a full-time job.

But the interesting thing is that I love every minute of it. It never feels like work.

I enjoy it, and it brings me a lot of pleasure to talk about personal finance and success.

The fact that I make as much as I do blogging blows my mind.

The key is finding the things you love to do and understanding your skills.

Then see if you can earn a living doing those things and using your skills.

If you can do this, you will significantly improve your odds of wealth and success.

One final tip on this point.

Don’t limit yourself.

I hated English class and writing papers in high school and college.

Yet, here I am, a writer.

I enjoy it because I get to write about something I enjoy, and I don’t have to include a bibliography at the end.

Do not cross something off because you don’t like it.

You may not like something just because of its association with something else.

Action Step

Spend some time figuring out what you want out of life.

What makes you happy? What makes you want to get out of bed in the morning and live?

Once you discover this, set up a plan so that this can be your reality.

This doesn’t mean you need to figure out how to save enough money to quit working and do what you want.

If this is the end result, great, but you can still do what you enjoy while working.

It’s not an either-or situation. It is about learning to include your main purpose in everyday life.

- Read now: Here is how to live a life of unlimited wealth

- Read now: See the things money can’t buy

Final Thoughts

There is your template for developing the same habits of wealthy people and becoming filthy rich and super successful.

If you study these rich habits and follow them, the world is yours, my friend.

I know that doing all these tips at once can be overwhelming, so start small.

Turn off the television and read or spend time on a hobby or with your family.

After some time, add something else into the mix, like volunteering.

The key is to take things slow. It is not a race.

The more patience you have with changing your routines, the more likely they will stick long-term.

The only thing left to do now is not to procrastinate and get to work.

- Read now: Here is how to save like a millionaire

- Read now: Click here to learn how to build stealth wealth

- Read now: Here is the ultimate guide on adulting 101

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

These are great! I definitely have a few of these habits already, but not all of them. I’m definitely good about eliminating toxic people now that I work from home. At my 9-5, I had no control at times.

@Holly@ClubThrifty: Yeah, work for me was tough too when trying to avoid toxic people….especially when the person is your supervisor. I was so happy when I moved on to another job and didn’t have to deal with her any longer.

It is true about being wary of toxic people, but sometimes people go way to far with this. If someone has a death in the family or a major life downturn they are not toxic people, they are just grieving a major loss.

This is an awesome list Jon! I do some of them already, though not all of them! I love your point on the lottery and relying on luck – I have a post on something related to that tomorrow on Sprout Wealth. Wealth, generally speaking, is built over time and requires hard work – something far too money don’t want to do.

@John @ Wise Dollar: So true John. We want the millions without having to put in the effort to get it. I am guilty of this at times myself. The key is catching yourself and realize that no one makes it without putting in the effort.

Great list. I think I’m on my way. I think you could include video games in there too, them seem to suck the time from the younger generation too.

@Brian @ Debt Discipline: I loved playing video games when I was younger. But now, the games are so involved that take up way too much time. If I do play, I tend to play old school NES games on the Wii.

Great article here Jon, feels like a lot of people are focusing on habits recently and this is probably one of the best I’ve ever read. The most powerful would be finding a mentor and eliminating the thought of bad luck at least from my perspective but all are important! 🙂

@Jef Miles: Finding a mentor is huge. I’ve been lucky to have so many great people around me over the years helping me out when it comes to blogging. I have no idea where I would be without them.

Great list Jon and an even better analysis of each!!

We’ve not renewed our television license for this year because we realised that we haven’t watched any live TV in the past six months. At £150 per year, this doesn’t have a HUGE saving by itself, but given the results of your study, I’m hoping that it will keep my productivity up!

@moneystepper: You always have to look at the other benefits of your choices. I’ve read a few other blogs where the person gave up cable TV and mentioned how much more active they are and how much more they read since they have so much more free time.

Jon,

It was such a great post! I’ll share it with the readers of my blog this week.

As a salaried worker, I always did what you did. If you want to get a promotion, get involved, do more that what is written in your task description, help your colleagues and your boss, become an invaluable asset for the company. That’s how I had tons of promotions in my career and went up the ladder pretty fast. I now make almost 3 times the salary of a median salaried worker in my province and even though I’d like to retire early and that I often find my job boring I recognize that I’m lucky but that I also had a big role in getting where I am righ now. It’s just a matter of doing the right things with the right people and to avoid toxic people.

This is only a small part of my plan to become rich and retire young. I’ve set goals for myself and reached them. I still have many other goals to reach. That’s how you can make things better and more important, that’s how you make things happpen. I totally agree on that!

I also read everyday for the same reasons you mentionned. I try to read on different subjects all the time. I started reading everyday or almost everyday when I was still a kid. It opens our minds and forces us to think twice and rethink things that are accepted as facts. As an example, someone told us about a documentary called Earthlings about animal cruelty last year. I decided one day to listen to it and then… Over the last year, I read a lot about animal cruelty and how they treat and raise animals in the food industry. I was so shocked that I read more and more and more and eventually became a vegan. I am in the process of starting another blog on that subject too because I think people need to see and hear what’s really happening in that industry, how we treat animals in our society, how we pollute the planet at the same time and what weird things we put in our mouths. There’s a saying who says “We are what we eat”… I was one of the biggest meat lover on earth but reading and keeping my mind open made me realized that animals we eat don’t live in happiness like the industry pretend.

I think the whole meaning of this post or these thoughts is to show that we have a lot of control on our life. Let’s assume it and make things better for us and others around us.

Thanks for sharing this with us!

Allan

@Allan: Wow! Truly awesome stuff Allan! You are right, we have so much more control over our lives than we think. It’s awesome that you have accomplished everything you have and continue to grow and learn. Keep up the great work!

These are great habits! I do some of them, but could definitely improve on a few others. Limiting time-wasting activities like TV, the internet, and video games are a great way to get more things done, as long as you have a goal or list of things that need to get done!

@Little House: We could all use a little less time in front of the TV!

That graphic on television habits is really compelling. My guess is that the time they do spend watching is informational gathering (like the news) or passion related shows (like sports, hobbies, etc.) Bet there is not a lot of reality TV viewing going on with the wealthy.

@Brian @ Luke1428: I agree Brian. Most likely some sort of education programming.

I read this one as well and found it fascinating. It seems I do most of these but have a problem with couple of them(important ones). I still have to listen more and eliminate limiting believes (with the believes the problem is that it is not an act but a process and a recurring one at that).

@maria@moneyprinciple: Most of us fall short on some of them. The key is to identify them and start taking action to change the habit into a more positive and productive one!

I love knowing the strategies of wealthy people. I almost do it all, but I am not that wealthy. Knowing all those, it feels like I am on the right path to wealth. I just have to keep fighting and never lost the big picture—never give up. Failure is just beginning, I will get better along the way. Your 16 habits excite me to make my new year’s resolution related to this. Thanks.

@Jayson @ Monster Piggy Bank: Great to hear. We all have to remember that we will fail, and many times at that. The key is to learn from that failure and not immediately give up. Look at failure as a positive – that you are trying to better yourself, your circumstances, etc. – and you won’t be concerned with failing.

Limiting beliefs is the one area I think most poor people don’t even realize is holding them back.

“It takes money to make money”

“Rich people are criminals”

etc.

Even knowing to watch out for and eradicate my limiting beliefs, is amazing how quickly and deeply they burrow into your mind and how difficult they are too root out.

@Jack @ Enwealthen: I agree Jack. It’s so natural to us that we don’t even realize we are doing it.

I would add one more habit to this list: Just Do It. Whether it’s starting a side business, setting up a blog, writing a book, creating a movie script, don’t wait until next year, don’t wait until next week, don’t wait until tomorrow. Start now. Successful people take the first step and don’t look back. I’ve met many people who have had great ideas for a business or a book, and never took that step. Get started now!

@Fred: That is a great tip to add to the list! I’ve run into many people (and am guilty too) who keep saying they are going to do this or that and never do it. Stop making excuses and just do it. It doesn’t mater if you fail as you can learn from it. If you don’t try, you will never succeed but guarantee failure.

What caught my attention was the idea that we should limit time wasted watching TV, surfing the internet, etc – but should network more. I totally agree. It’s about relationships, truly connecting with people, and prioritizing time/money. I have a friend who has turned his situation around to become quit successful, and he no longer owns a TV.

@Tie the Money Knot: I’ve read a bunch of stories about people who have come from nothing (or very little) and are wealthy now. None of them mention watching TV. They all talk about staying up late and learning about their industry and competition, etc.

This is a very detailed and truthful list my friend. I cant imagine watching 4 hours of tv a day or not living within my means. I also need to read everyday multiple blogs, and my current book in rotation. I can work on finding a mentor and networking more. Good post John.

@EL @ Moneywatch101: Thanks! I need to work on finding a mentor as well!

In my (limited) experience, the 2 most important for me are reading more books and finding a mentor. So many of my friends think that their education ended after they graduated college. That’s great for getting your entry level job, but to move up and build a career you really need to become an expert. Books are great to get in-depth knowledge, and a mentor can propel you way ahead of peers without one.

@Dividend Champion: So very true. I never want to stop learning. I am always reading and trying to better myself. Now I just need to find a mentor!

Love this list! There’s some really outstanding advice here!

I especially like $12. Never give up. I’ve failed so many times and learned so much from it. Eventually the wealth of experience that failure brings inevitably leads to success….but only if you keep going.

Great list. It is all about balance. Keep your mind right. Focus on your goals and stay away from negativity. If someone follows these suggestions, they will be successful on many levels.

So true.

Success comes down mostly to good habits. Yes, genes and luck are factors but I would estimate less than 5% of what determines success.

I raised myself up from poverty and ignorance to a very successful and enjoyable life by practicing these exact habits.